What Is A Loan Agreement Contract?

A loan agreement contract is a legal document that specifies the terms and conditions of a loan between a lender and a borrower.

This agreement outlines the loan amount, interest rate, repayment schedule, and any other relevant details. It serves as a crucial tool for both parties to understand their obligations and rights in the borrowing and lending process.

Why Is It Important?

Loan agreement contracts are essential for several reasons.

Protection Against Disputes

One of the primary reasons why loan agreement contracts are important is that they help prevent disputes between the lender and the borrower. By clearly defining the terms and conditions of the loan, including the repayment schedule and interest rate, the agreement reduces the likelihood of misunderstandings that could lead to disagreements or legal actions.

Legal Compliance

Loan agreement contracts also ensure legal compliance for both parties involved. By documenting the terms of the loan in a formal agreement, lenders and borrowers can ensure that they are adhering to relevant laws and regulations governing lending practices. This legal compliance protects both parties from potential legal consequences.

Establishing Trust

Establishing trust is another crucial aspect of loan agreement contracts. By formalizing the terms of the loan in a written agreement, both parties demonstrate their commitment to honoring the financial arrangement. This commitment helps build trust between the lender and the borrower, fostering a positive relationship based on mutual understanding and respect.

Clarity and Understanding

Loan agreement contracts provide clarity and understanding for both parties involved in the borrowing and lending process. By clearly outlining the terms of the loan, including the repayment schedule, interest rate, and any penalties for late payments, the agreement ensures that both parties are on the same page regarding their financial obligations. This clarity helps prevent confusion and ensures a smooth repayment process.

Protection of Rights

Loan agreement contracts protect the rights of both the lender and the borrower. By clearly defining the terms of the loan, including the rights and obligations of each party, the agreement ensures that both parties are aware of their legal responsibilities. This protection of rights helps prevent any potential abuses or misunderstandings that may arise during the loan repayment process.

Difference Between A Loan Agreement And A Mortgage

It is important to note that a loan agreement is not the same as a mortgage. While both documents involve borrowing money, they serve different purposes.

A loan agreement is a broader document that outlines the terms of a loan, including the repayment schedule, interest rate, and any penalties for late payments. On the other hand, a mortgage is specifically used to secure a loan with a property or asset, giving the lender the right to foreclose on the property if the borrower fails to repay the loan.

The Role Of The Lender And Borrower

In a loan contract agreement, the lender and borrower each have specific roles and responsibilities. The lender is responsible for providing the funds to the borrower, as outlined in the agreement. The lender also has the right to charge interest on the loan and to take legal action in the event of default.

On the other hand, the borrower is responsible for repaying the loan according to the terms specified in the agreement. This includes making timely payments, adhering to the repayment schedule, and avoiding any actions that could put the loan at risk.

When Is A Loan Agreement Legally Effective?

A loan agreement is legally effective once both parties have signed the document and agreed to its terms. It is important for both the lender and the borrower to carefully review the agreement before signing to ensure that they understand all of the terms and conditions. Once the agreement is signed, it becomes a legally binding contract that both parties are required to honor.

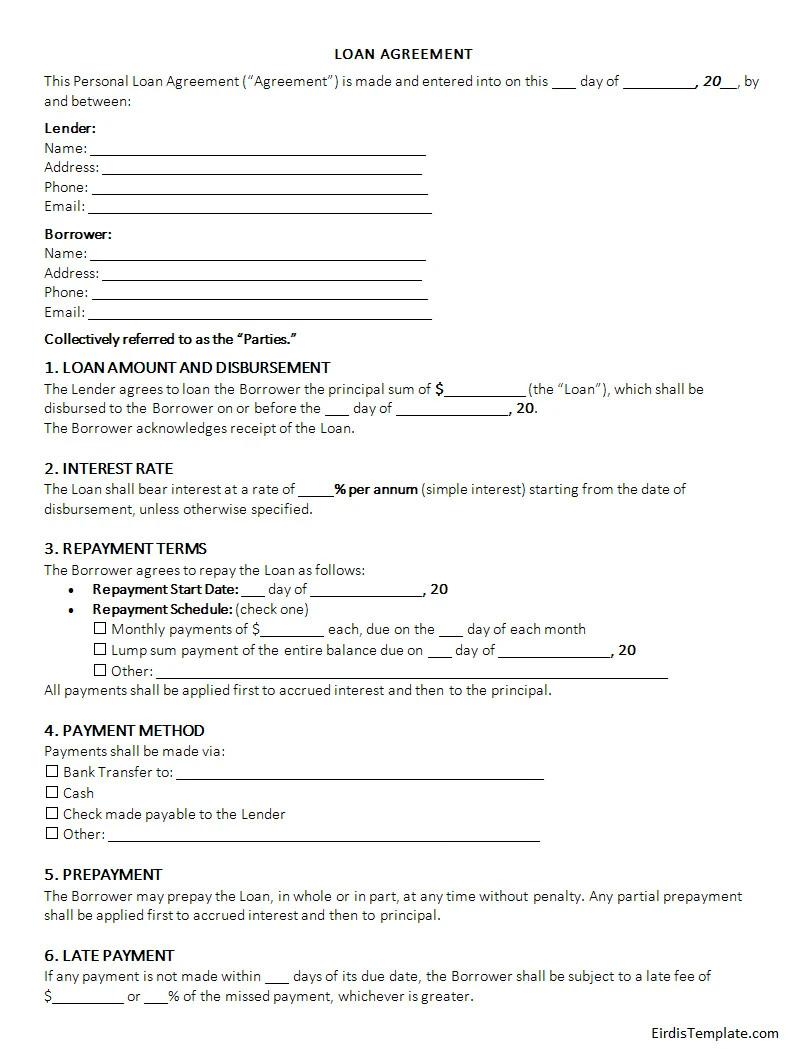

How To Write A Personal Loan Agreement

If you are considering lending money to a friend or family member, it is important to create a formal personal loan agreement to protect both parties.

When writing a personal loan agreement, be sure to include details such as the loan amount, interest rate, repayment schedule, and any collateral or guarantees required. It is also important to clearly outline the consequences of default, including any penalties or legal actions that may be taken.

Key Elements of a Personal Loan Agreement

When drafting a personal loan agreement, certain key elements should be included to ensure the agreement is comprehensive and legally binding. These elements typically include:

- Loan Amount: The specific amount of money being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Schedule: The timeline for repaying the loan, including the frequency and amount of payments.

- Collateral or Guarantees: Any assets or guarantees provided to secure the loan.

- Default Consequences: The penalties or legal actions that may be taken in case of default.

Loan Contract Agreement Template – DOWNLOAD

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026