What Is a Rent Ledger?

A rent ledger is an essential tool for both landlords and tenants in maintaining a transparent and organized financial record of all transactions related to a rental property. This detailed, chronological document provides a comprehensive overview of rent payments, security deposits, late fees, maintenance costs, and other expenses incurred during the tenancy.

By accurately documenting all financial transactions, a rent ledger helps prevent misunderstandings and disputes between landlords and tenants.

Importance of Rent Ledger

The importance of a rent ledger cannot be overstated in a rental agreement. It serves as a primary source of financial information for both parties, ensuring transparency, accountability, and legal protection.

Without a rent ledger, landlords may struggle to track rent payments and expenses accurately, leading to potential conflicts with tenants. Similarly, tenants rely on the rent ledger to ensure that all payments are properly recorded and to dispute any discrepancies that may arise.

Items to Include in a Rent Ledger

Creating a comprehensive rent ledger involves including specific details to ensure accuracy and completeness. By including the following items in a rent ledger, landlords and tenants can effectively track all financial transactions and maintain a transparent record of payments and expenses:

Tenant Information

At the core of a rent ledger is tenant information, which includes the name, contact information, and lease agreement details of the tenant. This ensures that all financial transactions are correctly attributed to the appropriate tenant and property. Including tenant information in the rent ledger also allows for easy reference and communication between landlords and tenants.

Rental Property Details

Another essential component of a rent ledger is detailed information about the rental property. This includes the address, unit number, type of property, square footage, amenities, and any other relevant details that help identify the property. By including specific property details in the rent ledger, landlords can accurately track payments and expenses associated with each rental unit.

Payment Records

Payment records are the core of the rent ledger, documenting all rent payments, security deposits, late fees, and other financial transactions in a chronological order. Each payment entry should include the date, amount, method of payment, and purpose of the transaction. By maintaining detailed payment records, landlords can easily track tenant payments, monitor outstanding balances, and reconcile any discrepancies.

Expense Tracking

In addition to payment records, a rent ledger should include a section for tracking expenses related to the rental property. This may include maintenance costs, repairs, utilities, property taxes, insurance premiums, and any other expenses incurred during the tenancy. By documenting all expenses in the rent ledger, landlords can accurately assess the financial health of their rental properties and make informed decisions about budgeting and maintenance.

Lease Agreement Details

Including lease agreement details in the rent ledger is essential for reference and clarification. This section should outline the terms of the lease agreement, including the duration of the tenancy, rent amount, payment due date, late fee policy, security deposit amount, pet policy, and any other relevant provisions. By incorporating lease agreement details into the rent ledger, landlords and tenants can easily refer to the terms of the rental agreement and ensure compliance with all obligations.

Communication Log

Another useful addition to a rent ledger is a communication log, where landlords and tenants can document important conversations, requests, agreements, and notices related to the rental property. This log serves as a written record of all interactions between parties, providing clarity and documentation in case of disputes or misunderstandings. By maintaining a communication log in the rent ledger, landlords and tenants can foster open communication and address issues promptly.

Financial Statements

Including financial statements in the rent ledger can provide a comprehensive overview of the rental property’s financial performance. These statements may include income statements, balance sheets, cash flow statements, and other financial reports that summarize the property’s revenue, expenses, and net income. By incorporating financial statements into the rent ledger, landlords can track financial trends, assess profitability, and make informed decisions about the management of their rental properties.

Document Storage

Lastly, it is essential to include a section for document storage in the rent ledger, where landlords can keep copies of lease agreements, rent receipts, maintenance records, insurance policies, and other important documents related to the rental property. By organizing and storing documents in the rent ledger, landlords can easily access and retrieve information when needed, ensuring compliance with legal requirements and facilitating efficient property management.

How Often Should a Rental Property Ledger Be Updated?

Updating a rental property ledger regularly is essential to ensure accuracy, transparency, and compliance with legal requirements. By establishing a consistent updating schedule, landlords can effectively track financial transactions, monitor payment status, and maintain up-to-date records of all income and expenses related to the rental property.

Monthly Updates

It is recommended to update the rental property ledger monthly to reflect rent payments, expenses, and any changes in the financial status of the property. By updating the ledger monthly, landlords can ensure that all transactions are accurately recorded, identify any discrepancies or late payments, and address any issues promptly. Monthly updates also help landlords track income and expenses over time, analyze financial trends, and make informed decisions about property management.

Immediate Updates

In addition to monthly updates, landlords should make immediate updates to the rental property ledger whenever a new transaction occurs or a change in financial status occurs. This includes recording rent payments, security deposits, late fees, maintenance costs, repairs, utilities, and any other expenses as soon as they occur. By updating the ledger immediately, landlords can maintain accurate records, avoid errors or omissions, and ensure that all financial transactions are properly documented.

End-of-Year Review

At the end of each year, landlords should conduct a thorough review of the rental property ledger to assess the property’s financial performance, identify any outstanding balances, reconcile any discrepancies, and prepare financial statements. This end-of-year review helps landlords analyze income and expenses for the past year, evaluate the property’s profitability, and make informed decisions about budgeting, maintenance, and future investments. By conducting an annual review of the rental property ledger, landlords can ensure financial compliance and strategic property management.

Who Can Use a Rent Ledger?

A rent ledger is a versatile tool that can be used by various parties involved in a rental agreement to manage finances, track payments, and maintain accurate records of all transactions related to the rental property. While landlords are primarily responsible for creating and updating the rent ledger, tenants can also benefit from using the ledger to track rent payments, dispute discrepancies, and communicate with their landlords effectively.

Landlords

Landlords are the primary users of a rent ledger, as they are responsible for creating, updating, and maintaining accurate financial records of all transactions related to the rental property. Landlords use the rent ledger to track rent payments, monitor income and expenses, reconcile accounts, assess financial performance, and make informed decisions about property management. By utilizing a rent ledger, landlords can ensure transparency, accountability, and legal compliance in their rental agreements, promoting a positive landlord-tenant relationship and efficient property management.

Tenants

While landlords are typically responsible for maintaining the rent ledger, tenants can also benefit from using the ledger to track rent payments, verify payment history, and dispute any discrepancies that may arise. Tenants can use the rent ledger to ensure that all payments are accurately recorded, monitor their financial obligations, and communicate effectively with their landlords regarding any financial concerns. By engaging with the rent ledger, tenants can take an active role in managing their finances and maintaining a clear record of their rental payments.

Property Managers

Property managers play a crucial role in managing rental properties on behalf of landlords, overseeing day-to-day operations, tenant relations, maintenance, and financial transactions. Property managers can utilize a rent ledger to track rent payments, expenses, maintenance costs, and other financial transactions related to the property. By maintaining accurate records in the rent ledger, property managers can provide landlords with detailed financial reports, analyze property performance, and make recommendations for improving profitability and efficiency in property management.

Real Estate Professionals

Real estate professionals, such as real estate agents, brokers, and consultants, may also benefit from using a rent ledger to track financial transactions related to rental properties. Real estate professionals can use the rent ledger to assess property income and expenses, evaluate investment opportunities, and provide valuable financial insights to clients. By utilizing the rent ledger as a tool for financial analysis and decision-making, real estate professionals can offer comprehensive services to landlords and tenants seeking guidance on rental property management.

Legal Professionals

Legal professionals, including lawyers specializing in real estate law, landlord-tenant disputes, and eviction proceedings, may rely on the rent ledger as a key source of financial information in legal cases. Legal professionals can use the rent ledger to review payment history, assess financial obligations, and gather evidence to support legal arguments. By analyzing the rent ledger in legal proceedings, legal professionals can advocate for their clients’ rights, resolve disputes, and ensure compliance with applicable laws and regulations governing rental agreements.

Financial Advisors

Financial advisors and accountants who work with landlords and tenants on financial matters related to rental properties can also benefit from using a rent ledger to track income, expenses, and financial trends. Financial advisors can use the rent ledger to assess property profitability, analyze cash flow, identify tax deductions, and provide guidance on financial planning strategies. By utilizing the rent ledger as a tool for financial analysis and reporting, financial advisors can assist clients in maximizing their investment returns and achieving their financial goals in rental property management.

Government Agencies

Government agencies responsible for regulating rental properties, enforcing housing laws, and overseeing landlord-tenant relationships may also utilize rent ledgers as part of their compliance monitoring and enforcement efforts. Government agencies can review rent ledgers to assess landlords’ compliance with rent control laws, security deposit regulations, fair housing practices, and other legal requirements. By analyzing rent ledgers, government agencies can identify potential violations, investigate complaints, and take enforcement actions to ensure that landlords and tenants adhere to applicable laws and regulations governing rental agreements.

Nonprofit Organizations

Nonprofit organizations that provide housing assistance, tenant advocacy, and support services to renters may use rent ledgers to help tenants manage their finances, understand their rights, and navigate rental agreements effectively. Nonprofit organizations can assist tenants in reviewing rent ledgers, identifying errors or discrepancies, and advocating on their behalf in disputes with landlords. By utilizing rent ledgers as a tool for financial empowerment and tenant support, nonprofit organizations can empower renters to make informed decisions, protect their rights, and maintain stable housing in a competitive rental market.

Community Organizations

Community organizations that serve as resources for landlords and tenants in local communities may also use rent ledgers to facilitate communication, education, and dispute resolution in rental agreements. Community organizations can provide training on rent ledger management, offer assistance in documenting financial transactions, and mediate disputes between landlords and tenants. By promoting the use of rent ledgers as a best practice in rental agreements, community organizations can foster transparency, accountability, and positive landlord-tenant relationships in their communities.

How to Use a Rent Ledger in the Case of an Eviction Action?

In the unfortunate event of an eviction action, a rent ledger can play a critical role in providing evidence of non-payment of rent or other financial violations by the tenant. Landlords can use the rent ledger as a legal document to support their case during eviction proceedings and demonstrate the tenant’s financial history related to the rental property. By presenting a detailed and accurate rent ledger in court, landlords can strengthen their legal position, establish the tenant’s payment history, and demonstrate compliance with legal requirements.

Evidence of Non-Payment

One of the primary uses of the rent ledger in an eviction action is to provide evidence of non-payment of rent by the tenant. Landlords can use the rent ledger to document missed payments, late fees, bounced checks, or other instances of non-compliance with the rental agreement. By presenting a clear record of payment history in the rent ledger, landlords can establish the tenant’s financial obligations, demonstrate a pattern of non-payment, and justify the eviction action based on legal grounds.

Documentation of Violations

In addition to non-payment of rent, landlords can use the rent ledger to document other financial violations by the tenant, such as failure to pay utilities, damages to the property, unauthorized occupants, or lease violations. By maintaining detailed records of all financial transactions in the rent ledger, landlords can provide a comprehensive overview of the tenant’s conduct during the tenancy, identify breaches of the rental agreement, and support their case for eviction based on material non-compliance.

Legal Compliance

When using a rent ledger in an eviction action, landlords must ensure that the ledger complies with all legal requirements and evidentiary standards. The rent ledger should be accurate, detailed, and well-maintained, with clear documentation of all financial transactions and communications related to the rental property. By adhering to legal standards for rent ledger management, landlords can strengthen their case in court, demonstrate good faith efforts to resolve disputes, and achieve a favorable outcome in the eviction proceedings.

Consultation with Legal Counsel

Before using a rent ledger in an eviction action, landlords should consult with legal counsel to ensure that the ledger is properly prepared, documented, and presented as evidence in court. Legal counsel can review the rent ledger, guide legal requirements for eviction actions, and advise landlords on best practices for utilizing the rent ledger in legal proceedings. By seeking legal advice and assistance, landlords can enhance the effectiveness of the rent ledger as a key piece of evidence in eviction cases and protect their rights as property owners.

Tenant Notification

When using a rent ledger in an eviction action, landlords are required to provide tenants with notice of non-payment, lease violations, or other grounds for eviction as specified in the rental agreement and applicable laws. Landlords should communicate clearly and professionally with tenants regarding the reasons for the eviction action, provide copies of the rent ledger as evidence, and offer opportunities for tenants to address any discrepancies or disputes. By maintaining open communication and adhering to legal requirements, landlords can navigate the eviction process effectively and uphold their rights as property owners.

Court Presentation

During eviction proceedings, landlords can present the rent ledger as evidence in court to support their case for eviction based on non-payment or other financial violations by the tenant. The rent ledger should be organized, legible, and accurate, with clear documentation of all relevant financial transactions and communications. By presenting the rent ledger in court, landlords can demonstrate their compliance with legal requirements, establish the tenant’s financial history, and justify the eviction action based on credible evidence. Effective presentation of the rent ledger can strengthen the landlord’s legal position, expedite the eviction process, and achieve a favorable outcome in court.

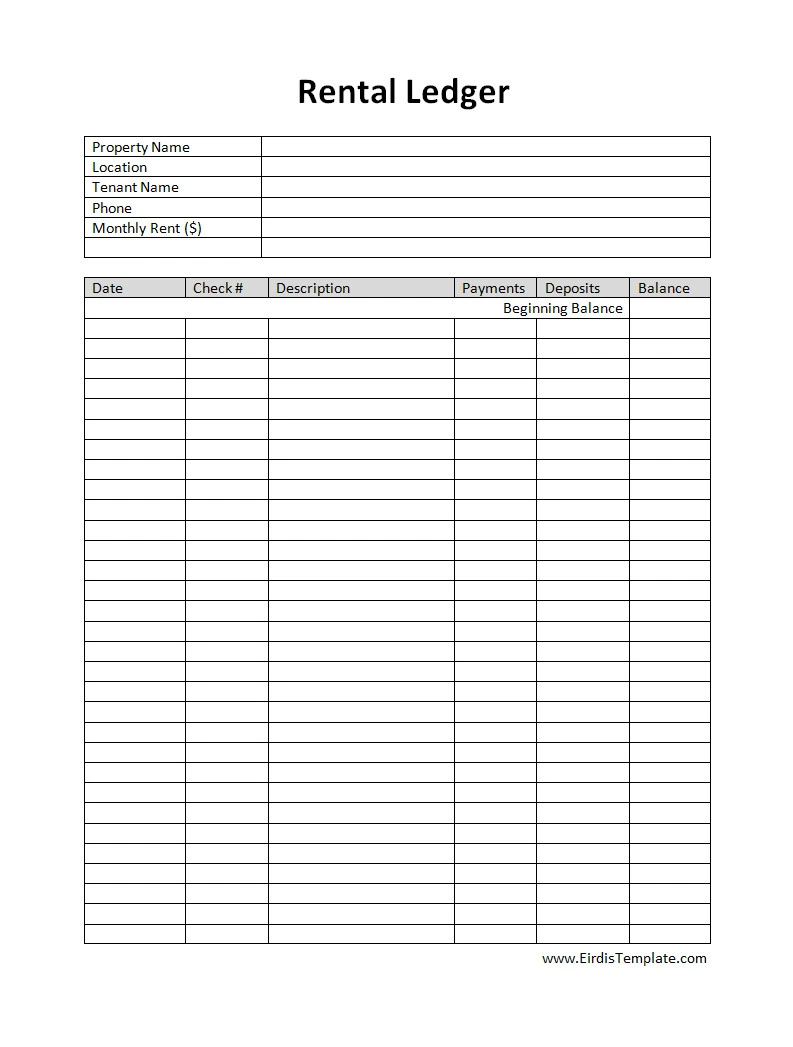

Free Rental Ledger Template

A Rental Ledger helps landlords and tenants stay organized with a clear record of payments, balances, and important rental details. It provides transparency, reduces disputes, and makes tracking rent history simple and stress-free. With a well-structured ledger, managing rental finances becomes easier and far more efficient.

Download the Rental Ledger Template today to keep your rental records accurate and up-to-date.

Rental Ledger Template – DOWNLOAD

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026