In the world of business, attracting investors is crucial for the growth and success of a company or project. An investment proposal is a formal document that serves as a roadmap for potential investors, outlining the business plan, market opportunity, financial projections, and how the requested funds will be utilized to achieve specific goals.

Crafting a compelling investment proposal is essential to persuade investors to fund a business or project by demonstrating a compelling opportunity for a profitable return on their investment.

What is an Investment Proposal?

An investment proposal is a detailed document that presents a business or project to potential investors, highlighting the value proposition and potential return on investment. It outlines the opportunity, market analysis, financial projections, and the specific use of funds requested from investors.

A well-crafted investment proposal is essential for attracting the interest of investors and securing the necessary funding for the business or project.

Why Create an Investment Proposal?

An investment proposal serves as a roadmap for potential investors, outlining the business plan, market opportunity, financial projections, and how the requested funds will be used to achieve specific goals. By presenting a compelling investment proposal, businesses and projects can attract investors and secure the necessary funding to grow and succeed.

Importance of a Well-Crafted Investment Proposal

A well-crafted investment proposal is essential for capturing the attention of potential investors and persuading them to fund a business or project. It provides a structured framework for presenting key information, such as the opportunity, market analysis, financial projections, and use of funds. Without a clear and persuasive investment proposal, it can be challenging to effectively communicate the value proposition and potential return on investment to investors.

Building Trust with Investors

Investors are looking for opportunities that offer a strong potential for a profitable return on their investment. An investment proposal helps build trust with investors by providing them with a detailed understanding of the business or project, its market opportunity, and the potential for growth and success. By presenting a well-researched and thoughtfully crafted proposal, businesses can instill confidence in investors and increase their likelihood of securing funding.

Setting Clear Objectives

One of the key benefits of creating an investment proposal is the opportunity to set clear objectives and milestones for the business or project. By outlining specific goals and targets, businesses can provide investors with a roadmap for success and demonstrate a clear plan for utilizing the requested funds to achieve these objectives. This level of clarity and transparency can help investors feel more confident in the potential return on their investment.

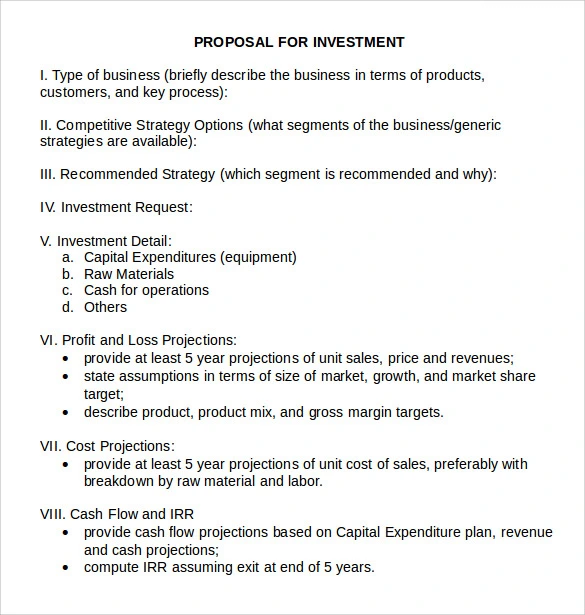

What to Include in an Investment Proposal?

When creating an investment proposal, there are several key components that should be included to effectively communicate the value proposition and potential return on investment to potential investors. These components include:

Executive Summary

The executive summary is a brief overview of the business or project, highlighting the key points of the investment proposal. It serves as an introduction to the proposal and provides investors with a snapshot of the opportunity, market potential, and financial projections. The executive summary should be concise yet impactful, capturing the interest of investors and prompting them to delve deeper into the details of the proposal.

Business Description

The business description provides a detailed overview of the business or project, including the industry, target market, competitive landscape, and unique selling points. It outlines the nature of the business, its mission and vision, and how it differentiates itself from competitors. By clearly articulating the core aspects of the business, investors can gain a better understanding of the opportunity and assess its potential for success.

Market Analysis

The market analysis section delves into the market opportunity, target market size, competition, and industry trends. It provides investors with a comprehensive overview of the market landscape, including the demand for the product or service, customer demographics, and competitive positioning. By conducting thorough market research and analysis, businesses can demonstrate a deep understanding of the market and showcase the potential for growth and success.

Value Proposition

The value proposition is a critical component of an investment proposal, as it clearly articulates the unique selling points of the business or project. It highlights the benefits and advantages that differentiate the business from competitors and provide value to customers. By effectively communicating the value proposition, businesses can capture the attention of investors and demonstrate the potential for a profitable return on investment.

Financial Projections

Financial projections are an essential part of an investment proposal, as they provide investors with insight into the revenue forecasts, expenses, and cash flow projections of the business or project. By presenting realistic and achievable financial projections, backed by thorough research and analysis, businesses can instill confidence in investors and demonstrate the potential for financial success. It is important to provide detailed and accurate financial projections to help investors make informed funding decisions.

Use of Funds

The use of funds section outlines how the requested funds will be utilized to achieve specific goals and milestones. It provides transparency and clarity regarding the allocation of funds, detailing the intended use of capital for operational expenses, marketing initiatives, product development, or other strategic investments. By presenting a clear plan for the use of funds, businesses can demonstrate accountability and show investors how their investment will contribute to the growth and success of the business.

Management Team

The management team overview introduces the key members of the leadership team, highlighting their experience, skills, qualifications, and track record of success. Investors are not just investing in the business or project but also in the people behind it. By showcasing the expertise and capabilities of the management team, businesses can build trust with investors and demonstrate their ability to execute on the business plan and achieve key objectives.

Risk Analysis

The risk analysis section assesses the potential risks and challenges facing the business or project, and how they will be mitigated. It is important to identify and address any potential risks that could impact the success of the business, such as market volatility, competition, regulatory changes, or operational challenges. By conducting a thorough risk analysis and outlining risk mitigation strategies, businesses can demonstrate their awareness of potential challenges and their ability to navigate them effectively.

Demonstrating Growth Potential

An investment proposal should also focus on demonstrating the growth potential of the business or project. By presenting a compelling case for growth, backed by market data, customer insights, and financial projections, businesses can showcase the scalability and sustainability of their venture. Investors are looking for opportunities that have the potential for significant growth and profitability, so it is essential to highlight the growth prospects of the business in the proposal.

Building Credibility and Trust

Credibility and trust are essential when attracting investors, and an investment proposal plays a key role in building confidence in the business or project. By providing detailed information, supporting data, and clear communication, businesses can establish credibility with investors and demonstrate their commitment to transparency and accountability. Building trust with investors is crucial for securing funding and fostering long-term partnerships that can drive the success of the business.

Creating a Compelling Narrative

In addition to presenting data and financial projections, an investment proposal should also tell a compelling story about the business or project. By weaving together key insights, market trends, customer testimonials, and success stories, businesses can create a narrative that resonates with investors and showcases the unique value proposition of the venture. A compelling narrative can help investors connect emotionally with the opportunity and see the potential for long-term success.

Emphasizing Achievements and Milestones

Highlighting past achievements, milestones, and successes can help build credibility and instill confidence in potential investors. By showcasing key accomplishments, such as product launches, revenue growth, customer acquisitions, or partnerships, businesses can demonstrate their track record of success and ability to deliver results. Emphasizing achievements and milestones can showcase the progress of the business and provide evidence of its potential for future success.

How to Create a Compelling Investment Proposal

Creating a compelling investment proposal requires careful planning, attention to detail, and a strategic approach. Here are some tips to help you craft an effective and persuasive investment proposal:

Know Your Audience

Understanding the needs and expectations of potential investors is essential for creating a compelling investment proposal. Tailor your proposal to address their concerns, interests, and investment criteria. By conducting research on potential investors and customizing your proposal to meet their specific requirements, you can increase your chances of attracting funding and securing partnerships.

Focus on the Value Proposition

The value proposition is the heart of your investment proposal, so it is important to clearly articulate the unique selling points

Use Visuals to Enhance Impact

Incorporating charts, graphs, and visuals can enhance the impact of your investment proposal and make complex data more accessible and engaging for investors. Visual representations of financial projections, market analysis, and growth potential can help investors better understand the information presented and make informed decisions. By using visuals strategically throughout your proposal, you can convey key messages effectively and capture the attention of investors.

Be Concise and Clear in Your Communication

It is essential to be concise and clear in your communication when crafting an investment proposal. Avoid using jargon or technical language that may confuse or overwhelm investors. Present information in a straightforward and easy-to-understand manner, focusing on key points and highlighting the value proposition of the business or project. By being concise and clear, you can ensure that investors grasp the key messages and make informed funding decisions.

Provide Realistic and Achievable Financial Projections

Financial projections are a critical component of an investment proposal, so it is important to provide realistic and achievable forecasts. Conduct thorough research and analysis to support your projections, taking into account market trends, competition, and potential risks. By presenting financial projections that are grounded in data and analysis, you can build credibility with investors and demonstrate the potential for financial success.

Include a Call to Action

End your investment proposal with a strong call to action that invites investors to take the next step in the investment process. Clearly outline the steps for moving forward, such as scheduling a meeting, conducting due diligence, or making a funding commitment. By including a call to action, you can prompt investors to engage with your proposal and move closer to making an investment decision.

Maintain Professionalism and Attention to Detail

Professionalism and attention to detail are crucial when creating an investment proposal. Ensure that the proposal is well-organized, free of errors, and visually appealing. Pay attention to formatting, grammar, and design to present a polished and professional document to potential investors. By demonstrating professionalism and attention to detail, you can instill confidence in investors and showcase the quality and credibility of your business or project.

Seek Feedback and Iteration

Seeking feedback from trusted advisors, mentors, or industry experts can help you refine and improve your investment proposal. Use feedback to identify areas for improvement, clarify key points, and strengthen the overall presentation of your proposal. Iterate on your proposal based on feedback to ensure that it effectively communicates the value proposition and potential return on investment to investors.

Continuously Update and Adapt Your Proposal

Investment proposals are not static documents but should be continuously updated and adapted to reflect changes in the business, market conditions, or investor feedback. Regularly review and revise your proposal to ensure that it remains relevant, accurate, and aligned with the latest developments in your business or project. By keeping your proposal up to date, you can maintain investor interest and demonstrate your commitment to growth and success.

Stay Persistent and Resilient

Creating a compelling investment proposal can be a challenging and time-consuming process, but it is important to stay persistent and resilient in your efforts. Rejection and feedback are a natural part of the fundraising process, so it is essential to remain positive, learn from setbacks, and continue refining your proposal. By staying persistent and resilient, you can increase your chances of attracting investors and securing the necessary funding for your business or project.

Tips for Crafting a Successful Investment Proposal

- Do Your Research: Conduct thorough market research and analysis to understand the market opportunity and competition.

- Highlight the Team: Showcase the experience, skills, and qualifications of the management team to instill confidence in potential investors.

- Focus on the Problem-Solution: Clearly articulate the problem your business or project solves, and how it provides a unique solution to address the market need.

- Be Transparent: Be honest and transparent about the risks and challenges facing the business or project, and how they will be managed.

- Seek Feedback: Get feedback from trusted advisors, mentors, or industry experts to refine and improve your investment proposal.

- Stay Persistent: Rejection is a natural part of the fundraising process, so stay persistent and resilient in your efforts to secure funding.

- Adapt and Update: Continuously update and adapt your proposal to reflect changes in the business, market conditions, or investor feedback.

- Maintain Professionalism: Present a polished and professional document that demonstrates attention to detail and credibility.

Investment Proposal Template

In conclusion, an Investment Proposal helps you present your business idea, financial projections, and funding needs clearly and persuasively to potential investors.

Impress stakeholders and secure the funding you need—download our Investment Proposal Template today to create a professional and compelling proposal!

Investment Proposal Template – DOWNLOAD

- Printable Monthly Budget Planner Template - February 10, 2026

- Free Printable Money Receipt Template - February 7, 2026

- Money Management Worksheet Template - February 5, 2026