When renting a car, having a car rental receipt is essential. This receipt serves as proof of purchase for the rental dealership and the customer, providing an official record of the rental transaction.

This guide will explore what a car rental receipt is, its benefits, how to write one, its legal implications, and tips for ensuring proper use.

What is a Car Rental Receipt?

A car rental receipt is a document a rental dealership provides to its customers after they rent a vehicle. It serves as proof of purchase and provides detailed information about the rental transaction. This includes the rental period, the vehicle details, the rental price, any additional fees or charges, and the total amount paid.

Car rental receipts are typically used by both individuals and businesses who rent vehicles for various purposes such as travel, business trips, or special occasions. They are essential documents for both the rental dealership and the customer, as they provide an official record of the rental transaction.

Users of Car Rental Receipts

Car rental receipts are used by a wide range of individuals and businesses.

Some of the key users of car rental receipts include:

- Individuals: Individuals who rent cars for personal use, such as vacations or weekend getaways, rely on car rental receipts to keep track of their expenses and for reimbursement purposes if applicable.

- Businesses: Businesses often rent cars for their employees, clients, or for company purposes. Car rental receipts help businesses keep track of their expenses, allocate costs to specific projects or clients, and for tax purposes.

- Rental Dealerships: Rental dealerships use car rental receipts to provide their customers with an official record of the rental transaction. These receipts also help dealerships keep track of their rental inventory, revenue, and for accounting purposes.

- Insurance Companies: Insurance companies may require car rental receipts as part of the claims process. These receipts serve as proof of the rental expenses incurred due to an accident or other covered incidents.

Overall, car rental receipts play a crucial role in maintaining transparency, accountability, and accuracy in rental transactions.

Benefits of Car Rental Receipts

Car rental receipts offer several benefits to both the rental dealership and the customer:

- Proof of Purchase: A car rental receipt serves as proof of purchase for the customer. It confirms that the rental transaction has taken place and provides detailed information about the rental period, vehicle details, and the total amount paid.

- Expense Tracking: Car rental receipts help customers track their rental expenses, making it easier for them to manage their personal or business budgets.

- Tax Deductions: For businesses, car rental receipts are essential for tax purposes. They can be used to claim deductions for rental expenses, reducing the overall tax liability.

- Dispute Resolution: In case of any disputes or discrepancies, car rental receipts provide a clear record of the rental transaction. They can be used as evidence to resolve any issues that may arise between the rental dealership and the customer.

- Insurance Claims: Car rental receipts are often required by insurance companies as part of the claims process. They serve as evidence of the rental expenses incurred due to an accident or other covered incidents, making it easier to process the claims.

How to Write a Car Rental Receipt

Writing a car rental receipt requires attention to detail and accuracy. Here are the key elements that should be included in a car rental receipt:

- Rental Dealership Information: Include the name, address, and contact details of the rental dealership.

- Customer Information: Include the name, address, and contact details of the customer.

- Vehicle Details: Provide detailed information about the rented vehicle, including the make, model, license plate number, and any other identifying information.

- Rental Period: Specify the start and end dates of the rental period.

- Rental Price: Clearly state the rental price per day or hour, depending on the rental agreement.

- Additional Fees or Charges: If there are any additional fees or charges, such as fuel charges, late return fees, or insurance fees, make sure to include them in the receipt.

- Total Amount Paid: Summarize the total amount paid by the customer, including any taxes or surcharges.

- Payment Method: Specify the payment method used by the customer, whether it’s cash, credit card, or any other form of payment.

- Terms and Conditions: Include any relevant terms and conditions of the rental agreement, such as the rental dealership’s cancellation policy or liability coverage.

It is important to ensure that the car rental receipt is accurate, legible, and provides all the necessary information for both the rental dealership and the customer.

Legal Implications of Using Car Rental Receipts

Using car rental receipts has legal implications for both the rental dealership and the customer. Here are some key points to consider:

- Contractual Obligations: A car rental receipt serves as evidence of the rental agreement between the rental dealership and the customer. Both parties are legally bound by the terms and conditions stated in the receipt.

- Liability: Car rental receipts may include liability waivers or insurance coverage details. It is important for both the rental dealership and the customer to understand their rights and responsibilities in case of accidents or damages.

- Tax Compliance: Car rental receipts are essential for tax compliance, especially for businesses. Both the rental dealership and the customer should ensure that the rental receipts are accurate and by the applicable tax regulations.

- Privacy and Data Protection: Car rental receipts may contain personal information of the customer. Both parties must handle and store this information securely, in compliance with data protection laws.

Both the rental dealership and the customer should seek legal advice to ensure compliance with relevant laws and regulations when using car rental receipts.

Tips for Ensuring Proper Use

Here are some tips to ensure proper use of car rental receipts:

- Accuracy: Double-check all the information before issuing a car rental receipt to ensure accuracy.

- Retain Copies: Both the rental dealership and the customer should keep copies of the car rental receipt for future reference or in case of any disputes.

- Secure Storage: Handle and store car rental receipts securely, especially if they contain personal or sensitive information.

- Compliance: Ensure compliance with relevant laws and regulations, including tax regulations and data protection laws.

- Clear Communication: Communicate the terms and conditions of the rental agreement to the customer to avoid any misunderstandings or disputes.

By following these tips, both the rental dealership and the customer can ensure the proper use of car rental receipts and minimize any potential issues or disputes.

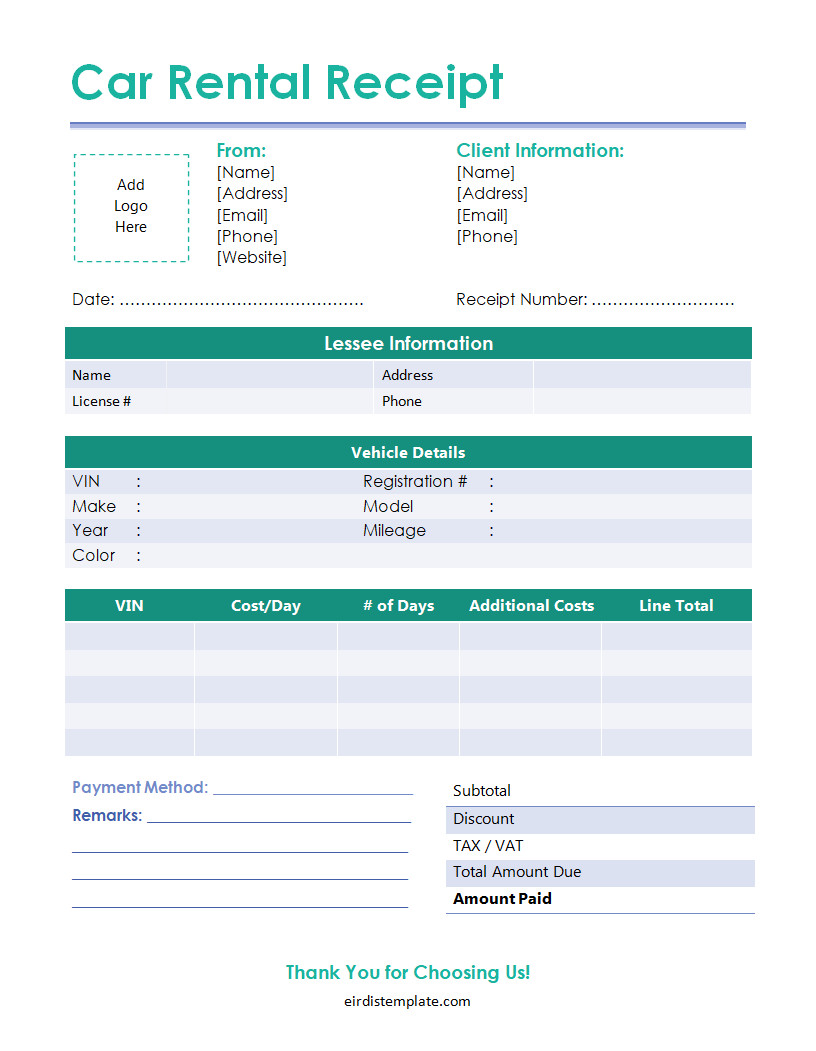

Free Car Rental Receipt Template!

Streamline your car rental transactions with our car rental receipt template in Word and PDF! This professional template is perfect for issuing clear, detailed receipts, covering rental dates, vehicle details, charges, and terms. Whether for business or personal use, it’s easy to customize and ensures organized record-keeping.

Present a polished image while simplifying your operations with this versatile, user-friendly tool designed to enhance your car rental service experience!

Car Rental Receipt Template – Word | PDF

- Month-to-month Lease Agreement Template - March 4, 2026

- Monthly Profit And Loss Statement Template - March 2, 2026

- Free Nurse Resignation Letter Template (Word) - February 28, 2026