Regarding estate planning, a living trust form can be a valuable tool to manage and distribute your assets both during your lifetime and after your death.

This legal document is designed to help you avoid the costly and public probate process, ensuring that your assets are handled according to your wishes. By creating a living trust, you can specify who will manage your assets as the trustee and who will inherit them as the beneficiary. Additionally, a living trust can provide a way to manage property for minor children and ensure that your assets are taken care of in case of incapacity.

What is a Living Trust Form?

A living trust form, also known as a revocable trust or inter vivos trust, is a legal document that allows you to place your assets into a trust during your lifetime. This trust is flexible and can be modified or revoked as long as you are mentally competent.

By creating a living trust, you can transfer ownership of your assets to the trust, which will be managed by a trustee of your choosing. The trust document also specifies how your assets should be distributed after your death.

Why Create a Living Trust Form?

There are several reasons to consider creating a living trust form as part of your estate planning strategy:

Probate Avoidance

One of the primary reasons people choose to create a living trust is to avoid the probate process. Probate is the legal process of administering an estate after someone passes away, which can be time-consuming, expensive, and public. By creating a living trust, you can ensure that your assets are distributed according to your wishes without the need for probate.

Privacy

Another benefit of a living trust is the privacy it offers. Unlike a will, which becomes part of the public record during the probate process, a living trust is a private document. This means that your assets and beneficiaries remain confidential, providing an added layer of privacy and security.

Asset Management

A living trust allows you to appoint a trustee to manage your assets on your behalf. This can be especially useful in the event of your incapacity, as the trustee can step in to manage your financial affairs and ensure that your assets are protected and distributed according to your wishes. By creating a living trust, you can have peace of mind knowing that your assets are in capable hands.

Caring for Minor Children

If you have minor children, a living trust can provide a way to manage property on their behalf. You can designate a trustee to oversee the management of assets for the benefit of your children until they reach a certain age, ensuring that their financial needs are taken care of. A living trust can also specify how assets should be distributed to minor children, providing a clear plan for their inheritance.

Key Elements of a Living Trust Form

When creating a living trust form, there are several key elements to consider:

Grantor

The grantor is the person who creates the living trust and transfers their assets into it. As the grantor, you have the power to determine how your assets should be managed and distributed both during your lifetime and after your death. You can also choose a successor grantor to take over management of the trust if you become incapacitated or pass away.

Trustee

The trustee is the person or entity responsible for managing the assets held in the living trust. The trustee has a fiduciary duty to act in the best interests of the beneficiaries and follow the instructions outlined in the trust document. It is important to choose a trustee who is trustworthy, responsible, and capable of managing your assets according to your wishes.

Beneficiary

The beneficiary is the person or entity who will inherit the assets held in the living trust. You can designate one or more beneficiaries and specify how the assets should be distributed to them. By naming beneficiaries in your living trust, you can ensure that your assets are passed on according to your wishes and avoid potential disputes among family members.

Trust Assets

The trust assets are the property and assets that are placed into the living trust. This can include real estate, bank accounts, investments, personal belongings, and any other valuable assets. By transferring ownership of your assets to the trust, you can ensure that they are managed and distributed according to the terms of the trust document.

Successor Trustee

The successor trustee is the person or entity designated to take over management of the living trust if the original trustee is unable to serve. This could be due to incapacity, death, or resignation. It is important to choose a successor trustee who is willing and able to fulfill the duties of a trustee and follow the instructions outlined in the trust document.

How to Create a Living Trust Form

Creating a living trust form involves several steps:

Consult with an Estate Planning Attorney

One of the first steps in creating a living trust is to consult with an experienced estate planning attorney. An attorney can help you understand the benefits of a living trust, assess your unique situation, and draft the necessary legal documents. They can also provide guidance on how to fund the trust and ensure that your assets are properly managed and distributed.

Gather Information

Before creating a living trust, you will need to gather information about your assets, beneficiaries, and any specific instructions you want to include in the trust document. This may involve making an inventory of your assets, identifying potential beneficiaries, and considering how you want your assets to be distributed.

Draft the Trust Document

Once you have gathered the necessary information, your attorney will draft the living trust document based on your instructions and preferences. The trust document will outline how your assets should be managed and distributed, who will serve as trustee and beneficiary, and any other provisions you wish to include. It is important to review the trust document carefully to ensure that it accurately reflects your wishes.

Fund the Trust

To ensure that your assets are transferred into the living trust, you will need to retitle them in the name of the trust. This may involve changing the ownership of bank accounts, real estate properties, and other assets to the name of the trust. By funding the trust, you can ensure that your assets are held and managed according to the terms of the trust document.

Review and Update

It is important to review your living trust form periodically and make updates as needed. Life circumstances can change, such as marriage, divorce, birth of children, or acquisition of new assets, which may necessitate changes to the trust document. By reviewing and updating your living trust regularly, you can ensure that it continues to meet your goals and objectives.

Tips for Successful Estate Planning with a Living Trust

Here are some tips to help you successfully incorporate a living trust form into your estate planning strategy:

Educate Yourself

Take the time to educate yourself about how a living trust works and the benefits it offers. Understanding the purpose and function of a living trust can help you make informed decisions about your estate planning strategy and ensure that your assets are protected and distributed according to your wishes.

Choose a Reliable Trustee

When selecting a trustee for your living trust, choose someone reliable, responsible, and capable of managing your assets. The trustee plays a crucial role in ensuring that your assets are managed and distributed according to the

Keep Your Trust Document Secure

It is important to keep your living trust document in a secure location, such as a safe deposit box or with your attorney. Inform your trustee and beneficiaries of the location of the trust document and provide instructions on how to access it in case of your incapacity or death. Keeping your trust document secure can help prevent unauthorized access and ensure that your wishes are carried out as intended.

Communicate Your Wishes

Clear communication is key when it comes to estate planning with a living trust. Make sure to communicate your wishes to your trustee and beneficiaries, explaining how you want your assets to be managed and distributed. By discussing your estate plan with your loved ones, you can avoid misunderstandings, conflicts, and disputes down the road.

Review Regularly

Reviewing your living trust form regularly is essential to ensure that it remains up to date and reflects your current wishes and circumstances. Life events such as marriage, divorce, birth of children, or changes in financial status may necessitate updates to your trust document. By reviewing your living trust periodically, you can ensure that it continues to serve its intended purpose and meets your estate planning goals.

Consider Professional Guidance

Seeking professional guidance from an estate planning attorney or financial advisor can help you navigate the complexities of creating and managing a living trust. An experienced professional can provide valuable insights, answer your questions, and guide you through the process of estate planning with a living trust. By working with a trusted advisor, you can ensure that your estate plan is tailored to your specific needs and goals.

Plan for Incapacity

In addition to managing your assets after your death, a living trust can also provide a way to manage your assets in case of incapacity. By designating a successor trustee to step in and manage your affairs if you become incapacitated, you can ensure that your financial matters are taken care of and that your assets are protected. Planning for incapacity is an important aspect of estate planning with a living trust.

Update Beneficiary Designations

It is important to review and update beneficiary designations on your accounts and assets to ensure that they align with the provisions of your living trust. By naming your living trust as the beneficiary of your accounts and assets, you can ensure that they are distributed according to the terms of the trust document. Regularly reviewing and updating beneficiary designations can help prevent unintended consequences and ensure that your assets are passed on as intended.

Consider Tax Implications

When creating a living trust, it is important to consider the potential tax implications of transferring assets into the trust. Depending on the value of your assets and the type of trust you create, there may be tax consequences to consider. Consulting with a tax professional or financial advisor can help you understand the tax implications of creating a living trust and develop strategies to minimize taxes and maximize the benefits of your estate plan.

Discuss Your Plan with Loved Ones

Openly discussing your estate plan with your loved ones can help ensure that everyone is on the same page and understands your wishes. By communicating your intentions, you can prevent confusion, conflicts, and misunderstandings among family members. Sharing your estate plan with your loved ones can also provide an opportunity to address any concerns or questions they may have, fostering transparency and trust within your family.

Seek Ongoing Guidance

Estate planning is a dynamic process that may require adjustments over time. Seeking ongoing guidance from a qualified professional can help you navigate changes in your life circumstances, laws, and regulations that may impact your estate plan. By staying informed and seeking advice as needed, you can ensure that your estate plan remains effective and aligned with your goals and objectives.

Conclusion

Creating a living trust form as part of your estate planning strategy can provide peace of mind knowing that your assets will be managed and distributed according to your wishes. By understanding the key elements of a living trust, the benefits it offers, and how to create and manage a living trust, you can develop a comprehensive estate plan that protects your assets and provides for your loved ones.

By following the tips outlined in this guide, you can successfully incorporate a living trust form into your estate plan and ensure that your legacy is preserved for future generations.

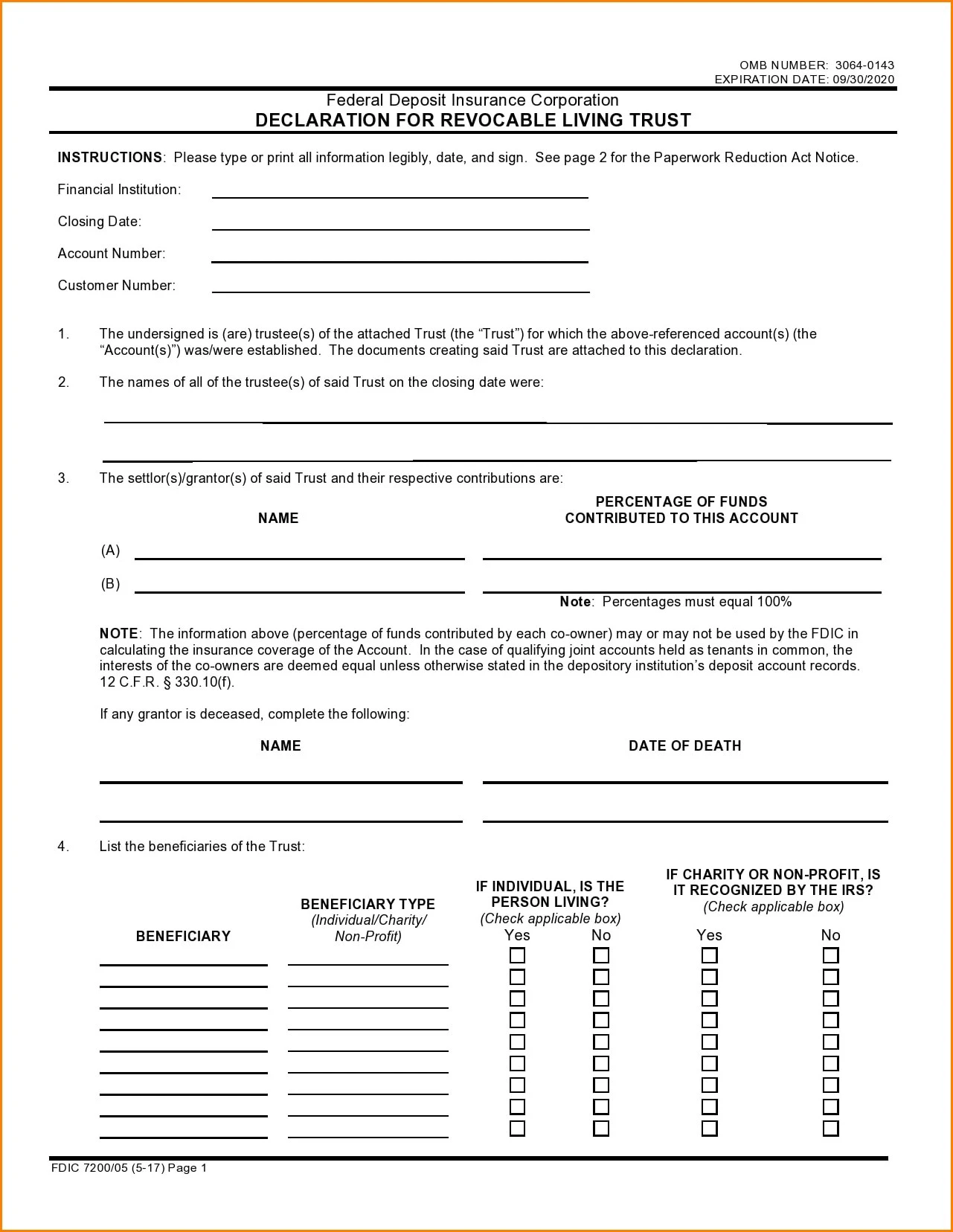

Living Trust Form Template – DOWNLOAD

- Free Printable Mailing Label Template - January 8, 2026

- Machine Lease Agreement Template - January 8, 2026

- Free Printable Luggage Tag Template - January 8, 2026