What is an IOU Form?

An IOU form is a simple document that serves as a written acknowledgment of a debt owed by one party to another. It is commonly used in informal settings where there is a need to document a financial transaction without the complexity of a formal contract.

While an IOU is not a legally binding document, it can help establish trust and clarity between the parties involved.

The Purpose of an IOU Form

While an IOU form may seem like a simple document, it serves several important purposes in informal financial transactions. Firstly, an IOU form helps formalize the agreement between the parties involved, providing a written record of the debt owed. This can help prevent misunderstandings or disagreements in the future by clearly outlining the terms of the agreement.

Additionally, an IOU form can help establish trust between the parties. By documenting the transaction in writing, both the borrower and the lender can feel more secure in their agreement, knowing that there is a record of the debt owed. This can be particularly important in personal relationships or informal business arrangements where trust is key.

Types of IOU Forms

Several types of IOU forms can be used depending on the nature of the transaction and the preferences of the parties involved. Some common types of IOU forms include:

- Basic IOU Form: A simple document that outlines the amount owed, the date of the transaction, and any terms of repayment.

- Interest-Bearing IOU Form: An IOU form that includes provisions for charging interest on the debt owed.

- Secured IOU Form: An IOU form that includes collateral or security for the debt, such as a valuable asset.

- Joint IOU Form: An IOU form that involves multiple parties sharing a debt or obligation.

By selecting the appropriate type of IOU form for your needs, you can ensure that all relevant details are captured and that both parties are clear on the terms of the agreement.

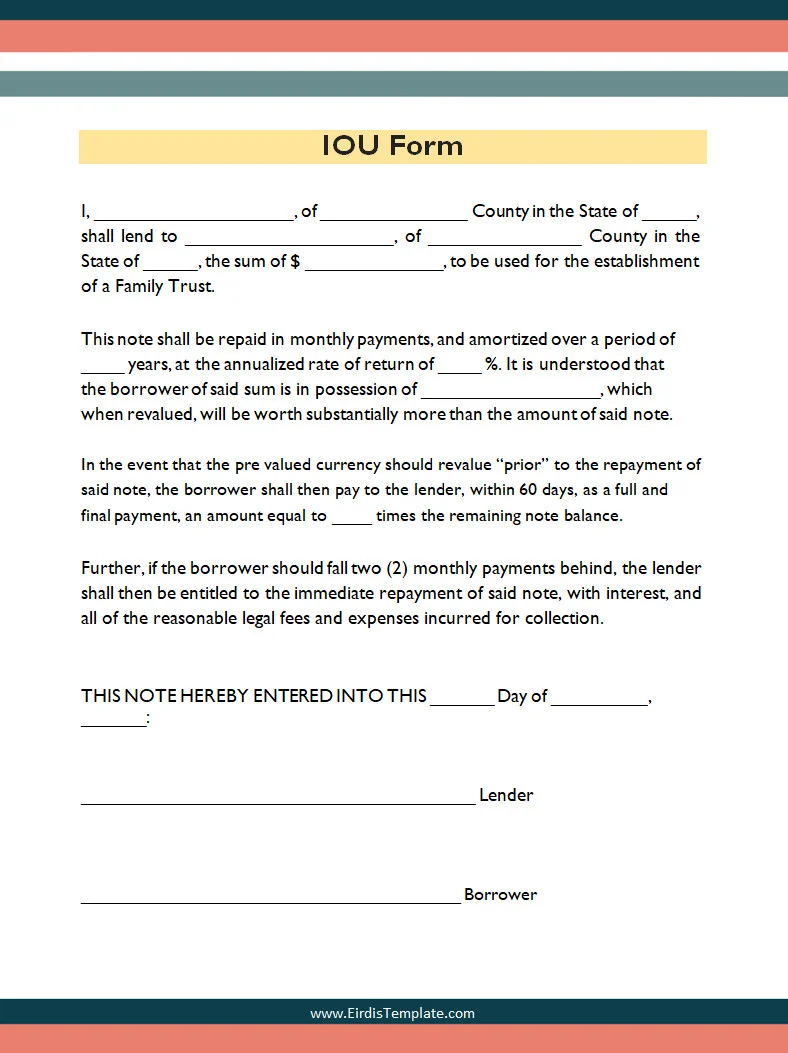

What to Include in an IOU Template?

When creating an IOU template, there are several key elements that should be included to ensure that all necessary information is captured. These elements can help clarify the terms of the agreement and provide a clear record of the debt owed. Some essential components to include in an IOU template are:

Names and Contact Information of the Parties

It is crucial to include the full names and contact information of both the borrower and the lender in an IOU template. This information helps identify the individuals involved in the transaction and provides a means of communication if needed. Including accurate contact information can also help prevent any misunderstandings or disputes that may arise during the repayment process.

Amount Owed and Currency

The IOU template should clearly state the exact amount of money or item that is owed by the borrower to the lender. This amount should be specified in the local currency to avoid any confusion or discrepancies. Including the amount owed in the IOU template helps establish the financial obligation and sets the terms for repayment.

Date of Transaction

It is essential to include the date on which the debt was incurred in the IOU template. This date serves as a reference point for both parties and helps establish a timeline for repayment. Including the date of the transaction can also help prevent any disputes regarding the timing of the debt and ensure clarity in the agreement.

Terms of Repayment

Outline any specific terms or conditions for repayment in the IOU template to avoid any confusion or misunderstandings. This may include details such as the deadline for repayment, the method of payment, any interest charges, or any other relevant terms. Clearly defining the terms of repayment in the IOU template can help both parties understand their obligations and responsibilities.

Witnesses or Notary Public

While not always necessary, including witnesses or having the IOU form notarized can add an extra layer of authenticity and credibility to the document. Witnesses can attest to the signing of the IOU form by both parties, while a notary public can provide an official seal of approval. This can be particularly useful in more formal or legally sensitive transactions.

Signatures of the Parties

Both the borrower and the lender should sign the IOU form to acknowledge their agreement to the terms outlined in the document. Signatures indicate that both parties understand their obligations and agree to the terms of repayment. Having signatures on the IOU form can help validate the document and establish its authenticity in case of any disputes.

Additional Terms and Conditions

Depending on the nature of the transaction, there may be additional terms or conditions that need to be included in the IOU template. This could include provisions for late payments, penalties for non-payment, or any other specific agreements between the parties. Including these additional terms in the IOU template can help prevent any misunderstandings and ensure that all aspects of the agreement are covered.

When Do You Need an IOU Template?

There are various situations in which using an IOU template can be beneficial for documenting financial transactions and agreements. Understanding when to use an IOU template can help individuals and businesses manage their finances effectively and avoid any potential misunderstandings. Some common scenarios where an IOU template may be needed include:

Informal Loans

When borrowing money from friends or family members, an IOU template can help formalize the agreement and provide a clear record of the debt owed. This can prevent any misunderstandings or conflicts that may arise during the repayment process. Using an IOU template for informal loans can help maintain trust and transparency between the parties involved.

Small Debts

For small debts or obligations, such as splitting a restaurant bill or sharing expenses with roommates, an IOU template can be a useful tool for keeping track of who owes what. By documenting these small transactions with an IOU template, individuals can ensure that all debts are repaid promptly and avoid any confusion or disputes over the amounts owed.

Business Transactions

In business partnerships or informal agreements, an IOU template can serve as a temporary record of a transaction until a more formal contract is put in place. Using an IOU template for business transactions can help establish trust between partners and provide clarity on the terms of the agreement. It can also serve as a valuable reference in case of any disputes or disagreements in the future.

Rent and Lease Agreements

When renting a property or leasing equipment, an IOU template can be used to document the payment of rent or lease payments. This can help establish a clear record of the financial obligations of both parties and provide a reference point for any disputes or issues that may arise during the rental or lease period. Using an IOU template for rent and lease agreements can help ensure that both parties adhere to the terms of the agreement.

Personal IOUs

For personal loans or informal agreements between individuals, an IOU template can help formalize the agreement and provide a written record of the debt owed. This can be particularly useful in situations where there is a risk of misunderstandings or disagreements over the terms of repayment. Using an IOU template for personal IOUs can help maintain trust and clarity in the relationship between the parties involved.

How to Make an IOU

Creating an IOU template is a relatively simple process that can be done in a few easy steps. By following these steps, you can ensure that your IOU template is clear, comprehensive, and tailored to your specific needs.

Step 1: Choose a Format

The first step in creating an IOU template is to decide on the format you want to use. You can choose to create a digital template using word processing software or an online template builder, or you can opt for a handwritten template if you prefer a more personalized touch. Consider the preferences of the parties involved and the complexity of the transaction when selecting the format for your IOU template.

Step 2: Include Details

Once you have chosen a format for your IOU template, it’s time to fill in the necessary details. Start by including the names and contact information of the borrower and lender, the amount owed, the date of the transaction, and any terms of repayment. Be as specific and detailed as possible to avoid any misunderstandings or disputes later on. Make sure to double-check all the information before finalizing the IOU template.

Step 3: Sign and Date

Both parties involved in the transaction should sign and date the IOU template to acknowledge their agreement to the terms outlined in the document. Signatures indicate that both the borrower and the lender understand their obligations and agree to the repayment terms. Dating the IOU template helps establish a timeline for repayment and provides a reference point for both parties.

Step 4: Keep a Copy

Make copies of the signed IOU template for both parties to keep as a record of the transaction. This can serve as evidence of the agreement in case of any disputes or disagreements in the future. Keeping a copy of the IOU template also helps both parties track the progress of repayment and ensures that all terms are being met according to the agreement.

Step 5: Review and Update

Periodically review and update the IOU template as needed to reflect any changes in the terms of the agreement. If there are any modifications to the repayment schedule or additional terms that need to be included, make sure to update the IOU template accordingly. Communicate any changes to the other party and ensure that both parties are in agreement before finalizing the updated template.

Step 6: Seek Legal Advice (Optional)

If the debt involved is substantial or if some complex terms and conditions need to be included in the IOU template, consider seeking legal advice to ensure that the document is legally sound and enforceable. A legal professional can provide guidance on how to structure the IOU template to protect the interests of both parties and ensure that all legal requirements are met.

Step 7: Maintain Open Communication

Throughout the repayment process, it’s essential to maintain open communication with the other party to address any concerns or issues that may arise. If there are delays in repayment or if there are any changes to the terms of the agreement, be transparent and communicate these changes promptly. By keeping the lines of communication open, you can avoid misunderstandings and work together to resolve any issues that may arise.

Step 8: Record Repayments

As the borrower makes repayments on the debt owed, be sure to record these transactions and update the IOU template accordingly. This helps both parties track the progress of repayment and ensures that all payments are being accurately recorded. By maintaining detailed records of repayments, you can avoid any confusion or disputes over the amount owed and the remaining balance.

Step 9: Close Out the Agreement

Once the debt has been fully repaid, it’s important to close out the agreement and acknowledge that the debt has been settled. Update the IOU template to reflect that the debt has been paid in full, and have both parties sign and date the document to confirm the repayment. Closing out the agreement formally helps ensure that both parties are in agreement and that no outstanding debts or obligations remain.

Final Thoughts

IOU templates are valuable tools for documenting debts and agreements between parties clearly and concisely. Whether you’re borrowing money from a friend, keeping track of small debts, or formalizing a business transaction, an IOU template can help provide clarity and peace of mind.

By following the steps outlined in this guide and customizing your IOU template to suit your specific needs, you can create a comprehensive document that captures all the necessary details of the agreement.

Remember to communicate openly with the other party, maintain detailed records of repayments, and seek legal advice if needed to ensure that your IOU template is effective and enforceable.

IOU Template – DOWNLOAD

- Free Customizable Notarized Letter Template - February 16, 2026

- Non-disclosure Agreement Template for Employees - February 16, 2026

- Free Nursing Resignation Letter Template - February 16, 2026