A nanny receipt is a document that serves as proof of payment for dependent care services. The nanny or caregiver typically provides it to the employer or parent, and it outlines the details of the payment made, such as the amount, date, and purpose of the payment. This receipt is important as it serves as a legal record and can be used as evidence of the payments made.

While not all nannies or caregivers may provide a receipt, it is highly recommended to have one to ensure proper record-keeping and to maintain transparency in the financial transactions related to dependent care services.

The Importance of a Nanny Receipt

Hiring a nanny or caregiver involves financial responsibilities, and having a receipt is crucial for several reasons:

- Evidence of payment: A receipt shows that payments have been made for the dependent care services provided. In case of any disputes or discrepancies in the future, this receipt can serve as proof of payment.

- Tax purposes: A receipt is essential if you are eligible for tax deductions or credits related to dependent care expenses. It helps in accurately reporting these expenses and ensures compliance with tax regulations.

- Financial record-keeping: Keeping track of all payments made to the nanny or caregiver is important for financial record-keeping. A receipt helps in maintaining organized records and makes it easier to track expenses and budget accordingly.

- Transparency: Providing a receipt to the employer or parent demonstrates transparency in financial transactions. It helps in building trust and maintaining a healthy working relationship between the employer and the nanny or caregiver.

What Information Is Needed to Fill Up in a Nanny Receipt?

When creating a nanny receipt, certain information needs to be included to ensure its accuracy and legitimacy.

The following details should be filled up:

- Date: The date when the payment was made.

- Name and address of the employer: The employer’s full name and address.

- Name and address of the nanny or caregiver: The nanny or caregiver’s full name and address.

- Payment details: The amount paid, the purpose of the payment (e.g., weekly salary, overtime, reimbursement), and the period covered by the payment.

- Payment method: How the payment was made (e.g., cash, check, bank transfer).

- Signatures: Both the employer and the nanny or caregiver should sign the receipt to acknowledge the payment.

It is important to ensure that all the information provided in the nanny receipt is accurate and up to date. Any errors or discrepancies may affect its validity as proof of payment.

Is It Necessary To Have A Nanny Receipt, Even For Informal Arrangements?

Yes, it is necessary to have a receipt even for informal arrangements. While informal arrangements may not involve a formal employment contract or payroll system, it is still important to maintain proper records of the payments made for dependent care services.

Having a receipt for informal arrangements helps both parties involved in several ways:

- Proof of payment: It serves as evidence of the payments made, protecting both the employer and the nanny or caregiver in case of any disputes or misunderstandings.

- Tax purposes: Even for informal arrangements, certain tax deductions or credits may be applicable. Having a receipt helps in accurately reporting these expenses and ensures compliance with tax regulations.

- Financial record-keeping: Maintaining records of the payments made is important for financial management. It helps in tracking expenses, budgeting, and planning for future payments.

Therefore, regardless of the nature of the arrangement, it is recommended to have a receipt to maintain transparency and ensure proper record-keeping.

Can a Nanny Receipt be used for tax purposes?

Yes, a nanny receipt can be used for tax purposes. In many countries, including the United States, taxpayers may be eligible for tax deductions or credits related to dependent care expenses.

When it comes to claiming these tax benefits, having a nanny receipt becomes crucial. The receipt provides the necessary documentation to support the claims made on the tax return. It helps in accurately reporting expenses and ensures compliance with tax regulations.

In order to claim tax benefits for dependent care expenses, it is important to keep all the nanny receipts and related records organized. This includes receipts for payments made to the nanny or caregiver, as well as any other relevant documentation, such as contracts or agreements.

It is advisable to consult with a tax professional or refer to the specific tax laws and regulations of your country to understand the eligibility criteria and requirements for claiming tax benefits related to dependent care expenses.

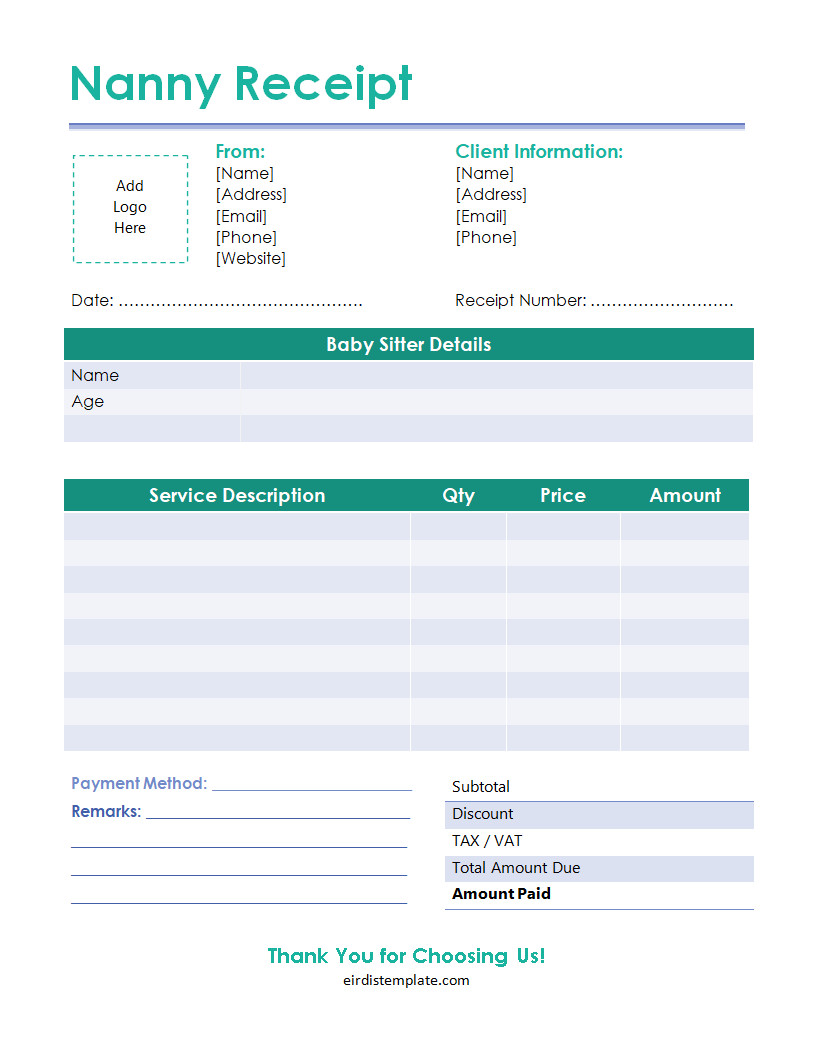

Free Nanny Receipt Template!

Simplify childcare payments with our nanny receipt template! Perfect for nannies and families, this professional template helps you issue clear, detailed receipts for services. Record hours worked, rates, and payment details effortlessly while maintaining accurate records.

Ensure transparency and trust in your childcare arrangements with this easy-to-use and customizable tool!

Nanny Receipt Template – Word | PDF

- Free Printable Mailing Label Template - January 8, 2026

- Machine Lease Agreement Template - January 8, 2026

- Free Printable Luggage Tag Template - January 8, 2026