A security deposit receipt is a document that proves a tenant has paid a security deposit and that the landlord has received it. This receipt is an important piece of documentation for both landlords and tenants, as it outlines the terms of the security deposit and protects the interests of both parties.

When a tenant rents a property, it is common for the landlord to require a security deposit upfront. This deposit serves as a form of protection for the landlord in case the tenant causes any damage to the property or fails to fulfill their rental obligations. The security deposit receipt ensures a transaction record, giving both parties peace of mind.

How a Security Deposit Works

A security deposit is a sum of money, usually equivalent to one or two months’ rent, that a tenant pays to a landlord before moving into a rental property. The purpose of this deposit is to provide the landlord with financial protection in case the tenant causes any damage to the property or breaches the terms of the lease agreement.

Once the tenant pays the security deposit, the landlord must keep it in a separate account, known as an escrow account, for the duration of the tenancy. The landlord cannot use the security deposit for personal expenses and must return it to the tenant at the end of the lease term, minus any deductions for damages or unpaid rent, within a specific timeframe as dictated by state laws.

Why is It Important to Have a Receipt for a Security Deposit Payment?

A receipt for a security deposit payment is crucial for both landlords and tenants.

Here are a few reasons why it is important:

- Proof of payment: The receipt acts as evidence that the tenant has made the required security deposit payment.

- Dispute resolution: In case of any disputes regarding the amount of the security deposit or its return, the receipt can serve as a reference point to resolve the issue.

- Legal protection: A security deposit receipt helps protect both parties legally by clearly outlining the terms and conditions of the security deposit.

- Record-keeping: Having a receipt ensures that both the landlord and tenant have a record of the security deposit payment, which can be useful for tax purposes or future references.

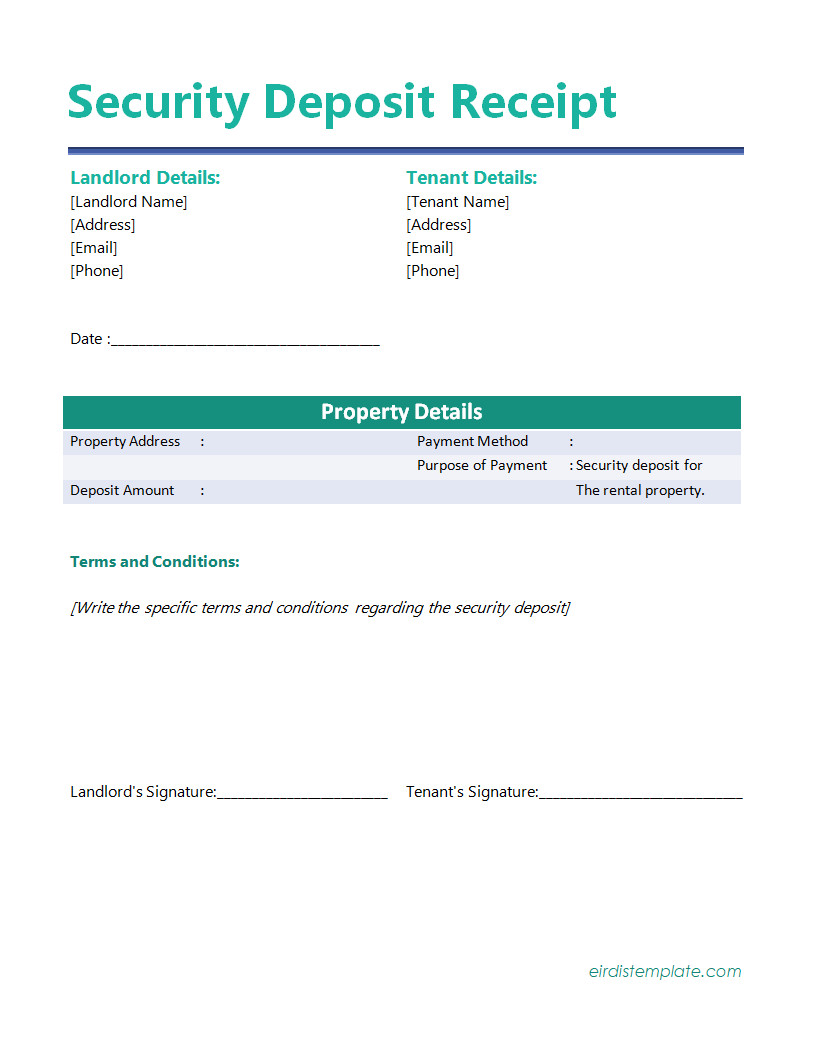

What to Include in a Security Deposit Receipt?

A well-written security deposit receipt should include the following information:

- Tenant’s information: The receipt should clearly state the name, address, and contact details of the tenant.

- Landlord’s information: It should also include the name, address, and contact details of the landlord or property management company.

- Payment details: The receipt should specify the amount of the security deposit paid and the method of payment (e.g., cash, check, online transfer).

- Date of payment: It is important to include the date when the security deposit payment was made.

- Property details: The receipt should mention the address of the rental property for which the security deposit is being paid.

- Terms and conditions: It is advisable to include any relevant terms and conditions regarding the security deposit, such as the conditions for its refund or deductions.

- Signature: Both the landlord and tenant should sign the receipt to acknowledge the payment.

By including these details, the security deposit receipt becomes a comprehensive document that protects the interests of both parties involved.

How Much Should a Landlord Charge for a Security Deposit?

The amount a landlord can charge for a security deposit varies depending on local laws and regulations. In most cases, it is common for landlords to charge one or two months’ rent as a security deposit. However, some states may have specific restrictions on the maximum amount that can be charged.

It is important for landlords to familiarize themselves with their state’s laws regarding security deposits to ensure they comply. Charging an excessive security deposit amount may result in legal consequences and potential penalties.

How and When Do Landlords Have to Return a Security Deposit?

Once the tenant’s lease term comes to an end, the landlord is typically required to return the security deposit within a specific timeframe as dictated by state laws. This timeframe can vary, but it is commonly between 14 to 30 days.

Before returning the security deposit, the landlord has the right to deduct any amounts for damages beyond normal wear and tear or unpaid rent. The deductions should be documented and explained to the tenant. If there are no deductions, the full security deposit amount should be returned to the tenant.

If there are any disputes regarding the deductions or the return of the security deposit, both parties should try to resolve the issue amicably. If a resolution cannot be reached, legal recourse may be necessary.

Free Security Deposit Receipt Template!

Provide clear documentation for rental transactions with our security deposit receipt template! Perfect for landlords and tenants, this professional tool records payment details, including amounts, dates, and terms, ensuring transparency and trust. Simplify your record-keeping process while maintaining legal compliance.

Use this essential template to create organized, accurate receipts for every security deposit exchange!

Security Deposit Receipt Template – Word | PDF

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026