When buying or selling a business, having a solid legal framework in place is crucial. A business purchase agreement serves as the foundation for the sale and transfer of a business, outlining the rights and responsibilities of both the buyer and the seller.

This legally binding document ensures that all parties involved have a clear understanding of the terms of the sale, the assets and liabilities being transferred, and the final terms of the transaction.

By defining key details such as the purchase price, payment terms, and responsibilities for outstanding debts, a business purchase agreement helps safeguard the interests of both parties and minimizes the risk of disputes.

What is a Business Purchase Agreement?

A business purchase agreement, also known as a sale of business agreement, is a legal document that outlines the terms and conditions of a business sale. It covers all aspects of the transaction, including the purchase price, payment terms, assets and liabilities being transferred, warranties, and any other specific terms agreed upon by the buyer and seller.

This agreement serves as a roadmap for the sale process, ensuring that both parties are on the same page and protecting their interests.

The Importance of Business Purchase Agreements

Legal Framework

A business purchase agreement provides a legal framework for the sale and transfer of a business. It outlines the terms and conditions of the transaction, including the rights and obligations of both parties. By clearly defining these terms, the agreement helps protect the interests of both the buyer and seller and minimizes the risk of disputes.

Transparency

One of the key benefits of a business purchase agreement is that it promotes transparency in the sale process. By detailing all aspects of the transaction, including the purchase price, payment terms, and assets and liabilities being transferred, the agreement ensures that both parties have a clear understanding of their roles and responsibilities.

Protection

A business purchase agreement also serves as a protective document for both parties. It helps safeguard the interests of the buyer by ensuring that the assets and liabilities being transferred are accurately represented. For the seller, the agreement protects from any future liabilities related to the business post-sale.

Compliance

Having a business purchase agreement in place helps ensure that the sale transaction complies with applicable laws and regulations. The agreement can include provisions to address legal requirements related to the sale, protecting both parties from potential legal issues down the line.

Flexibility

While a business purchase agreement provides a legal framework for the sale, it also offers flexibility for the parties involved. The agreement can be customized to meet the specific needs and requirements of the buyer and seller, allowing for a tailored approach to the transaction.

Enforceability

One of the key features of a business purchase agreement is its enforceability. By signing the agreement, both parties agree to abide by its terms and conditions, making it legally binding. This enforceability helps ensure that all parties fulfill their obligations under the agreement.

Professional Assistance

Given the complex nature of business transactions, it is advisable to seek the assistance of a legal professional when drafting a business purchase agreement. An experienced lawyer can help ensure that the agreement is comprehensive and legally sound, protecting the interests of their client throughout the sale process.

Elements of a Business Purchase Agreement

There are several key elements that should be included in a business purchase agreement to ensure that all aspects of the transaction are covered. These elements include:

Identification of the Parties

The first step in drafting a business purchase agreement is to clearly identify the parties involved in the transaction. This includes providing the legal names and contact information of both the buyer and seller, as well as any other individuals or entities involved in the sale.

Description of the Business

A detailed description of the business being sold should be included in the agreement. This description should outline the nature of the business, its assets and liabilities, and any other relevant information that is necessary for the buyer to make an informed decision.

Purchase Price

One of the most important aspects of a business purchase agreement is the purchase price. This section should clearly specify the total purchase price for the business, as well as any payment terms or conditions that have been agreed upon by the buyer and seller.

Payment Terms

The payment terms section of the agreement should outline how and when the purchase price will be paid. This may include details on any down payments, financing arrangements, or escrow arrangements that have been agreed upon by the parties.

Assets and Liabilities

Detailing the assets and liabilities being transferred as part of the sale is crucial in a business purchase agreement. This section should include a comprehensive list of all assets and liabilities, as well as any warranties or representations made by the seller regarding the accuracy of this information.

Non-Compete Agreement

It is common for business purchase agreements to include a non-compete agreement, which prevents the seller from competing with the business post-sale. This section should outline the terms and duration of the non-compete agreement, as well as any penalties for violating its terms.

Confidentiality Agreement

Protecting the confidentiality of sensitive business information is essential in a business sale transaction. Including a confidentiality agreement in the purchase agreement can help prevent the unauthorized disclosure of confidential information to third parties.

Closing Conditions

There may be certain conditions that must be met before the sale can be finalized, such as obtaining regulatory approvals or completing due diligence. The closing conditions section of the agreement should outline these requirements and specify who is responsible for meeting them.

Representations and Warranties

Both the buyer and seller may make certain representations and warranties regarding the sale transaction. These statements should be included in the agreement to provide assurances to both parties that certain facts or conditions are true and accurate.

Indemnification

Indemnification clauses are common in business purchase agreements and help protect the parties from potential claims or liabilities that may arise after the sale. This section should outline the indemnification obligations of both the buyer and seller in relation to any post-closing disputes.

Allocation of Purchase Price

Specifying how the purchase price will be allocated among the assets being transferred is important for tax purposes. This section should detail the allocation method used and provide a breakdown of the purchase price for each asset included in the sale.

Working Capital Adjustment

Some business purchase agreements include provisions for adjusting the purchase price based on the business’s working capital at closing. This section should outline how working capital will be calculated and adjusted, if necessary, to reflect the business’s financial position accurately.

Escrow Arrangements

Escrow arrangements are often used in business sale transactions to hold funds until certain conditions are met or disputes are resolved. This section should detail the terms of any escrow arrangements, including the amount of funds being held, the conditions for release, and the responsibilities of the escrow agent.

Penalties and Remedies

In the event of a breach of the purchase agreement, it is essential to include provisions for penalties and remedies. This section should outline the consequences for failing to meet the obligations of the agreement, as well as the remedies available to the non-breaching party.

Dispute Resolution

Including a dispute resolution clause in the purchase agreement can help parties resolve conflicts quickly and amicably. This section should outline the process for resolving disputes, whether through mediation, arbitration, or litigation, and specify the governing law of the agreement.

Termination

It is crucial to include provisions for terminating the purchase agreement in certain circumstances, such as a breach of contract or failure to meet closing conditions. This section should outline the grounds for termination and the consequences of terminating the agreement.

Severability

A severability clause is often included in business purchase agreements to ensure that if one part of the agreement is deemed invalid or unenforceable, the rest of the agreement remains intact. This section should specify that the remaining provisions of the agreement will still be valid in such situations.

Signatures

Finally, all parties involved in the business purchase agreement should sign the document to make it legally binding. This section should include spaces for each party to sign and date the agreement, as well as any witnesses or legal representatives who are present at the signing.

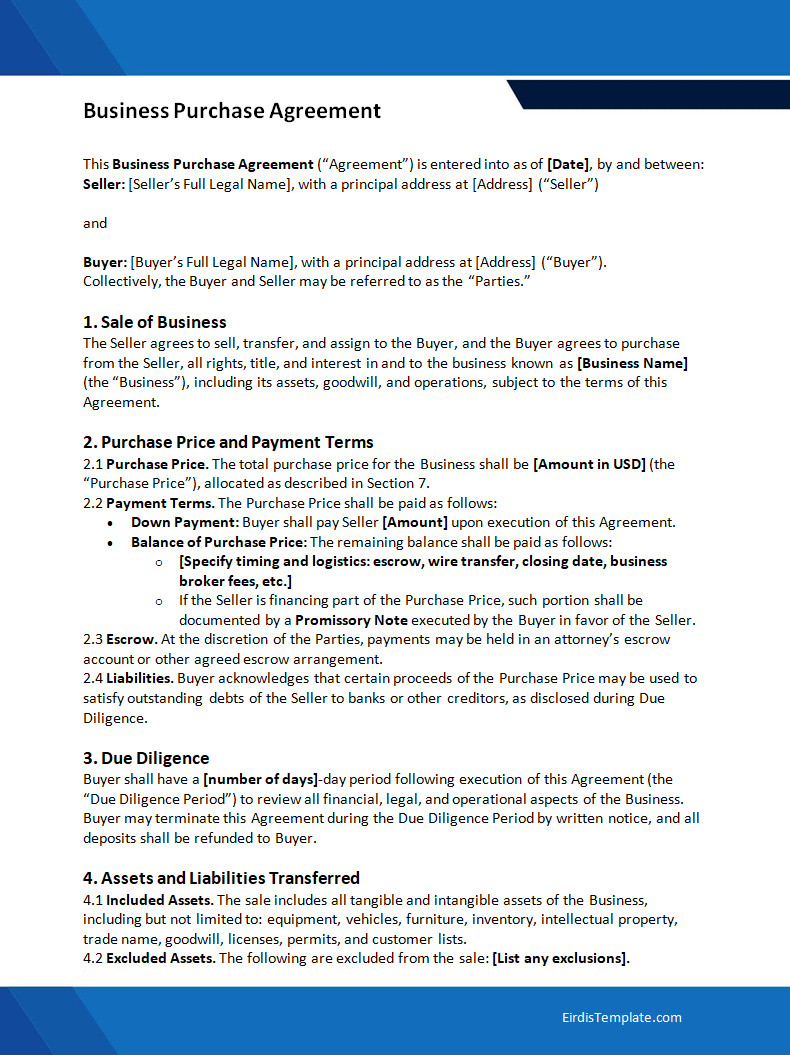

Business Purchase Agreement Template

A business purchase agreement is a crucial document that outlines the terms of a business sale between a buyer and a seller. It includes important details such as purchase price, payment terms, assets, liabilities, and responsibilities, ensuring clarity and legal protection for both parties.

To ensure a smooth and professional transaction, use our free business purchase agreement template and finalize your deal with confidence.

Business Purchase Agreement Template – Word

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026