What is Proof of Funds?

Proof of Funds (POF) is a financial document or bank statement that demonstrates a person or entity has sufficient funds available to complete a transaction.

In real estate, a Proof of Funds letter serves as a guarantee to sellers or lenders that the buyer has the necessary cash available to purchase a property. It is a crucial document that can help expedite the closing process and secure the deal.

Why Do You Need Proof of Funds?

Establishing Credibility

Having a Proof of Funds letter establishes credibility with sellers and lenders in real estate transactions. It shows that you are a serious buyer who has done your due diligence in securing the necessary funds to complete the purchase. This can give you a competitive edge over other potential buyers.

Streamlining the Process

Providing a Proof of Funds letter can help streamline the closing process by giving the seller confidence that you have the funds readily available. It can reduce the time it takes to finalize the transaction and can help prevent any delays or complications that may arise due to financial issues.

Risk Mitigation

For sellers and lenders, requiring a Proof of Funds letter is a risk mitigation strategy. It helps ensure that the buyer is financially capable of completing the transaction, reducing the likelihood of the deal falling through due to insufficient funds. It provides a level of assurance and security for all parties involved.

Professionalism and Preparedness

Presenting a Proof of Funds letter demonstrates professionalism and preparedness as a buyer. It shows that you have taken the necessary steps to secure your finances and are ready to move forward with the transaction. This can help build trust and confidence with the seller or lender.

Types of Proof of Funds Letters

Bank Comfort Letter

A Bank Comfort Letter is a document issued by a bank to reassure a seller or lender that the buyer has the necessary funds available for the transaction. It serves as a confirmation from the bank that the buyer’s funds are legitimate and accessible for the purchase.

Bank Readiness Letter

A Bank Readiness Letter confirms that the buyer’s bank is prepared and able to provide the required funds for the purchase. It indicates that the bank is ready to facilitate the transfer of funds when needed and is committed to supporting the buyer throughout the transaction.

Blocked Funds Letter

A Blocked Funds Letter demonstrates that the buyer has funds that are set aside and cannot be accessed for a certain period. This type of letter is often used to show financial stability and commitment to the purchase, as the funds are effectively reserved for the transaction.

Verification of Deposit Letter

A Verification of Deposit Letter is issued by a bank to confirm the amount of money in the buyer’s account and validate their financial standing. It provides a snapshot of the buyer’s financial position and can be used to reassure sellers or lenders of their ability to complete the transaction.

Tips for Building Your Funds for Your Proof of Funds Letter

Start Saving Early

One of the most important tips for building funds for your Proof of Funds letter is to start saving early. By setting aside money regularly and consistently, you can accumulate the necessary funds over time and be well-prepared for any potential real estate transactions.

Set Realistic Goals

Setting realistic financial goals can help you stay focused and motivated in building your funds. Determine how much you need for the purchase and create a savings plan that aligns with your budget and timeline to achieve your target amount.

Reduce Unnecessary Expenses

To increase your savings and build your funds faster, consider cutting back on unnecessary expenses. Identify areas where you can reduce spending, such as dining out less frequently, limiting impulse purchases, or finding more affordable alternatives for everyday items.

Explore Investment Opportunities

Exploring investment opportunities can help grow your funds and increase your financial resources for a Proof of Funds letter. Consider options like stocks, bonds, mutual funds, real estate investments, or high-yield savings accounts to maximize your returns and boost your available funds.

Consult with Financial Advisors

If you are unsure about how to best build your funds for a Proof of Funds letter, consider consulting with financial advisors or professionals. They can provide valuable insights, personalized recommendations, and strategic advice to help you achieve your financial goals and secure the necessary funds for your real estate transaction.

Common Mistakes for Proof of Funds Letters

Providing Outdated Information

One common mistake to avoid when preparing a Proof of Funds letter is providing outdated information. Make sure that the details in your letter are current and accurate, including your account balance and contact information, to prevent any delays or misunderstandings in the verification process.

Not Disclosing All Sources of Funds

It is essential to be transparent about all sources of your funds in the Proof of Funds letter. Disclose where the money is coming from, whether it’s savings, investments, loans, or gifts, to provide a comprehensive picture of your financial situation and avoid any discrepancies or suspicions during verification.

Using a Generic Template

Avoid using a generic template for your Proof of Funds letter. Tailor the letter to the specific transaction and recipient by including relevant details, addressing any specific requirements, and personalizing the content to make it more credible, relevant, and impactful in demonstrating your financial readiness.

Overcomplicating the Letter

Keep your Proof of Funds letter clear, concise, and straightforward. Avoid using technical jargon, complex language, or unnecessary details that could confuse or overwhelm the recipient. Present the information in a simple and easy-to-understand manner to ensure clarity and effectiveness in conveying your financial capacity.

Failure to Verify Letter Authenticity

Before submitting your Proof of Funds letter, ensure that it is authentic and verifiable. Double-check the information provided, confirm that it aligns with your financial records, and be prepared to respond to any verification requests promptly. By validating the accuracy and legitimacy of your letter, you can instill confidence and trust in the recipient.

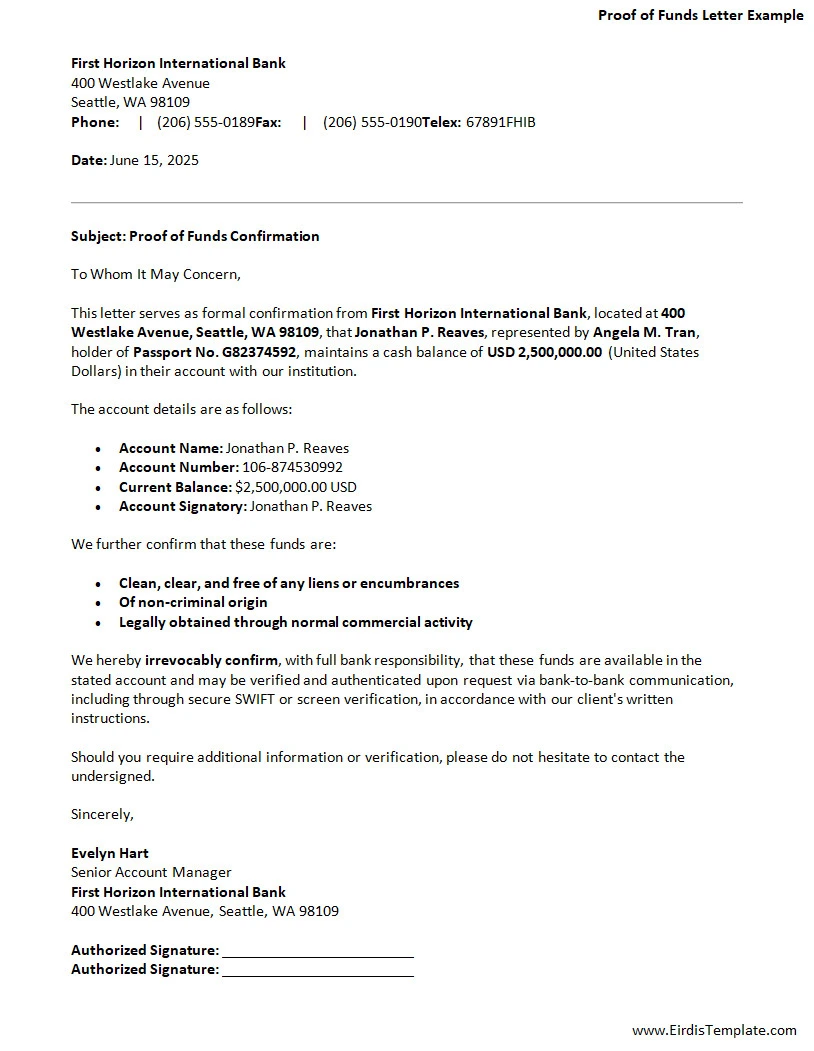

Proof of Funds Letter Template

A Proof of Funds Letter provides clear verification of your financial ability when making major purchases, securing rentals, or completing important transactions. A well-structured letter helps establish trust, speed up approvals, and demonstrate that you have the resources required to move forward confidently.

Download the Proof of Funds Letter Template today to create a professional, reliable document in minutes.

Proof of Funds Letter Template – DOWNLOAD

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026