What is a Gift Letter for Mortgage?

A gift letter for a mortgage is a legally binding document that declares that the money provided for a mortgage down payment is a gift and does not need to be repaid. It is a critical piece of documentation required by mortgage lenders to confirm the source of the funds and ensure that there are no undisclosed debts associated with the transaction.

The gift letter is signed by both the gift donor and the gift recipient, affirming that the funds are indeed a gift and not a loan.

Why is a Gift Letter Important?

The gift letter plays a crucial role in the mortgage process for several reasons.

Verification of Down Payment

One of the primary reasons why a gift letter is important is that it verifies the source of the down payment funds. Lenders need to ensure that the funds being used for the down payment are coming from an acceptable source and that there are no undisclosed debts associated with the transaction. The gift letter provides a clear trail of documentation regarding the origin of the funds.

Financial Stability

By confirming that the funds are a gift, the gift letter helps lenders evaluate the borrower’s financial stability. Lenders want to make sure that the borrower will be able to afford their mortgage payments without taking on additional financial obligations. The gift letter assures that the borrower’s financial situation is not compromised by a new debt to the donor.

Legal Protection

From a legal standpoint, the gift letter offers protection for both the borrower and the donor. By clearly stating that the funds are a gift and not a loan, the letter prevents any potential disputes or misunderstandings in the future. It outlines the terms of the gift, including the amount given and the purpose, ensuring that both parties understand the nature of the transaction.

Key Elements of a Gift Letter

When writing a gift letter for a mortgage, there are several key elements that should be included to make it comprehensive and legally binding.

Names of Parties

The gift letter should clearly state the full names of both the gift donor and the gift recipient. This information ensures that both parties are identified in the document and that there is no confusion about who is providing the gift and who is receiving it.

Amount of Gift

It is essential to specify the exact amount of the gift in the letter. This amount should be clearly stated to indicate the value of the gift being provided for the mortgage down payment. Lenders need this information to verify the source of the funds.

Relationship Between Parties

The gift letter should outline the relationship between the gift donor and the gift recipient. This information is important for lenders to understand the connection between the parties involved in the transaction and to ensure that there are no conflicts of interest or undisclosed agreements.

Purpose of Gift

Clearly stating the purpose of the gift in the letter is essential. The gift letter should explicitly state that the funds are being provided as a gift and not as a loan. This declaration is crucial for establishing that the funds do not need to be repaid by the borrower.

Signatures of Parties

Both the gift donor and the gift recipient should sign the gift letter to make it legally binding. Signatures indicate that both parties have agreed to the terms outlined in the letter and that they understand the nature of the transaction. This step ensures that the gift is documented and enforceable.

How to Write a Gift Letter for Mortgage

Writing a gift letter for a mortgage is a straightforward process, but attention to detail is essential to ensure that all necessary information is included for the lender’s review.

Clarity and Concise

When drafting the gift letter, it is crucial to be clear and concise in your language. Clearly state that the funds are a gift and not a loan to avoid any confusion or misinterpretation. Use simple and direct language to convey the purpose of the gift.

Inclusion of Information

Make sure to include all essential information in the gift letter, such as the names of the parties, the amount of the gift, the relationship between the parties, and the purpose of the gift. Providing comprehensive details ensures that the lender has all the necessary information to verify the source of the funds.

Formal Tone

The gift letter should be written in a formal tone to convey the seriousness of the transaction. Use official language and professionally structure the letter to demonstrate that the gift is a legitimate and binding arrangement between the parties involved.

Legal Language

Include any necessary legal language in the gift letter to ensure its validity and enforceability. Legal terms and clauses can help clarify the terms of the gift and protect both parties from any potential disputes or challenges regarding the nature of the transaction.

Signatures for Legality

Both the gift donor and the gift recipient should sign the gift letter to make it legally binding. Signatures indicate that both parties have agreed to the terms outlined in the letter and that they understand the implications of the gift. This step is crucial for formalizing the agreement.

Tips for Successful Gift Letters

When preparing a gift letter for a mortgage, there are several tips that can help ensure the process goes smoothly and that all requirements are met.

Provide Documentation

In addition to the gift letter, lenders may require additional documentation to verify the source of the gift funds. This documentation could include bank statements showing the transfer of funds or other evidence of the gift transaction. Providing comprehensive documentation can help expedite the approval process.

Consult with a Professional

If you have any questions or concerns about the gift letter or the gift process, it is advisable to consult with a legal professional or financial advisor. These experts can provide guidance on the legal requirements and implications of the gift transaction and ensure that all necessary steps are taken.

Submit Promptly

It is essential to submit the gift letter to the lender promptly to avoid any delays in the mortgage approval process. Once the gift is provided, make sure to prepare the gift letter and submit it along with any additional documentation required by the lender. Timely submission can help keep the mortgage process on track.

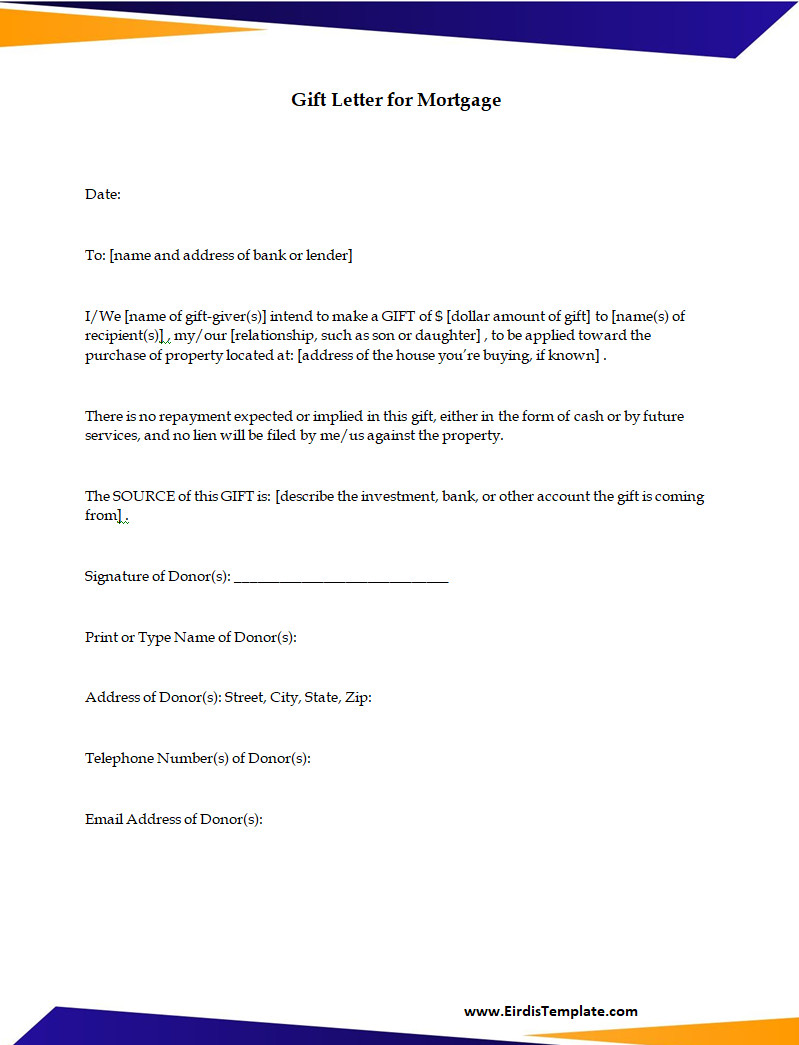

Free Gift Letter Template for Mortgage

A gift letter for a mortgage is an essential document used to confirm that funds given to a homebuyer are a genuine gift, not a loan that must be repaid. It helps lenders verify the source of the down payment and ensures compliance with mortgage requirements. This template provides a clear, professional format for both the giver and recipient to sign.

Download and use our gift letter template for a mortgage today to simplify your loan process, meet lender requirements, and move one step closer to your new home.

Gift Letter Template for Mortgage – WORD

- Mileage Reimbursement Form Template - January 29, 2026

- Free Printable Menu Planner Template - January 27, 2026

- Free Mental Status Exam Template - January 26, 2026