Trading in the financial markets can be a rollercoaster of emotions and decisions. It’s a world where every trade counts, and even the smallest decisions can have a significant impact on your overall success. This is where a trading journal comes in handy.

A trading journal is not just a diary of your trades; it’s a powerful tool that can help you track your performance, analyze past trades, and improve future strategies by documenting every aspect of a trade, including entry/exit points, outcomes, and associated emotions. It serves as a tool for self-reflection, allowing traders to identify strengths and weaknesses, develop emotional discipline, and create more data-driven and consistent trading plans.

What is a Trading Journal?

A trading journal is a detailed record of all your trades, including information such as the date and time of the trade, the financial instrument traded, entry and exit points, position size, profit or loss, and any other relevant details.

In addition to these quantitative aspects, a trading journal also includes qualitative information, such as your thoughts and emotions during the trade, your reasoning for entering or exiting a position, and any mistakes or lessons learned.

Why You Need a Trading Journal?

A trading journal is a crucial tool for any trader, regardless of their experience level. Here are some key reasons why you need to start keeping a trading journal:

Tracking Your Performance

Tracking your performance is essential for understanding your strengths and weaknesses as a trader. By recording the details of each trade in your journal, you can track your progress over time and identify areas for improvement. This data-driven approach allows you to make informed decisions and adjust your trading strategy accordingly.

Analyzing Past Trades

One of the most valuable aspects of a trading journal is the ability to analyze your past trades. By reviewing your journal entries, you can identify patterns in your trading behavior, pinpoint mistakes, and recognize successful strategies. This retrospective analysis can provide you with valuable insights that can help you refine your approach and become a more consistent and profitable trader.

Improving Future Strategies

Documenting your trades in a journal enables you to learn from both your successes and failures. By reflecting on past trades, you can identify what worked well and what didn’t, allowing you to refine your trading strategy and make more informed decisions in the future. This iterative process of self-improvement is essential for evolving as a trader and achieving long-term success in the markets.

Developing Emotional Discipline

Emotions can often cloud judgment and lead to irrational decisions in trading. By documenting your emotions during each trade, you can gain insight into how your feelings impact your decision-making process. This self-awareness can help you develop emotional discipline and avoid making impulsive or fear-based decisions that may jeopardize your results.

Creating More Data-Driven Plans

With a trading journal, you can make more data-driven trading plans based on historical evidence rather than gut feelings or impulses. By analyzing the data in your journal, you can identify trends, patterns, and correlations that can inform your decision-making process and help you develop more effective strategies for navigating the markets.

Key Elements of a Trading Journal

When creating a trading journal, there are several key elements that you should include to make it a valuable resource for your trading journey:

Date and Time

Recording the date and time of each trade is essential for tracking the timing of your trades and analyzing the market conditions during those times. This information can help you identify optimal trading hours and days that align with your trading strategy.

Financial Instrument

Specifying the financial instrument that you traded allows you to track your performance across different markets and instruments. By documenting the instrument’s name, symbol, or code, you can easily categorize and analyze your trades based on asset class or market sector.

Entry and Exit Points

Documenting the price at which you entered and exited each trade is critical for evaluating your entry and exit strategies. By recording these points, you can assess the effectiveness of your timing and execution, identify areas for improvement, and refine your approach to maximizing profits and minimizing losses.

Position Size

Noting the size of your position in each trade helps you manage risk and control the amount of capital at stake. By recording the position size in your journal, you can calculate the risk-reward ratio, set appropriate stop-loss levels, and implement proper money management techniques to safeguard your trading account.

Outcome

Recording the outcome of each trade, whether it resulted in a profit or loss, is crucial for assessing the success of your trading decisions. By documenting the financial result of each trade, you can track your overall performance, evaluate the effectiveness of your strategies, and adjust your approach based on real-time feedback from the market.

Thoughts and Emotions

Including your thoughts and emotions during each trade provides valuable insights into your psychological state and decision-making process. By documenting your feelings, fears, and biases, you can identify emotional triggers that may influence your trading behavior and develop strategies to maintain a clear and rational mindset while making trading decisions.

Reasoning and Strategy

Explaining your reasoning for entering or exiting a trade and outlining your trading strategy for each trade is essential for understanding the logic behind your decisions. By documenting your rationale, analysis, and plan of action, you can reflect on the effectiveness of your strategies, learn from your mistakes, and refine your approach to trading based on empirical evidence and sound reasoning.

How to Maintain a Trading Journal

Maintaining a trading journal requires discipline and consistency. Here are some tips on how to effectively manage your trading journal:

Set Aside Time

Dedicate a specific time each day to update your trading journal, preferably after the market closes. By establishing a routine for journaling, you can ensure that you capture accurate and timely information about your trades while the details are still fresh in your mind.

Be Consistent

Consistency is key when it comes to maintaining a trading journal. Make it a habit to record every trade, regardless of its outcome, to maintain a comprehensive record of your trading activity. By consistently updating your journal, you can track your progress, identify patterns, and make informed decisions based on historical data.

Review Regularly

Schedule regular reviews of your trading journal to track your progress and identify areas for improvement. By analyzing your past trades, reviewing your performance metrics, and reflecting on your emotional state during trades, you can gain valuable insights that can help you refine your strategies and optimize your trading performance over time.

Identify Patterns

Look for patterns and trends in your trading journal to optimize your trading strategy and decision-making process. By analyzing the data in your journal, you can identify recurring behaviors, profitable setups, and areas of improvement that can help you refine your approach, minimize risks, and maximize returns in the market.

Tips for Using a Trading Journal

Here are some additional tips for maximizing the benefits of your trading journal:

Be Honest

Be honest with yourself when documenting your trades in your journal. Transparency and authenticity are essential for accurately assessing your strengths and weaknesses as a trader. By acknowledging your mistakes, learning from your failures, and celebrating your successes, you can cultivate a growth mindset and continuously improve your trading skills.

Learn from Every Trade

Treat each trade as a learning opportunity and extract valuable lessonsfrom both profitable and losing trades. By analyzing the factors that contributed to your successes and failures, you can identify patterns, trends, and areas for improvement in your trading strategy. Every trade provides valuable insights that can help you refine your approach, enhance your decision-making process, and ultimately become a more profitable trader.

Stay Organized

Keeping your trading journal well-organized and structured is essential for easy navigation and efficient analysis. Consider creating categories or sections within your journal to categorize different types of trades, strategies, or markets. By maintaining a clear and systematic layout, you can quickly access relevant information, track your progress, and make informed decisions based on the data recorded in your journal.

Celebrate Progress

Recognizing and celebrating your progress and achievements documented in your trading journal can boost your motivation and confidence as a trader. Whether it’s achieving a trading goal, successfully implementing a new strategy, or learning from a past mistake, acknowledging your growth and development can reinforce positive behaviors, inspire continued learning, and drive you towards even greater success in the future.

Seek Feedback

Consider sharing your trading journal with a trusted mentor, coach, or fellow trader to receive constructive feedback and insights. External perspectives can offer valuable observations, alternative viewpoints, and constructive criticism that can help you identify blind spots, refine your strategies, and overcome challenges more effectively. By soliciting feedback from others, you can gain fresh perspectives and valuable advice that can enhance your trading performance.

Use Technology

Take advantage of technology and trading journal apps to streamline the process of maintaining and analyzing your trades. There are various software tools and mobile applications designed specifically for traders to record, track, and analyze their trading activity. These platforms often offer advanced features, customization options, and data visualization tools that can simplify the journaling process, provide real-time insights, and enhance the overall efficiency of your trading analysis.

Continuous Improvement

View your trading journal as a dynamic and evolving document that reflects your growth, learning, and progress as a trader. Continuously review and update your journal with new insights, strategies, and observations to ensure that it remains a relevant and valuable resource for your trading journey. By embracing a mindset of continuous improvement and self-reflection, you can adapt to changing market conditions, refine your strategies, and stay ahead of the curve in the competitive world of trading.

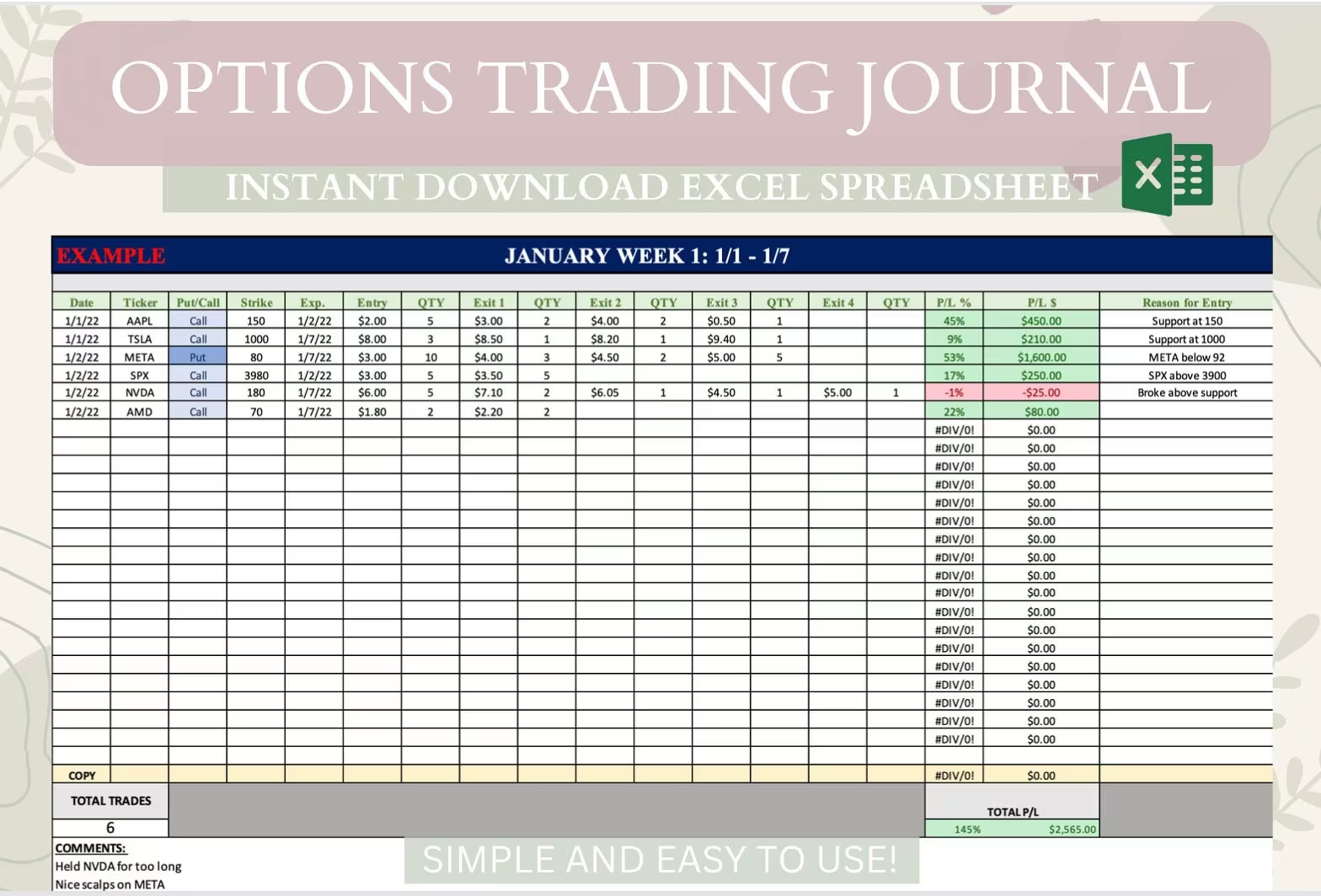

Free Trading Journal Template

In conclusion, a Trading Journal is an invaluable tool for tracking trades, analyzing performance, and refining your investment strategy over time.

Stay disciplined and make smarter trading decisions—download our Trading Journal Template today to take control of your trading success!

Trading Journal Template – DOWNLOAD

- Free Printable Money Receipt Template - February 7, 2026

- Money Management Worksheet Template - February 5, 2026

- Free Customizable Modern Resume Template - February 3, 2026