When applying for a mortgage, it’s essential to understand the role of a Letter of Explanation (LOE). This document provides borrowers with an opportunity to provide context for any discrepancies or red flags in their financial history.

Lenders use the LOE to gain a better understanding of the borrower’s financial situation and make an informed decision about loan approval.

Why Do Lenders Require a Letter of Explanation?

Lenders require a Letter of Explanation to ensure that borrowers are transparent about their financial history and to address any concerns that may arise during the mortgage application process. The LOE helps lenders assess the borrower’s creditworthiness and make a more accurate evaluation of their ability to repay the loan.

By providing a detailed explanation of any issues in their financial history, borrowers can demonstrate their ability to manage their finances responsibly and mitigate any potential risks for the lender. The LOE serves as a tool for borrowers to explain any gaps, late payments, credit inquiries, or other red flags that may appear on their credit report.

Benefits of a Letter of Explanation

There are several benefits to including a Letter of Explanation with your mortgage application. Firstly, it allows borrowers to provide context for any questionable items on their credit report, which can help lenders make a more informed decision about loan approval. Secondly, the LOE allows borrowers to demonstrate their financial responsibility and address any concerns that may arise during the underwriting process.

Additionally, a well-written Letter of Explanation can help borrowers build trust with the lender and improve their chances of securing loan approval. By being proactive and transparent about their financial history, borrowers can show lenders that they are committed to repaying the loan and can effectively communicate any extenuating circumstances that may have affected their credit.

Common Reasons for a Letter of Explanation

There are several common reasons why borrowers may need to provide a Letter of Explanation when applying for a mortgage:

- Employment Gaps: If there are gaps in the borrower’s employment history, the LOE can explain the reasons for these gaps and reassure the lender that the borrower is currently employed and able to repay the loan.

- Late Payments: If the borrower has late payments on their credit report, the LOE can explain why these payments were late and demonstrate that the borrower has since improved their payment history.

- Credit Inquiries: Large or numerous credit inquiries can raise red flags for lenders. The LOE can help borrowers explain the reasons behind these inquiries and clarify that they were not seeking additional credit.

- Large Deposits: If there are large deposits in the borrower’s bank account that cannot be easily explained, the LOE can clarify the source of these funds and demonstrate that they are not from undisclosed loans or gifts.

How a Letter of Explanation Helps Borrowers

A well-crafted Letter of Explanation can significantly benefit borrowers during the mortgage application process. By providing a detailed explanation of any red flags or discrepancies in their financial history, borrowers can increase their chances of securing loan approval and obtaining favorable loan terms.

The LOE serves as a tool for borrowers to communicate with lenders and address any concerns that may arise during the underwriting process. By being upfront and transparent about their financial history, borrowers can build trust with the lender and demonstrate their commitment to repaying the loan on time and in full.

Key Components of a Letter of Explanation

When writing a Letter of Explanation for a mortgage, it’s essential to include the following key components:

- Introduction: Start by introducing yourself and providing basic information about the loan you are applying for, including your name, address, and loan number.

- Explanation: Clearly explain the reason behind any red flags or discrepancies in your financial history, providing specific details and context to support your explanation.

- Solutions: If applicable, outline the steps you have taken to address any issues and demonstrate your financial responsibility, such as improving your credit score or paying off outstanding debts.

- Closing: End your LOE with a polite and professional closing, thanking the lender for their time and consideration, and expressing your willingness to provide any additional information if needed.

Tips for Writing a Successful Letter of Explanation

When writing a Letter of Explanation for a mortgage, consider the following tips to ensure your letter is effective and well-received by the lender:

- Be Honest: Always be honest and transparent in your LOE, as lenders appreciate borrowers who are forthright about their financial history.

- Be Specific: Provide specific details and examples to support your explanation, including dates, amounts, and any relevant documentation.

- Be Concise: Keep your explanations clear and to the point, avoiding unnecessary details or irrelevant information that may confuse the lender.

- Proofread Carefully: Check your LOE for spelling and grammatical errors before submitting it, as a well-written document reflects positively on your attention to detail.

- Seek Feedback: Consider asking a trusted friend or family member to review your LOE before submitting it, as a second pair of eyes can help catch any potential mistakes or inconsistencies.

What To Do If Your Letter of Explanation is Rejected?

If your Letter of Explanation is rejected by the lender, don’t panic. Take the following steps to address the situation and improve your chances of securing loan approval:

- Ask for Feedback: Reach out to the lender and request specific feedback on why your LOE was rejected and what you can do to improve it for reconsideration.

- Revise and Resubmit: Make any necessary adjustments to your letter based on the lender’s feedback and resubmit it for further review and consideration.

- Provide Additional Documentation: Include any additional documentation or proof to support your explanation and strengthen your case, such as updated bank statements or pay stubs.

- Consider Alternative Options: If your LOE continues to be rejected, explore other lenders or mortgage programs that may be more flexible with their requirements and willing to work with you to secure loan approval.

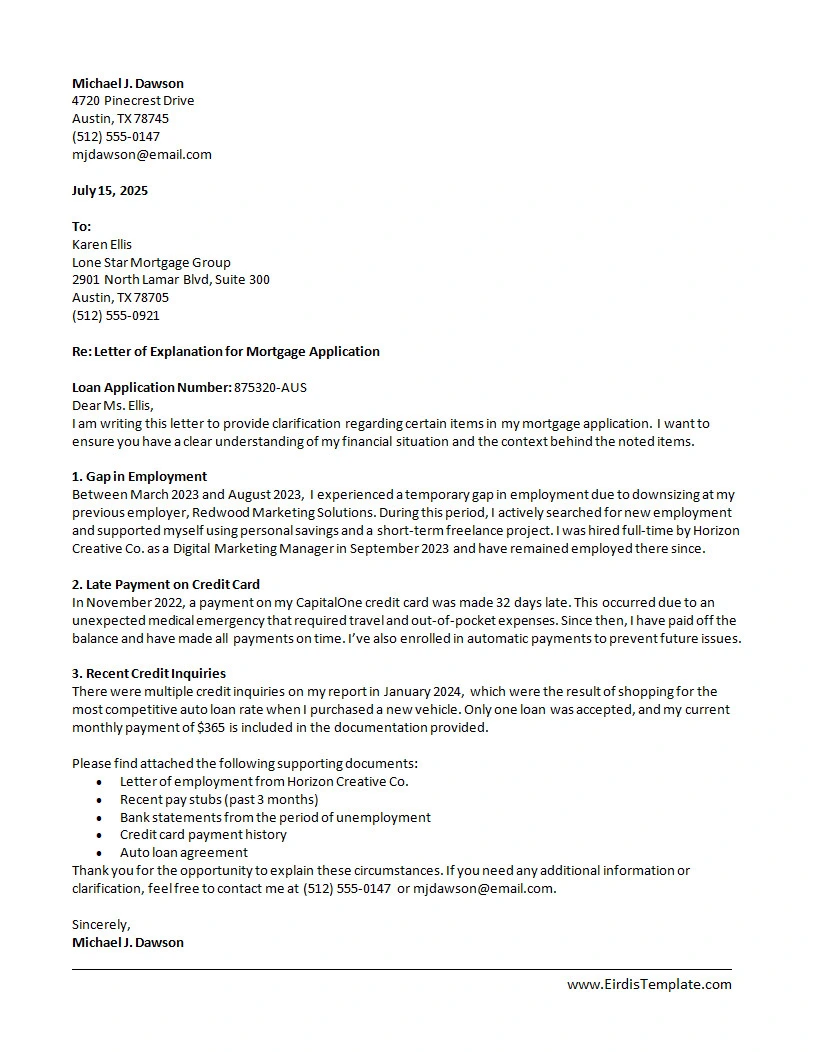

Mortgage Letter of Explanation Template

A Mortgage Letter of Explanation helps clarify financial circumstances, address lender concerns, and provide context that numbers alone can’t fully explain. A clear, well-written letter can strengthen your mortgage application by showing responsibility, transparency, and readiness to move forward.

Download the Mortgage Letter of Explanation Template today to create a polished, effective letter that supports your path to approval.

Mortgage Letter of Explanation Template – DOWNLOAD

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026