What Is A Loan Contract?

A loan contract is a legally binding document that outlines the terms and conditions of a loan agreement between two parties.

In the context of lending money between friends, a loan contract serves as a formal agreement that specifies important details such as the amount borrowed, repayment schedule, interest rate (if applicable), and any other relevant terms agreed upon by both parties.

Why Is A Loan Contract Important?

A loan contract is essential when lending money to friends or family for several reasons. Let’s delve deeper into why having a loan contract between friends is crucial for a successful borrowing experience.

Protecting Your Relationship

One of the primary reasons why a loan contract is important when borrowing money from friends is that it helps protect your relationship. Money matters can strain even the strongest friendships, but having a formal agreement in place can prevent misunderstandings and disagreements that could damage your bond. By clearly outlining the terms of the loan in a contract, both parties know what to expect and can avoid potential conflicts.

Legal Recourse

In the unfortunate event that the borrower is unable to repay the loan as agreed, having a loan contract provides the lender with legal recourse. The contract serves as proof of the terms of the loan and can be used to pursue legal action if necessary. Without a written agreement, it can be challenging to enforce repayment or protect your interests in case of default.

Establishing Trust and Understanding

By formalizing the terms of the loan in a contract, you are establishing trust and understanding between both parties. A loan contract demonstrates that you take the agreement seriously and are committed to following through on the terms set out. This level of professionalism and transparency can help build trust in the borrowing relationship and ensure that both parties are on the same page.

Preventing Miscommunications

One of the most common sources of conflict in lending money informally is miscommunication. Without a written agreement, it’s easy for misunderstandings to arise regarding the loan amount, repayment schedule, or other terms. A loan contract eliminates these uncertainties by clearly laying out all the details of the agreement, reducing the risk of miscommunication and confusion.

Protecting Your Financial Interests

When lending money to friends or family, it’s important to protect your financial interests. A loan contract does just that by outlining the terms of the loan, including the repayment schedule, interest rate (if applicable), and any other conditions. This document acts as a safeguard for your investment, ensuring that you have a legal basis for recourse if the borrower fails to repay the loan.

Establishing Accountability

A loan contract helps establish accountability for both the lender and the borrower. By clearly defining the terms of the loan and setting expectations in writing, both parties are accountable for upholding their end of the agreement. This accountability can help ensure that the borrower takes the loan seriously and makes a concerted effort to repay it according to the agreed-upon terms.

Providing Clarity and Certainty

Having a loan contract provides clarity and certainty for both parties involved in the borrowing transaction. The document clearly outlines the terms of the loan, leaving no room for ambiguity or confusion. This clarity can help alleviate any doubts or concerns about the agreement and give both the lender and the borrower confidence in the borrowing arrangement.

Protecting Your Friendship

Money has the potential to strain even the strongest of friendships. By having a loan contract in place, you can protect your friendship by setting clear boundaries and expectations from the beginning. The contract serves as a tool to prevent misunderstandings and disagreements that could jeopardize your relationship, allowing you to navigate the borrowing process with respect and understanding.

Ensuring Fairness and Equity

A loan contract helps ensure fairness and equity in the borrowing process. By documenting the terms of the loan in writing, both parties have a clear understanding of their rights and responsibilities. This transparency promotes fairness in the agreement and prevents any potential disputes that could arise from differing interpretations of verbal agreements.

Building Financial Literacy

Creating a loan contract between friends can also help build financial literacy for both parties involved. By discussing and agreeing upon the terms of the loan, borrowers can gain a better understanding of financial responsibility and the importance of repaying debts. Lenders, on the other hand, can learn about the importance of setting clear terms and protecting their financial interests.

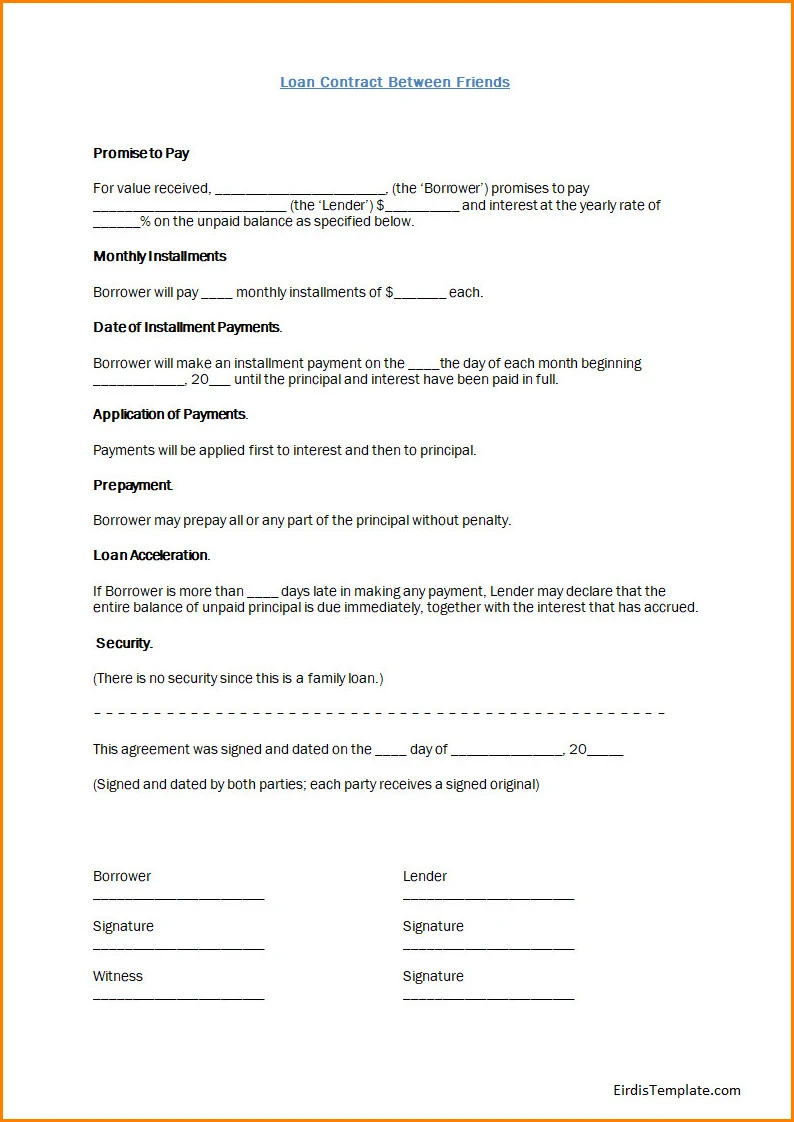

Key Parts Of A Loan Contract

When drafting a loan contract between friends, there are several key components that should be included to ensure clarity and enforceability. Let’s explore the essential parts of a loan contract and why they are important for a successful borrowing arrangement.

Loan Amount

The loan amount is one of the most critical components of a loan contract. Clearly stating the exact amount of money being lent helps avoid any confusion or disputes about the total sum borrowed. Both parties should agree on the loan amount and ensure that it is accurately documented in the contract to prevent any misunderstandings down the line.

Repayment Terms

The repayment terms outline the schedule and method by which the borrower will repay the loan. This includes details such as the frequency of payments, due dates, and any applicable interest rates. Clearly defining the repayment terms in the loan contract helps set expectations for both parties and ensures that the borrower understands their obligations regarding repayment.</p

Interest Rate

If interest is being charged on the loan, it is essential to clearly specify the interest rate in the loan contract. This helps prevent any confusion about the total amount owed by the borrower and ensures that both parties are aware of the cost of borrowing the money. Including the interest rate in the contract adds transparency to the lending agreement and helps maintain a fair and equitable transaction.

Collateral (if applicable)

In some cases, lenders may require collateral to secure the loan, especially when lending a significant amount of money. If collateral is part of the agreement, it should be clearly outlined in the loan contract. This can include assets such as property, vehicles, or valuable items that the borrower pledges as security for the loan. Including collateral in the contract provides added protection for the lender in case the borrower defaults on the loan.

Payment Schedule

The payment schedule details the specific dates on which the borrower is required to make payments toward the loan. This includes the amount due on each payment date and the method of payment accepted by the lender. By clearly defining the payment schedule in the loan contract, both parties have a clear understanding of when payments are due, helping to avoid confusion and late payments.

Consequences of Default

It is crucial to outline the consequences of default in the loan contract to clarify what will happen if the borrower fails to repay the loan as agreed. This may include late fees, penalty interest rates, or the lender’s right to pursue legal action to recover the outstanding amount. Including the consequences of default in the contract helps deter the borrower from missing payments and reinforces the seriousness of the agreement.

Signatures

Both parties should sign the loan contract to indicate their agreement to the terms and conditions laid out in the document. Signatures serve as evidence that both the lender and the borrower have read and understood the terms of the loan, and they are legally binding. Having signatures on the contract reinforces the commitment of both parties to uphold their obligations and provides additional protection in case of any disputes.

How To Write A Loan Contract Between Family Or Friends

Discuss the Terms

Before drafting a loan contract between friends or family members, it is essential to have an open and honest discussion about the terms of the loan. Both parties should clearly communicate their expectations, including the loan amount, repayment schedule, interest rate (if applicable), and any other conditions they want to include in the agreement.

Document the Agreement

Once you have agreed on the terms of the loan, it’s time to document the agreement in a formal loan contract. The contract should clearly outline all the details discussed, including the loan amount, repayment terms, interest rate (if applicable), and any other relevant provisions. Make sure to use clear and concise language to avoid any ambiguity in the agreement.

Review and Sign

Before finalizing the loan contract, both parties must review the document carefully. Ensure that all the terms are accurately reflected in the contract and that both parties agree to the conditions outlined. Once you are satisfied with the terms, sign the contract to make it legally binding. Keep a copy of the signed contract for your records.

Consider Legal Advice

If you are unsure about the legal implications of the loan contract or if you have any concerns about the agreement, it may be wise to seek legal advice. A legal professional can review the contract and guide how to protect your interests and ensure that the agreement is enforceable in case of any disputes. While legal advice may come with a cost, it can offer added peace of mind and security in the lending transaction.

What Should I Do If My Family Member Or Friend Can’t Repay The Loan On Time?

Communicate Openly

If your family member or friend is unable to repay the loan as agreed, it’s essential to have an open and honest conversation about the situation. Approach the issue with empathy and understanding, and listen to their reasons for not being able to make the payments on time. Communication is key to finding a solution that works for both parties.

Explore Flexible Options

Work together to explore flexible options that can help your family member or friend repay the loan without causing financial strain. This may include adjusting the repayment schedule, renegotiating the terms of the loan, or finding alternative ways for them to make payments. Being flexible and understanding can help alleviate the pressure and find a resolution that works for both parties.

Seek Mediation

If you are unable to resolve on your own, consider seeking mediation to help facilitate a productive conversation between you and your family member or friend. A neutral third party can help mediate the discussion, identify areas of compromise, and work toward finding a mutually acceptable solution. Mediation can be a valuable tool in resolving conflicts and reaching a fair outcome in challenging situations.

Consider Legal Recourse

If all attempts to resolve the issue amicably have been unsuccessful, you may need to consider legal recourse to enforce the terms of the loan contract. Consult with a legal professional to understand your rights as a lender and explore legal options available to recover the outstanding amount. While legal action should be a last resort, it can provide a formal process for resolving disputes and protecting your financial interests.

What To Ask Yourself Before Loaning Money?

Can I Afford It?

Before lending money to a family member or friend, ask yourself if you can afford to part with the funds without causing financial strain. Consider your own financial situation and whether you have the resources to lend the money without jeopardizing your own financial stability. It’s essential to prioritize your financial well-being and ensure that lending the money will not put you at risk.

What Are The Terms?

Clarify the terms of the loan before agreeing to lend money to a family member or friend. Discuss the loan amount, repayment schedule, interest rate (if applicable), and any other conditions you want to include in the agreement. Ensure that both parties are clear on the terms and have a shared understanding of the expectations regarding the loan.

What If They Can’t Repay?

Consider the potential consequences if your family member or friend is unable to repay the loan as agreed. Think about how you would handle the situation if they encounter financial difficulties or unexpected challenges that prevent them from making payments on time. Having a plan in place for such scenarios can help you navigate the lending process more effectively.

Is There a Better Alternative?

Explore alternative options before deciding to lend money to a family member or friend. Consider whether there are other ways you can help them without providing a monetary loan, such as offering advice, support, or connecting them with resources that can assist them. Sometimes, non-financial assistance may be more beneficial than a monetary loan in the long run.

Have I Considered the Impact?

Think about the potential impact of lending money to a family member or friend on your relationship. Consider how the borrowing arrangement may affect your dynamic and whether you are comfortable with the potential implications. Be mindful of the emotional and social aspects of lending money to someone close to you and assess whether it aligns with your values and boundaries.

Am I Willing to Set Boundaries?

Setting boundaries is crucial when lending money to family or friends. Determine what boundaries you are comfortable with regarding the loan, such as the repayment terms, communication about the loan, and expectations for repayment. Clearly define these boundaries from the outset to avoid misunderstandings and maintain a healthy lending relationship.

Do I Have a Plan for Repayment?

Prior to lending money to a family member or friend, have a plan in place for repayment. Consider how you will handle the repayment process, track payments, and address any issues that may arise during the loan term. Having a repayment plan can help you stay organized and ensure that both parties are aligned on the expectations for the loan.

Can I Maintain Transparency?

Transparency is key in any lending arrangement, especially when it involves friends or family. Be open and honest about the terms of the loan, including the amount borrowed, repayment schedule, and any other conditions. Maintain clear communication throughout the lending process to ensure that both parties are informed and have a shared understanding of the agreement.

Have I Considered Alternative Funding Sources?

Consider whether there are alternative funding sources available to your family member or friend before agreeing to lend them money. Explore other options such as personal loans, credit unions, or financial assistance programs that may provide a more suitable solution for their needs. Encouraging them to explore alternative funding sources can help them find the best financial support for their situation.

Loan Contract Template Between Friends – DOWNLOAD

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026