In today’s fast-paced world, managing your finances can often feel overwhelming. With so many expenses to keep track of and income sources to manage, it’s easy to lose sight of where your money is going. This is where a simple budget template can make a world of difference.

By tracking your income and expenses, a budget gives you control over your spending and helps you reach financial goals like saving for emergencies or a down payment. It reduces financial stress by providing clarity on where your money goes, allowing you to make informed spending decisions and prevent overspending.

What is a Simple Budget?

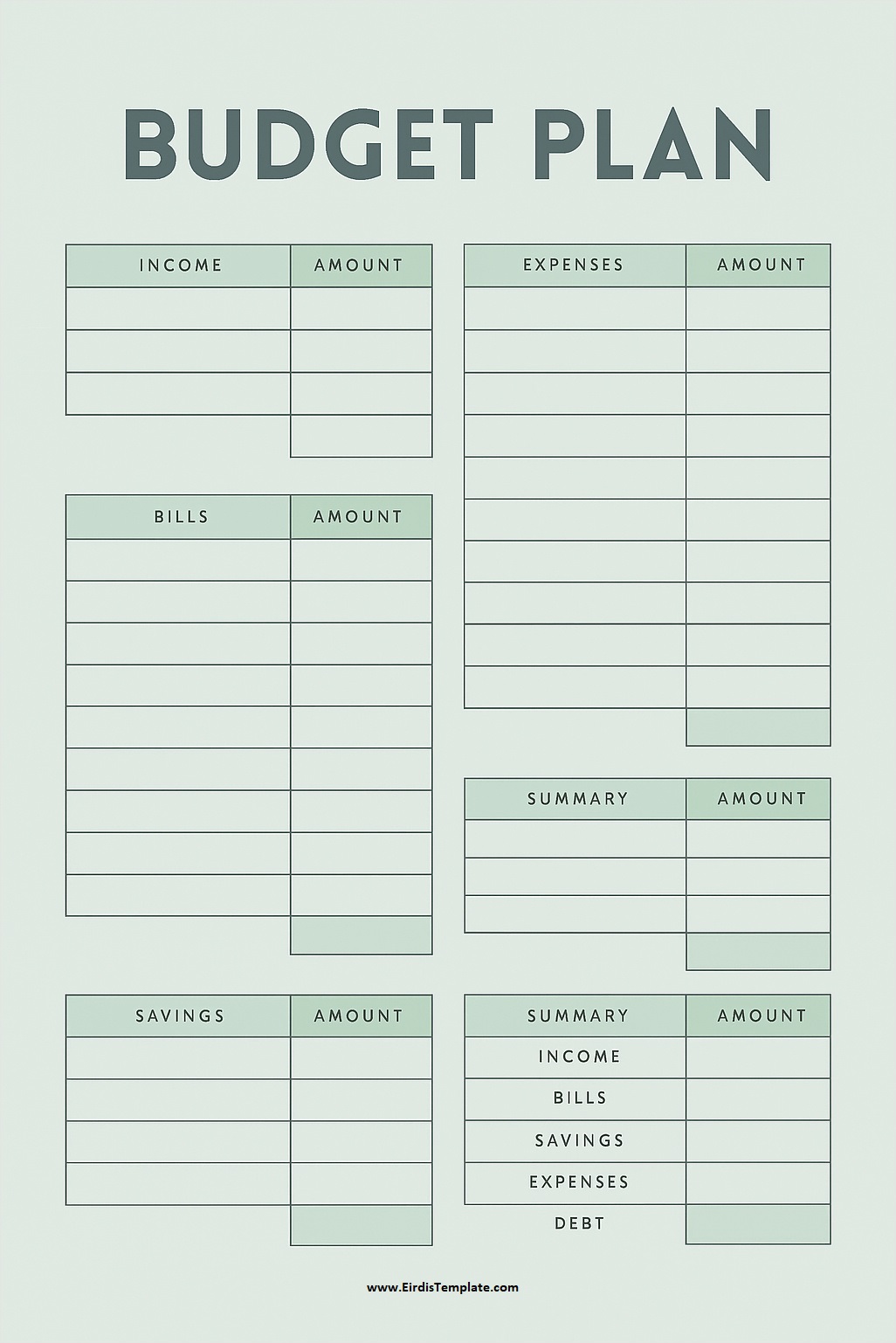

A simple budget is a financial tool that allows you to track your income and expenses over a specific period, typically monthly. It helps you allocate your money towards different categories, such as housing, groceries, transportation, and entertainment. By recording your expenses and comparing them to your income, you can see where you may be overspending and make adjustments to stay within your financial means.

Creating a budget involves listing all your sources of income and categorizing your expenses. This can be done using a spreadsheet, a budgeting app, or even a pen and paper. The goal is to have a clear picture of your financial situation so you can make informed decisions about where to allocate your money.

Why You Should Use a Simple Budget?

Using a simple budget offers numerous benefits that can positively impact your financial health and overall well-being. Let’s explore some of the key reasons why you should consider implementing a budget in your financial routine.

Track Your Spending

Tracking your spending is essential for understanding where your money goes each month. A budget allows you to categorize your expenses, such as housing, utilities, groceries, entertainment, and transportation, giving you a clear picture of your spending habits. By tracking your expenses, you can identify areas where you may be overspending and make adjustments to stay within your budget.

- Identify Problem Areas: By tracking your spending, you may discover that you’re spending more than you realize on certain non-essential items. This awareness can help you make informed decisions about where to cut back.

- Set Spending Limits: Categorizing your expenses in a budget allows you to set spending limits for each category. This can help you prioritize your spending and allocate funds towards your financial goals.

- Monitor Your Progress: Tracking your spending allows you to monitor your progress towards your financial goals. You can see if you’re staying within your budget and make adjustments as needed to stay on track.

Reach Financial Goals

Setting financial goals is essential for achieving long-term financial success. Whether you’re saving for a major purchase, building an emergency fund, or planning for retirement, a budget can help you allocate funds towards your goals. By setting specific and achievable financial goals in your budget, you can track your progress and stay motivated to reach them.

- Allocate Funds Towards Goals: A budget allows you to allocate a portion of your income towards your financial goals. Whether it’s saving a certain amount each month or paying off debt, having a plan in place can help you achieve your goals faster.

- Prioritize Saving: Saving money can be challenging without a clear plan in place. By including savings goals in your budget, you make saving a priority and ensure that you’re setting aside funds for the future.

- Celebrate Milestones: As you reach your financial goals, celebrate your achievements. Whether it’s reaching a savings milestone or paying off a credit card, acknowledging your progress can help you stay motivated to continue working towards your goals.

Avoid Overspending

Overspending can quickly derail your financial progress and lead to unnecessary debt. A budget helps you set limits for each spending category, preventing you from overspending and ensuring that you’re living within your means. By tracking your expenses and comparing them to your income, you can identify areas where you may be overspending and make adjustments to stay on track.

- Stick to Your Budget: Setting spending limits in your budget is important, but sticking to them is crucial. Avoid overspending by tracking your expenses regularly and making adjustments as needed to stay within your budget.

- Avoid Impulse Purchases: Impulse purchases can quickly add up and derail your budget. By planning your spending in advance and sticking to your budget, you can avoid unnecessary purchases and stay on track towards your financial goals.

- Focus on Needs vs. Wants: A budget can help you distinguish between essential needs and non-essential wants. By prioritizing your needs and allocating funds towards them first, you can ensure that your basic expenses are covered before spending on wants.

Reduce Financial Stress

Financial stress is a common source of anxiety for many individuals. By having a simple budget in place, you can reduce financial stress by gaining clarity on your financial situation and having a plan in place to achieve your goals. Knowing where your money goes each month and having control over your spending can alleviate anxiety and provide peace of mind.

- Peace of Mind: Knowing that you have a plan in place for your finances can provide peace of mind and reduce anxiety about money. A budget gives you control over your spending and allows you to make informed decisions about where to allocate your funds.

- Emergency Preparedness: Building an emergency fund is essential for financial security. By including an emergency savings category in your budget, you can prepare for unexpected expenses and reduce the stress of facing a financial crisis.

- Improved Well-Being: Financial stress can impact your overall well-being and quality of life. By implementing a budget and taking control of your finances, you can improve your mental health and reduce stress related to money.

What to Include in Your Simple Budget?

When creating a simple budget, there are several key components to include to ensure that your budget is comprehensive and effective. Let’s explore the essential elements that should be included in your budget to help you achieve your financial goals.

Income

Your income is the foundation of your budget and serves as the starting point for allocating funds towards your expenses and financial goals. When listing your income in your budget, be sure to include all sources of income, including your primary salary, bonuses, side hustle earnings, rental income, and any other sources of income you may have.

- Primary Salary: Your primary salary from your job is likely the largest source of income in your budget. Be sure to include your net income after taxes and deductions to accurately reflect your take-home pay.

- Additional Income: If you have any additional sources of income, such as bonuses, commissions, or freelance earnings, include these in your budget to capture your total income for the month.

- Passive Income: If you earn passive income from investments, rental properties, or other sources, include these earnings in your budget to ensure that you’re accounting for all sources of income.

Expenses

Expenses are the costs associated with living your life and maintaining your lifestyle. When categorizing your expenses in your budget, be sure to include both fixed costs, such as rent or mortgage payments, utilities, and insurance, and variable costs, such as groceries, dining out, entertainment, and transportation.

- Fixed Costs: Fixed costs are expenses that remain consistent each month, such as rent or mortgage payments, car payments, insurance premiums, and subscription services. Include these expenses in your budget to ensure that you’re accounting for your essential monthly costs.

- Variable Costs: Variable costs are expenses that can fluctuate from month to month, such as groceries, dining out, entertainment, and transportation. Categorize these expenses in your budget to track your discretionary spending and identify areas where you can cut back if needed.

Debt Payments

If you have any outstanding debts, such as credit card debt, student loans, or personal loans, it’s important to include debt payments in your budget. By allocating funds towards debt repayment each month, you can make progress towards paying off your debts and improving your financial health.

- Credit Card Debt: If you have credit card debt, include your monthly minimum payments in your budget. Consider allocating additional funds towards paying off your credit card balances to reduce interest charges and pay down your debt faster.

- Student Loans: If you have student loans, include your monthly loan payments in your budget. Depending on your loan terms, you may be able to adjust your repayment plan to better fit your budget and financial goals.

- Personal Loans: If you have any other personal loans, such as a car loan or personal line of credit, include these payments in your budget. Making consistent payments towards these debts can help you reduce your overall debt load and improve your financial situation.

Savings Goals

Saving money is a crucial component of financial stability and success. Whether you’re saving for an emergency fund, a major purchase, or retirement, including savings goals in your budget can help you prioritize saving and allocate funds towards your future financial goals.

- Emergency Fund: Building an emergency fund is essential for financial security. Include a category in your budget for your emergency fund savings and aim to save at least three to six months’ worth of expenses to cover unexpected costs.

- Short-Term Goals: If you’re saving for a specific short-term goal, such as a vacation, a new car, or a home renovation, include a savings category in your budget for these goals. Set a target amount and timeline for achieving each goal to stay motivated and on track.

- Long-Term Goals: Saving for long-term goals, such as retirement or your children’s education, should also be included in your budget. Allocate funds towards these goals each month to ensure that you’re making progress towards achieving them.

Review and Adjust

Regularly reviewing and adjusting your budget is essential for staying on track towards your financial goals. Life circumstances and financial priorities can change, so it’s important to revisit your budget regularly to ensure that it reflects your current financial situation and goals.

- Monthly Check-Ins: Schedule time each month to review your budget and compare your actual expenses to your budgeted amounts. Identify any discrepancies or areas where you may have overspent and make adjustments for the following month.

- Adjust as Needed: Life changes, such as a job loss, a pay increase, or a major expense, may require adjustments to your budget. Be flexible and willing to make changes as needed to ensure that your budget reflects your current financial reality.

- Celebrate Successes: Celebrate your financial wins, whether it’s reaching a savings goal, paying off a debt, or sticking to your budget for the month. Acknowledging your progress and achievements can help you stay motivated and committed to your financial goals.

How to Create a Simple Budget

Creating a simple budget doesn’t have to be complicated. With the right tools and mindset, you can establish a budget that works for your unique financial situation and goals. Let’s explore the steps you can take to create a simple budget and take control of your finances.

Gather Your Financial Information

Before you can create a budget, you’ll need to gather all your financial information, including your income sources, bills, and financial statements. Having a clear picture of your finances will help you create a realistic budget that reflects your financial reality.

- Income Sources: Gather information about all your sources of income, including your salary, bonuses, side hustle earnings, and any other income you receive each month. Ensure that you’re capturing all sources of income to accurately reflect your total earnings.

- Expenses: Collect your monthly bills, receipts, and financial statements to track your expenses. Categorize your expenses into fixed costs, such as rent and utilities, and variable costs, such as groceries and entertainment, to create a comprehensive overview of your spending habits.

- Financial Statements: Review your bank statements, credit card statements, and any other financial documents to understand your spending patterns and identify areas where you may be overspending. This information will help you create a budget that aligns with your financial goals.

List Your Income and Expenses

Once you’ve gathered your financial information, it’s time to list your income and expenses in your budget. Start by recording your monthly income and categorizing your expenses into different spending categories to get a clear picture of your financial situation.

- Income: List all your sources of income in your budget, including your net income after taxes and deductions. Be sure to include all income sources to accurately reflect your total earnings for the month.

- Expenses: Categorize your expenses into fixed costs and variable costs in your budget. Include all your essential expenses, such as rent, utilities, groceries, and transportation, as well as discretionary expenses like dining out and entertainment, to create a comprehensive overview of your spending habits.

- Savings Goals: Allocate funds towards your savings goals in your budget. Whether you’re saving for an emergency fund, a vacation, or retirement, include savings categories in your budget to prioritize saving and achieve your financial goals.

Set Spending Limits

Setting spending limits for each spending category in your budget is essential for staying within your financial means and achieving your financial goals. By allocating specific amounts to each spending category, you can prioritize your spending and avoid overspending.

- Determine Your Limits: Decide how much you can afford to spend in each spending category based on your income and financial goals. Set realistic limits that align with your financial priorities and ensure that you’re staying within your budget each month.

- Prioritize Essential Expenses: Allocate funds towards your essential expenses, such as rent, utilities, and groceries, before budgeting for discretionary expenses like dining out and entertainment. Prioritizing your needs will ensure that your basic expenses are covered each month.

- Track Your Spending: Keep track of your expenses throughout the month to ensure that you’re staying within your budget. Use budgeting apps, spreadsheets, or pen and paper to record your expenses and compare them to your budgeted amounts to identify any areas where you may be overspending.

Review and Adjust Your Budget

Regularly reviewing and adjusting your budget is key to staying on track towards your financial goals and making progress towards achieving them. By monitoring your spending, identifying areas where you may be overspending, and making adjustments as needed, you can ensure that your budget reflects your current financial reality and goals.

- Monthly Review: Set aside time each month to review your budget and compare your actual expenses to your budgeted amounts. Identify any discrepancies or areas where you may have overspent and make adjustments for the following month to stay on track towards your financial goals.

- Make Adjustments: Be flexible and willing to make changes to your budget as needed. Life circumstances and financial priorities can change, so it’s important to adjust your budget accordingly to ensure that it reflects your current financial situation and goals.

- Celebrate Progress: Celebrate your financial wins and milestones, whether it’s reaching a savings goal, paying off a debt, or sticking to your budget for the month. Acknowledging your progress and achievements can help you stay motivated and committed to your financial goals.

Tips for Successful Budgeting

Successfully managing your money through a simple budget requires discipline, commitment, and a clear plan of action. By following these tips and strategies, you can set yourself up for financial success and achieve your financial goals.

Be Realistic

When creating a budget, it’s essential to be realistic about your financial situation and spending habits. Set achievable goals, be honest about your income and expenses, and create a budget that aligns with your financial priorities and goals.

- Set Achievable Goals: Establish realistic financial goals that are attainable based on your income and expenses. Whether you’re saving for a major purchase or paying off debt, set goals that are achievable within your means to stay motivated and committed to your budget.

- Honesty About Spending Habits: Be honest about your spending habits and identify areas where you may be overspending. By acknowledging your financial weaknesses and making adjustments to your budget, you can take control of your spending and achieve your financial goals.

Automate Savings

Automating your savings is a simple yet effective way to ensure that you’re consistently setting aside funds towards your financial goals. By setting up automatic transfers to your savings account, you can make saving a priority and remove the temptation to spend those funds elsewhere.

- Set Up Automatic Transfers: Arrange for a portion of your income to be automatically transferred to your savings account each month. This way, you’re prioritizing saving without having to think about it, making it easier to reach your savings goals.

- Pay Yourself First: Treat your savings like a bill that must be paid each month. Prioritize saving by setting aside a portion of your income before allocating funds towards other expenses. This mindset shift can help you build your savings faster and achieve your financial goals.

Emergency Fund

Building an emergency fund is essential for financial security and peace of mind. Including an emergency fund category in your budget can help you prioritize saving for unexpected expenses and ensure that you’re prepared for any financial setbacks that may arise.

- Establish an Emergency Fund: Aim to save at least three to six months’ worth of expenses in an emergency fund to cover unexpected costs like medical bills, car repairs, or job loss. Include an emergency fund category in your budget to prioritize saving for unforeseen circumstances.

- Consistent Contributions: Make consistent contributions to your emergency fund each month to build it up over time. By including this savings category in your budget and making it a priority, you can ensure that you’re prepared for any financial emergencies that may arise.

Reward Yourself

Incorporating rewards into your budget can help you stay motivated and committed to your financial goals. Whether it’s treating yourself to a small splurge for reaching a savings milestone or achieving a budgeting target, celebrating your successes can keep you on track and motivated to continue managing your money effectively.

- Set Milestone Rewards: Establish milestones in your budget for achieving specific financial goals, such as reaching a savings target or paying off a debt. Reward yourself with a small treat or indulgence when you reach these milestones to celebrate your progress and stay motivated.

- Stay Motivated: Recognize your achievements and progress towards your financial goals by rewarding yourself periodically. By acknowledging your hard work and dedication to managing your money, you can maintain momentum and stay focused on reaching your goals.

Seek Support

Managing your finances can be challenging, but you don’t have to do it alone. Seeking support from a financial advisor, using budgeting tools and resources, or joining a community of like-minded individuals can help you stay accountable, gain valuable insights, and make informed decisions about your financial future.

- Financial Advisor: Consider working with a financial advisor to get personalized guidance and advice on managing your money, setting financial goals, and creating a budget that aligns with your objectives. A financial professional can offer valuable insights and expertise to help you make informed decisions about your finances.

- Budgeting Tools: Utilize budgeting tools and apps to simplify the budgeting process and track your income and expenses more effectively. There are numerous budgeting tools available that can help you create a budget, set financial goals, and monitor your progress towards achieving them.

- Community Support: Joining a community of individuals who are also focused on managing their money can provide a sense of accountability, motivation, and support. Whether it’s online forums, social media groups, or local meetups, connecting with others who share similar financial goals can help you stay on track and achieve success.

Free Simple Budget Template

In conclusion, a Simple Budget is a powerful tool for tracking your income, expenses, and savings with ease. It helps you stay organized, make smarter financial decisions, and reach your money goals faster.

Take control of your finances today—download our Simple Budget Template and start managing your budget effortlessly!

Simple Budget Template – DOWNLOAD

- Money Management Worksheet Template - February 5, 2026

- Free Customizable Modern Resume Template - February 3, 2026

- Free Missing Person Poster Template - February 2, 2026