Managing your monthly expenses is essential for achieving financial stability and reaching your financial goals. By tracking your income and spending, you can gain valuable insights into your financial situation, identify where your money is going, and effectively manage your finances to save money or pay off debt.

This process allows you to compare your budgeted amounts with your actual spending, make informed decisions about your finances, pinpoint areas where you can cut costs, and hold yourself accountable for your financial choices.

What Are Monthly Expenses?

Monthly expenses refer to the regular payments you make monthly to cover essential living costs, such as housing, utilities, groceries, transportation, and healthcare. These expenses are recurring and can vary in amount depending on your lifestyle and financial obligations.

Why Should You Track Your Monthly Expenses?

Tracking your monthly expenses is crucial for several reasons:

- Understanding Your Financial Situation. By tracking your income and spending, you can gain a clear picture of your financial health and identify areas for improvement.

- Identifying Where Your Money Is Going. Tracking your expenses helps you see where your money is being spent, allowing you to prioritize spending and cut costs in non-essential areas.

- Managing Your Finances Effectively. By monitoring your expenses, you can create a realistic budget, set financial goals, and make informed decisions to achieve them.

- Comparing Budgeted Amounts with Actual Spending. Tracking your expenses allows you to compare what you planned to spend with what you actually spent, giving you insights into your spending habits and where adjustments may be necessary.

- Spotting Areas to Cut Costs. By analyzing your spending patterns, you can identify areas where you can reduce expenses and save money.

- Staying Accountable for Your Financial Decisions. Tracking your expenses helps you stay accountable for your financial choices, leading to better money management and financial discipline.

What to Include in Your Monthly Expense Tracking

When tracking your monthly expenses, it’s important to include the following:

- Income Sources. Record all sources of income, including wages, salary, bonuses, and side hustles.

- Fixed Expenses. List all fixed expenses that remain constant each month, such as rent or mortgage payments, utilities, insurance premiums, and loan payments.

- Variable Expenses. Track variable expenses that can fluctuate, such as groceries, dining out, entertainment, and shopping.

- Savings Contributions. Include any contributions to savings accounts, retirement funds, or other investment accounts.

- Debt Payments. Record any payments towards outstanding debts, such as credit card balances, student loans, or car loans.

- Emergency Fund Contributions. Note any contributions made towards building or replenishing an emergency fund for unexpected expenses.

How to Track Your Monthly Expenses

There are several methods you can use to track your monthly expenses effectively:

1. Create a Budget

Start by creating a detailed budget that outlines your income, fixed expenses, variable expenses, savings goals, and debt payments. This will serve as a roadmap for your financial planning.

2. Use an Expense Tracking App

Utilize expense tracking apps or software to input and categorize your expenses automatically. These tools can provide real-time insights into your spending habits and help you stay on top of your finances.

3. Keep Receipts and Records

Maintain a system for organizing receipts, bills, and financial records to ensure accurate tracking of your expenses. This will also come in handy for tax purposes and budget reviews.

4. Review Your Expenses Regularly

Set aside time each month to review your expenses, compare them to your budget, and identify areas where you can make adjustments to improve your financial situation.

5. Adjust Your Budget as Needed

Be flexible with your budget and make adjustments as needed based on changes in income, expenses, or financial goals. Regularly reassessing your budget will help you stay on track.

6. Seek Professional Advice

If you’re struggling to track your expenses or manage your finances effectively, consider seeking guidance from a financial advisor or planner who can provide expert advice tailored to your specific financial situation.

Tips for Successful Expense Tracking

Follow these tips to make the most out of tracking your monthly expenses:

- Be Consistent. Make expense tracking a regular habit to ensure accuracy and reliability in your financial records.

- Set Realistic Goals. Establish achievable financial goals and use expense tracking to monitor your progress towards them.

- Be Mindful of Your Spending. Practice mindful spending by questioning each purchase and considering its impact on your overall financial well-being.

- Automate Where Possible. Use automation for bill payments, savings transfers, and expense categorization to streamline the tracking process.

- Reward Yourself for Milestones. Celebrate small victories along the way to staying motivated and committed to your financial goals.

- Stay Positive and Patient. Remember that financial progress takes time, so stay positive, patient, and persistent in your efforts to track and manage your expenses effectively.

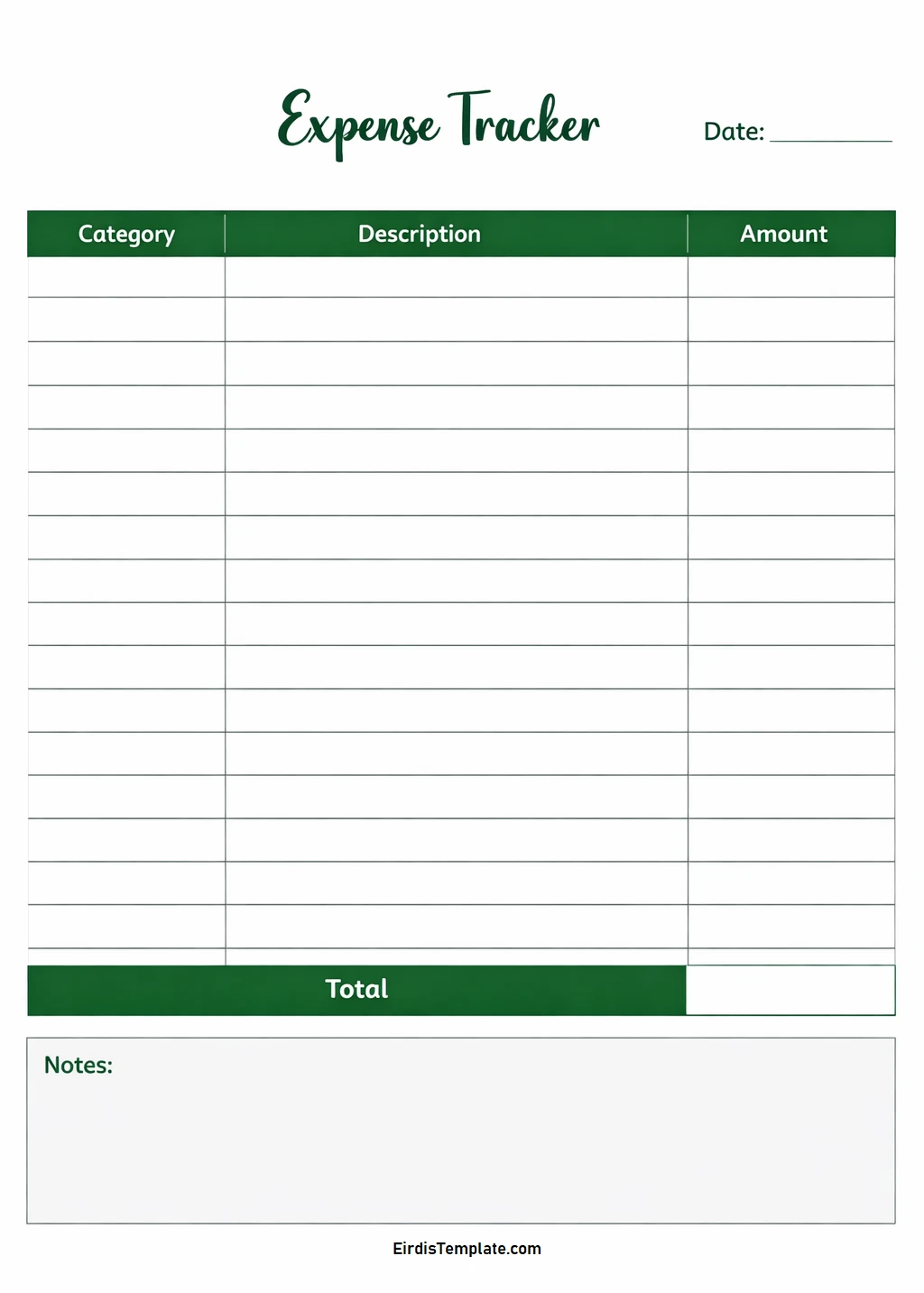

Monthly Expenses Template – DOWNLOAD

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026