When borrowing money, understanding how your loan will be paid off over time is crucial. This is where a loan amortization schedule comes into play. By providing a clear breakdown of each payment, showing the portion that goes towards principal and interest, both borrowers and lenders can effectively budget, track loan progress, understand the total cost of borrowing, and strategize on how to pay off the loan more quickly by making extra payments.

In this comprehensive guide, we will delve into the key elements of a loan amortization schedule and provide tips for successful loan repayment.

What is a Loan Amortization Schedule?

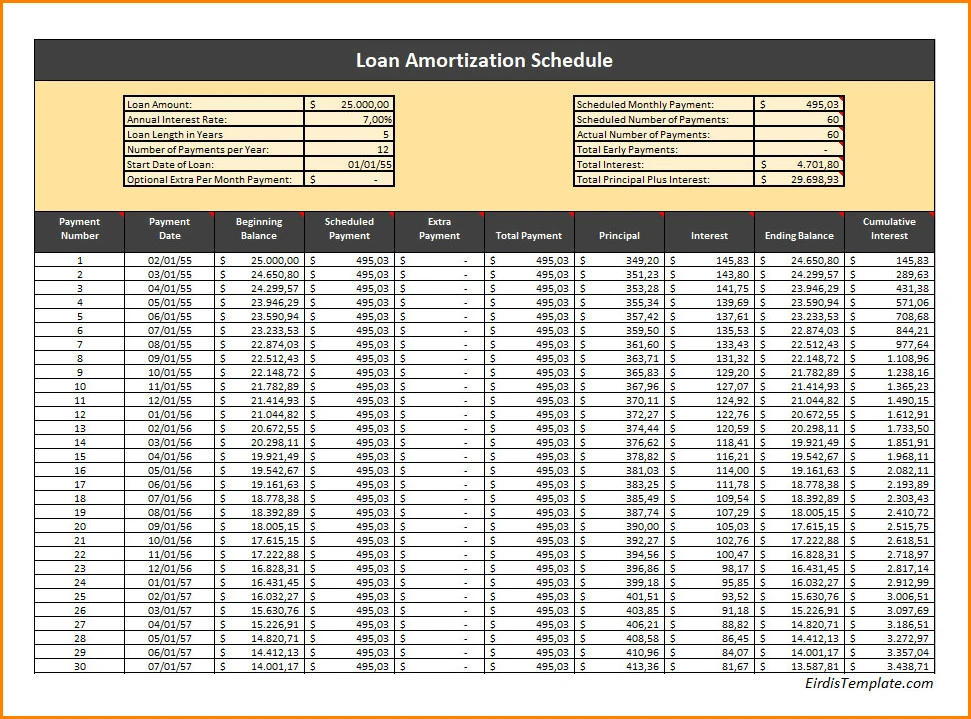

A loan amortization schedule is a table that details how a loan will be paid off over time. It breaks down each payment into two components: principal and interest. The principal is the amount borrowed, while the interest is the cost of borrowing the money.

As you make payments on your loan, the proportion of each payment allocated to principal and interest will change. This schedule helps you visualize how your loan balance decreases over time and how much of each payment goes towards reducing the principal amount.

Why is a Loan Amortization Schedule Important?

Having a loan amortization schedule is essential for both borrowers and lenders for several reasons. For borrowers, it provides clarity on how much they owe and how their payments are being applied. It helps them budget effectively and plan for the future by understanding the total cost of borrowing. For lenders, the schedule serves as a tool to track loan progress, assess the creditworthiness of the borrower, and ensure repayment is on track.

Overall, a loan amortization schedule promotes transparency and accountability in the borrowing process.

Key Elements of a Loan Amortization Schedule

When looking at a loan amortization schedule, there are several key elements to consider:

Loan Amount

The loan amount is the total sum of money borrowed from a lender. This amount forms the basis of the loan and is what needs to be paid back over time, along with any accrued interest.

Interest Rate

The interest rate is the percentage charged by the lender for borrowing the money. It is applied to the outstanding balance of the loan and accrues over time, increasing the total amount owed by the borrower.

Loan Term

The loan term refers to the length of time over which the loan will be repaid. This can vary depending on the type of loan and the agreement between the borrower and lender.

Monthly Payment

The monthly payment is the amount due each month to the lender. It consists of both principal and interest, with the proportion of each varying over the life of the loan.

Principal Payment

The principal payment is the portion of each payment that goes towards reducing the loan balance. As the loan is repaid, the principal amount decreases, leading to a lower overall debt burden for the borrower.

Interest Payment

The interest payment is the cost of borrowing the money, calculated based on the outstanding balance of the loan. This amount is in addition to the principal payment and is determined by the interest rate and loan term.

How to Read a Loan Amortization Schedule

Reading a loan amortization schedule may seem daunting at first, but it is relatively straightforward once you understand the basics. Here’s a step-by-step guide:

Identify the Loan Information

Start by locating the loan amount, interest rate, loan term, and monthly payment on the schedule. This information will give you a clear overview of the terms of your loan and what you can expect to pay each month.

Review the Payment Breakdown

Examine how each payment is divided between principal and interest. Note how the proportion changes over time, with more going towards principal as the loan is repaid.

Tips for Successful Loan Repayment

Here are some tips to help you successfully repay your loan:

Set a Budget

Create a budget that includes your loan payments to ensure you can afford them each month. This will help you prioritize your loan repayment and avoid financial difficulties.

Make Extra Payments

Consider making extra payments towards the principal to pay off the loan faster. Even small additional payments can make a significant impact on reducing your overall debt burden.

Communicate with Your Lender

Keep your lender informed of any changes in your financial situation to avoid defaulting on the loan. If you anticipate any difficulties in making payments, reach out to your lender to discuss alternative arrangements.

Monitor Your Progress

Regularly review your loan amortization schedule to track your progress and make adjustments as needed. This will help you stay on top of your repayment schedule and make any necessary changes to meet your financial goals.

Plan for the Future

Use the information from your schedule to plan for future financial goals and make informed decisions about borrowing and repayment. By staying proactive and strategic, you can achieve financial success and secure a stable financial future.

Loan Amortization Schedule Template – DOWNLOAD

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026