Managing finances is an essential aspect of running a successful business. To ensure accuracy and organization, companies utilize various financial tools, one of which is a general ledger. It is a comprehensive record of a company’s financial transactions, providing a detailed overview of its financial health.

This article will delve into the concept of a general ledger, how it works, its benefits, and how to use it effectively.

What Is a General Ledger?

A general ledger is a central repository for all financial transactions of a company. It serves as the foundation for a company’s accounting system, capturing and categorizing every financial activity, including revenues, expenses, assets, and liabilities.

It helps businesses track and monitor their financial performance, ensuring accurate reporting and compliance with accounting standards.

How a General Ledger Works?

A general ledger works by recording each financial transaction in a standardized format. It follows the double-entry bookkeeping method, which means that every transaction has equal debits and credits. When a transaction occurs, it is entered into the general ledger, with the debit amount recorded in one account and the corresponding credit amount in another.

For example, when a company receives cash from a customer, the general ledger would record a debit in the cash account and a credit in the accounts receivable account. This ensures that both sides of the transaction are accounted for and maintains the balance between assets, liabilities, and equity.

Why Use a General Ledger?

- Accurate Financial Reporting: It provides a clear and organized record of all financial transactions, enabling businesses to generate accurate financial statements and reports.

- Improved Decision Making: With access to up-to-date financial information, companies can make informed decisions regarding investments, budgeting, and resource allocation.

- Internal and External Compliance: It helps ensure compliance with accounting regulations and facilitates audits by providing a detailed trail of financial activities.

- Identifying Financial Trends: By analyzing the data in a general ledger, businesses can identify trends, patterns, and potential areas of improvement in their financial performance.

- Budget Monitoring: Companies can compare actual expenses and revenues against budgeted amounts using the general ledger, enabling them to track their financial performance and make necessary adjustments.

Is a General Ledger Part of the Double-Entry Bookkeeping Method?

Yes, a general ledger is an integral part of the double-entry bookkeeping method. This method requires that every financial transaction be recorded with equal debits and credits. It serves as the central record for these transactions, ensuring accuracy, balance, and consistency in the company’s financial accounts.

What Are the Components of a General Ledger?

- Chart of Accounts: This is a list of all the accounts used by a company to record its financial transactions. Each account is assigned a unique number or code for easy identification.

- Account Balances: It includes the balances of each account, showing the current financial position of the company.

- Transaction Details: Every financial transaction is recorded in the general ledger, including the date, description, debit amount, and credit amount.

- Adjusting Entries: Adjustments made to the accounts, such as accruals or deferrals, are also recorded in the general ledger.

- Closing Entries: At the end of an accounting period, closing entries are made to transfer the balances of temporary accounts, such as revenue and expense accounts, to the retained earnings account.

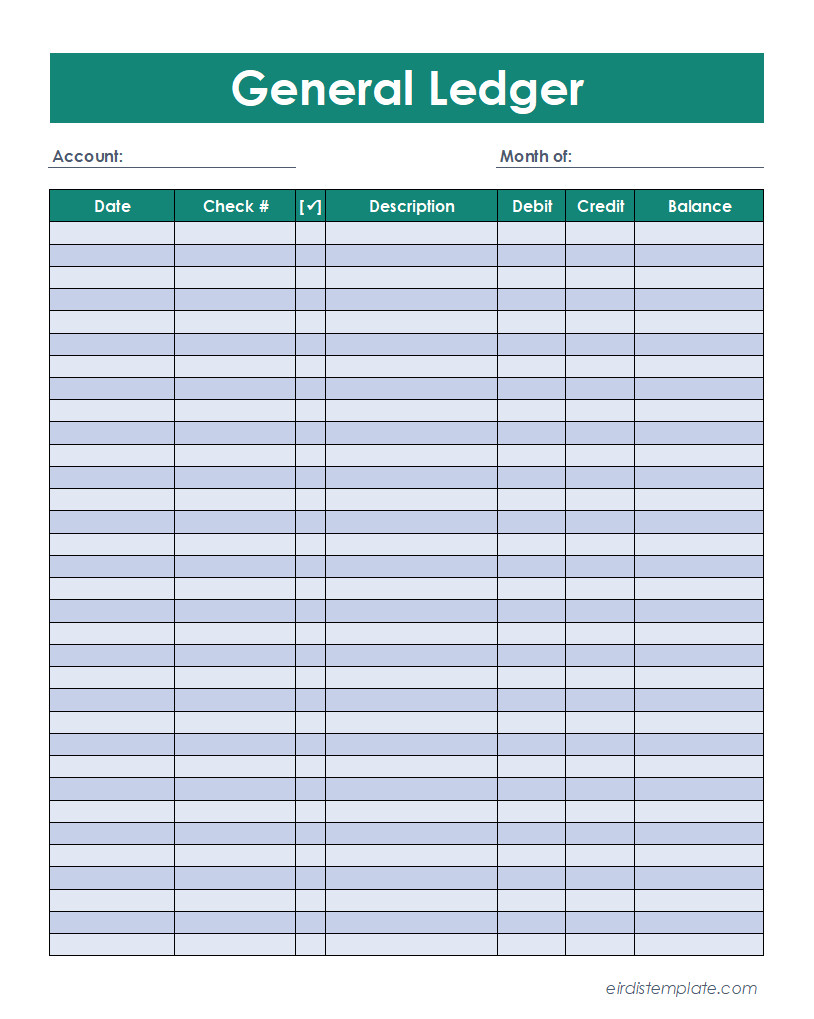

Example

Are There Drawbacks to Using a General Ledger?

While a general ledger is an essential tool for managing financial records, there are a few drawbacks to consider:

- Complexity: Maintaining a general ledger requires a solid understanding of accounting principles and practices. It may be challenging for individuals without accounting knowledge.

- Time-Consuming: Recording every financial transaction in the general ledger can be time-consuming, especially for businesses with a high volume of transactions.

- Human Error: Manual entry of data in the general ledger poses the risk of human error, which can lead to inaccuracies in financial reporting.

Tips for Using a General Ledger Effectively

To make the most of a general ledger, consider the following tips:

- Implement Proper Controls: Establish internal controls to ensure the accuracy and integrity of the data entered in the general ledger.

- Regularly Reconcile Accounts: Perform regular reconciliations to ensure that the balances in the general ledger match the actual balances in the bank accounts and other financial statements.

- Use Accounting Software: Consider using accounting software that automates the recording and tracking of financial transactions, reducing the chances of errors and saving time.

- Maintain Documentation: Keep supporting documents, such as invoices and receipts, organized and readily accessible for future reference or audit purposes.

- Train Staff: Provide adequate training to employees responsible for maintaining the general ledger to ensure accurate and consistent record-keeping.

Conclusion

Use our general ledger template in Excel to streamline your financial tracking and stay organized effortlessly. Ideal for businesses and personal finance management, this easy-to-use template helps you monitor income, expenses, and account balances with accuracy.

Customize to fit your needs and gain clear financial insights. Simplify your accounting—start now and take control of your finances!

General Ledger Template – Excel

- Free Letter of Goodwill Template (Word) - December 23, 2025

- Free Letter of Endorsement Template (Word) - December 23, 2025

- Free Letter of Complaint Template (Word) - December 23, 2025