In the world of credit repair, a letter of goodwill can be a powerful tool in improving your credit standing. This type of letter is often sent to a creditor to request the removal of a negative item, such as a late payment, from your credit report as a gesture of good faith.

The goal is to leverage the creditor’s willingness to overlook a past mistake, particularly if it was an isolated incident or due to extenuating circumstances. By doing so, you can potentially improve your credit score and financial future.

What is a Letter of Goodwill?

A letter of goodwill is a formal correspondence sent to a creditor in which the sender explains their situation, expresses regret for any past mistakes, and requests the removal of a negative item from their credit report.

This type of letter is typically used in cases where a late payment or other negative mark on the credit report was a one-time occurrence or was the result of extenuating circumstances. The sender is essentially asking the creditor to show compassion and understanding by removing the negative item as a gesture of goodwill.

Why Do You Need a Goodwill Letter?

A goodwill letter can be a valuable tool in credit repair for several reasons.

Taking Initiative in Credit Repair

Taking the initiative to address negative items on your credit report through a goodwill letter demonstrates a proactive approach to credit repair. By acknowledging past mistakes, expressing regret, and requesting the removal of negative items, the sender shows a commitment to improving their credit standing and financial future. This proactive stance can help build credibility with creditors and increase the likelihood of a positive response to the goodwill letter request.

Building Trust and Credibility with Creditors

Sending a goodwill letter to a creditor is an opportunity to build trust and credibility by demonstrating honesty, responsibility, and a willingness to rectify past mistakes. By taking the initiative to address negative items on their credit report, the sender shows a proactive attitude towards credit repair and financial accountability. Building trust and credibility with creditors can lead to more favorable outcomes, such as the removal of negative items and improved credit standing.

Enhancing Financial Opportunities Through Credit Repair

Improving your credit standing through a goodwill letter can open up new financial opportunities and benefits. A higher credit score resulting from the removal of negative items can lead to lower interest rates on loans and credit cards, increased chances of approval for credit applications, and access to better financial products and services. By taking steps to repair your credit, you can enhance your financial well-being and secure a more stable financial future.

When Do You Need This Letter?

A goodwill letter can be particularly useful in situations where a negative item on your credit report is impacting your credit score and financial opportunities. For example, if you are trying to qualify for a mortgage or car loan, a late payment or other negative mark on your credit report could result in higher interest rates or even denial of credit. In these cases, a goodwill letter can be a proactive step towards improving your credit standing and achieving your financial goals.

Impact of Negative Items on Credit Applications

Negative items on your credit report, such as late payments or collections, can have a significant impact on your ability to qualify for credit applications. Lenders and creditors use credit reports to assess the risk of lending money to individuals, and negative items can signal potential financial irresponsibility or risk. By addressing and potentially removing negative items through a goodwill letter, you can improve your credit standing and increase your chances of approval for credit applications.

Benefits of Improving Credit Standing

Improving your credit standing through a goodwill letter can have numerous benefits beyond qualifying for credit applications. A higher credit score can lead to lower interest rates on loans and credit cards, saving you money on interest payments over time. Additionally, a positive credit history can make it easier to secure rental housing, obtain insurance coverage, and qualify for favorable terms on utility services. By taking steps to repair your credit, you can enhance your financial stability and quality of life.

Opportunities for Financial Growth and Stability

A strong credit standing opens up opportunities for financial growth and stability in the long term. With an improved credit score, you may be able to qualify for higher credit limits, better rewards programs on credit cards, and favorable terms on loans and mortgages. Additionally, a positive credit history can enhance your reputation with lenders and creditors, leading to more favorable treatment and opportunities for financial growth. By leveraging a goodwill letter to improve your credit standing, you can position yourself for a more secure financial future.

Pros And Cons of a Goodwill Letter

When considering whether to send a goodwill letter, it’s important to weigh the potential pros and cons. Some of the benefits of sending a goodwill letter include the potential for improving your credit standing, demonstrating responsibility to creditors, and increasing your chances of qualifying for credit. However, there are also potential downsides to consider, such as the possibility that the creditor may not agree to remove the negative item or that the process may take time and effort on your part.

Potential Benefits of Sending a Goodwill Letter

Sending a goodwill letter can offer several potential benefits to the sender. By addressing negative items on your credit report proactively, you demonstrate responsibility and a commitment to improving your credit standing. This proactive approach can lead to favorable outcomes, such as the removal of negative items, an increase in your credit score, and improved financial opportunities. Additionally, sending a goodwill letter can help build trust and credibility with creditors, which can be beneficial for future credit applications.

Possible Drawbacks of Sending a Goodwill Letter

While goodwill letters can be effective in credit repair, there are potential drawbacks to consider. One possible drawback is that the creditor may not agree to remove the negative item from your credit report, despite your best efforts and explanations. In some cases, creditors may have strict policies regarding the removal of negative items, leading to a denial of your goodwill letter request. Additionally, the process of sending a goodwill letter and following up with the creditor may require time and effort on your part, with no guarantee of success.

Strategies to Mitigate Drawbacks of Goodwill Letters

To mitigate potential drawbacks of sending a goodwill letter, there are several key strategies that can enhance the effectiveness of your request. First, research the creditor’s policies regarding goodwill adjustments and tailor your letter to address specific concerns or requirements. Providing detailed explanations and supporting documentation can strengthen your case and increase the likelihood of a positive response. Additionally, following up with the creditor after sending the goodwill letter can demonstrate persistence and determination, which may improve the chances of a favorable outcome.

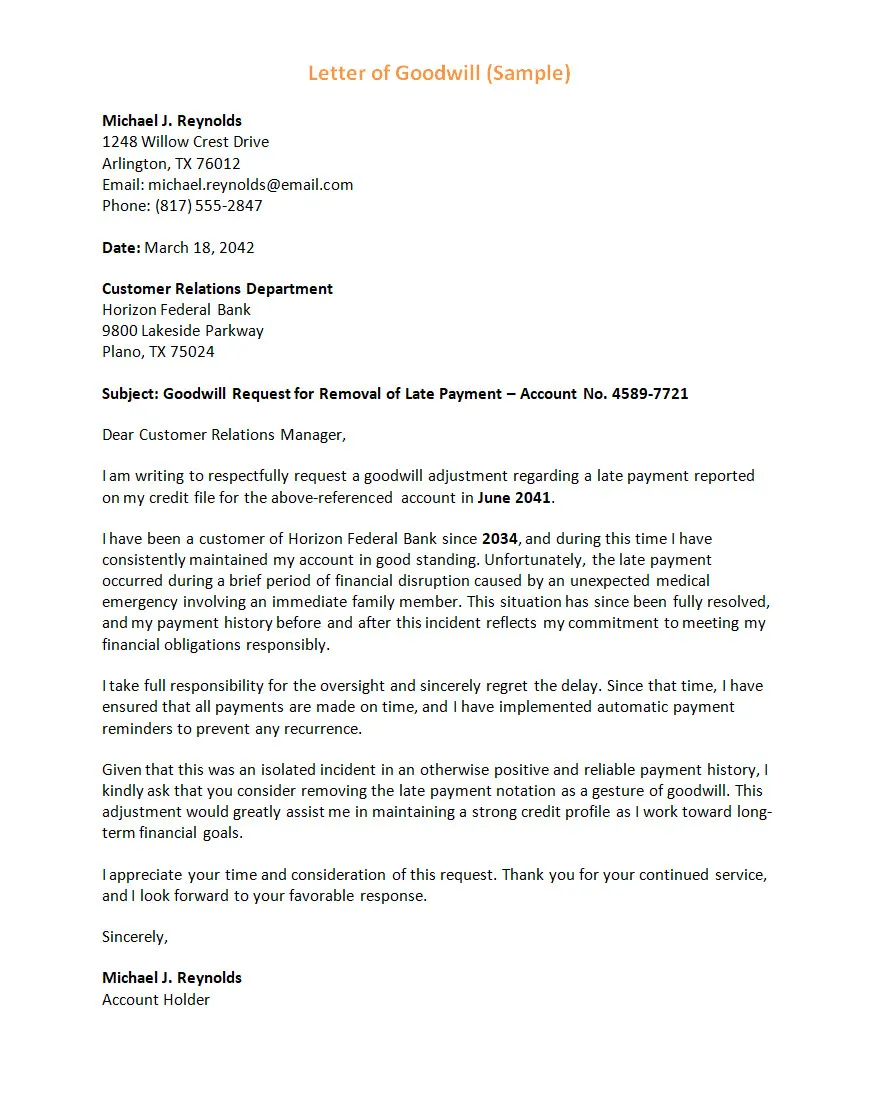

What To Include In a Letter of Goodwill?

When writing a goodwill letter to a creditor, it’s important to include specific details and information that will help support your case. Be sure to explain the circumstances that led to the negative item on your credit report, express regret for any mistakes, and provide any relevant documentation or evidence to support your claims. Additionally, be polite and respectful in your tone, and clearly state your request for the removal of the negative item as a gesture of goodwill.

Explanations of Circumstances

One of the key components of a goodwill letter is providing a detailed explanation of the circumstances that led to the negative item on your credit report. Whether the late payment was due to a financial hardship, a misunderstanding, or an oversight, it’s essential to convey the situation honestly and transparently. By providing context and explaining the factors that contributed to the negative mark, you can help the creditor understand your perspective and reasons for requesting its removal.

Expression of Regret and Responsibility

In a goodwill letter, it’s important to express genuine regret for any mistakes that led to the negative item on your credit report. Take ownership of the situation and demonstrate a willingness to learn from the experience and make positive changes moving forward. By acknowledging the impact of the negative item and expressing a sincere desire to rectify the situation, you can convey your responsibility and commitment to improving your credit standing.

Supporting Documentation and Evidence

To strengthen your case in a goodwill letter, consider including any supporting documentation or evidence that can help substantiate your claims. This may include proof of a financial hardship, documentation of a payment arrangement, or records of your on-time payment history. By providing concrete evidence to support your explanations and demonstrate your financial responsibility, you can enhance the credibility of your goodwill letter and increase the likelihood of a positive response from the creditor.

Polite and Respectful Tone

Maintaining a polite and respectful tone throughout your goodwill letter is essential in fostering a positive relationship with the creditor. Avoid using accusatory language or placing blame on the creditor, as this can hinder your chances of reaching a favorable resolution. Instead, approach the letter with humility, understanding, and a willingness to work collaboratively towards a mutually beneficial outcome. By showing respect and courtesy in your communication, you can increase the likelihood of the creditor considering your request sympathetically.

Clear Request for Removal

In the conclusion of your goodwill letter, clearly state your request for the removal of the negative item from your credit report as a gesture of goodwill. Be direct and specific in outlining the desired outcome, and express gratitude for the creditor’s consideration and understanding. By clearly articulating your request and demonstrating appreciation for the creditor’s attention to your case, you can leave a positive impression and increase the likelihood of a favorable response to your goodwill letter.

How to Write a Goodwill Letter for a Late Payment

Writing a goodwill letter for a late payment requires careful attention to detail and a persuasive argument. Start by addressing the letter to the appropriate contact at the creditor, and clearly explain the circumstances that led to the late payment. Express regret for any mistakes and take responsibility for your actions. Provide any relevant documentation or evidence to support your case, and clearly state your request for the removal of the late payment from your credit report. End the letter on a positive note, expressing gratitude for the creditor’s consideration and understanding.

Addressing the Letter to the Correct Contact

When writing a goodwill letter for a late payment, it’s important to address the letter to the appropriate contact at the creditor. Research the creditor’s contact information and ensure that your letter reaches the individual or department responsible for handling goodwill requests. By addressing the letter to the correct contact, you increase the chances of your request being reviewed promptly and considered by the appropriate party.

Explanation of Late Payment Circumstances

In the body of your goodwill letter, provide a detailed explanation of the circumstances that led to the late payment on your credit report. Whether the late payment was due to a financial hardship, a medical emergency, or another valid reason, it’s essential to convey the situation honestly and transparently. By explaining the factors that contributed to the late payment and demonstrating remorse for the oversight, you can build a compelling case for the creditor to consider removing the negative mark.

Expression of Regret and Accountability

Express genuine regret for the late payment and take accountability for the mistake in your goodwill letter. Acknowledge the impact of the late payment on your credit score and financial standing, and demonstrate a willingness to rectify the situation. By accepting responsibility for the late payment and expressing a sincere desire to improve your credit standing, you can convey your commitment to financial responsibility and accountability.

Providing Supporting Documentation

To support your explanation of the late payment circumstances, consider including any relevant documentation or evidence in your goodwill letter. This may include proof of a financial hardship, documentation of a payment arrangement, or records of your on-time payment history. By providing concrete evidence to substantiate your claims, you can strengthen your case and increase the credibility of your goodwill letter. Supporting documentation can help the creditor understand the context of the late payment and may enhance the chances of a positive response to your request.

Clearly Stating Your Request for Removal

In the conclusion of your goodwill letter, clearly state your request for the removal of the late payment from your credit report. Be direct and specific in outlining your desired outcome, and express gratitude for the creditor’s consideration of your request. By clearly articulating your request and demonstrating appreciation for the creditor’s attention to your case, you can leave a positive impression and increase the likelihood of a favorable response to your goodwill letter.

Following Up on Your Goodwill Letter

After sending your goodwill letter, it’s important to follow up with the creditor to ensure that your request is being reviewed and considered. Send a polite and professional follow-up email or phone call to inquire about the status of your goodwill letter and express your continued interest in resolving the matter. By following up on your goodwill letter, you demonstrate persistence, determination, and a proactive approach to credit repair, which can increase the chances of a positive outcome.

Understanding the Response

Once you receive a response to your goodwill letter, take the time to carefully review and understand the creditor’s decision. If the creditor agrees to remove the negative item from your credit report, express gratitude for their consideration and follow up to confirm that the removal has been processed. If the creditor denies your request, consider reaching out to discuss alternative options or strategies for improving your credit standing. By understanding the response and taking appropriate action, you can continue to work towards achieving your credit repair goals.

Letter of Goodwill Template – DOWNLOAD

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026