Direct deposit enrollment forms serve as written permission from an individual to have payments sent directly into their bank account. This process provides the payer with the necessary bank account and personal information to initiate the transfer and ensure that funds are delivered securely, conveniently, and on time. Whether you are an employer setting up payroll for your employees or an individual receiving recurring payments, understanding the direct deposit enrollment form is crucial.

In this comprehensive guide, we will explore everything you need to know about direct deposit enrollment forms, why they are important, what to include, how to fill them out correctly, and tips for successful enrollment. Let’s dive in!

What is a Direct Deposit Enrollment Form?

A direct deposit enrollment form is a document that authorizes a payer to electronically deposit funds directly into an individual’s bank account. This form serves as written permission for the payer to initiate the transfer of funds without the need for physical checks or cash transactions.

By providing the necessary bank account and personal information on the form, the individual ensures that payments are securely delivered to their account on time.

Why Use a Direct Deposit Enrollment Form?

There are several reasons why using a direct deposit enrollment form can be beneficial for both payers and recipients.

For payers, electronic payments are more efficient, cost-effective, and environmentally friendly compared to issuing paper checks. Direct deposit also reduces the risk of lost or stolen payments and streamlines the payment process.

For recipients, direct deposit offers convenience, security, and faster access to funds without the need to visit a bank or cash a check.

Cost-Effectiveness

Direct deposit eliminates the costs associated with printing, distributing, and processing paper checks, making it a more cost-effective payment method for payers. By switching to direct deposit, organizations can save on check printing fees, postage, and administrative expenses related to manual check processing.

Time-Saving

Direct deposit accelerates the payment process by eliminating the time-consuming steps involved in issuing paper checks. With direct deposit, payers can initiate payments electronically, reducing the time it takes for recipients to receive their funds. Recipients also benefit from immediate access to their funds on the payment date.

Environmental Impact

By opting for direct deposit, individuals and organizations can reduce their environmental footprint by minimizing paper usage. Direct deposit eliminates the need for paper checks, which contributes to paper waste and deforestation. Choosing electronic payments over paper checks helps conserve natural resources and promote sustainability.

Convenience and Security

Direct deposit offers recipients the convenience of receiving payments directly into their bank accounts without the need to visit a bank branch or wait for a check to clear. This secure payment method protects against the risk of lost or stolen checks and provides added peace of mind for recipients. With direct deposit, funds are deposited automatically and securely, ensuring timely access to funds.

Improved Payment Accuracy

Direct deposit reduces the likelihood of payment errors associated with manual check processing. By transferring funds electronically, payers can ensure that payments are processed accurately and delivered on time. Recipients can rely on direct deposit to receive their payments consistently without the risk of check delays or errors.

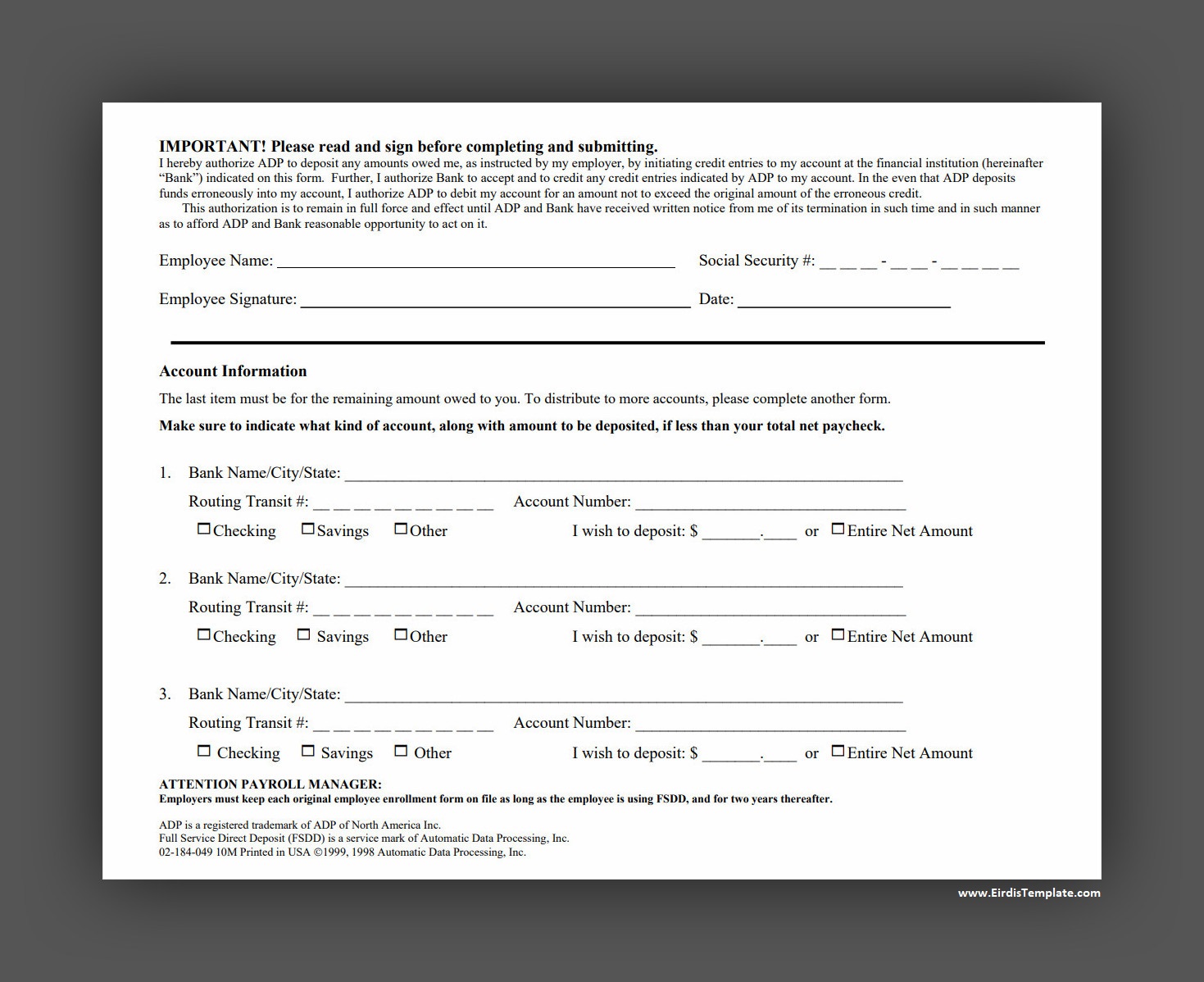

What to Include in a Direct Deposit Enrollment Form?

When filling out a direct deposit enrollment form, it is essential to include accurate and complete information to ensure that payments are processed correctly. Here are the key details that should be included in a direct deposit enrollment form:

Bank Account Information

The first section of a direct deposit enrollment form typically requires recipients to provide their bank account information, including the bank’s name, account number, and routing number. It is essential to double-check this information to avoid any delays in payment processing due to inaccuracies.

Personal Information

Recipients must also include their personal information on the direct deposit enrollment form, such as their full name, address, contact information, and any other required details. This information helps verify the recipient’s identity and ensures that payments are directed to the correct individual.

Payer Information

The direct deposit enrollment form may also ask for the payer’s information, including their name, contact information, and any additional details necessary for payment processing. Including this information helps establish a clear connection between the payer and recipient and facilitates the electronic transfer of funds.

Authorization Signature

One of the most critical elements of a direct deposit enrollment form is the recipient’s authorization signature. By signing the form, the recipient grants permission for electronic payments to be deposited into their bank account. The signature serves as a legal acknowledgment of the recipient’s consent to initiate direct deposit payments.

How to Fill Out a Direct Deposit Enrollment Form

Filling out a direct deposit enrollment form is a straightforward process, but it is crucial to provide accurate information to avoid any delays or errors in payment processing. Here are the steps to correctly fill out a direct deposit enrollment form:

Obtain the Form

The first step in setting up direct deposit is to obtain the direct deposit enrollment form from your employer or the organization making the payments. This form may be provided in paper format or accessible online through the payer’s website or payroll portal.

Provide Bank Account Information

Enter your bank account information accurately on the form, including the name of your bank, your account number, and routing number. This information is crucial for ensuring that payments are deposited into the correct account and processed efficiently.

Complete Personal Information

Fill in your personal details as requested on the direct deposit enrollment form, including your full name, address, contact information, and any other required information. Providing accurate personal information helps verify your identity and ensures that payments are directed to the correct individual.

Include Payer Information

Provide any requested information about the payer, such as their name, contact information, and any additional details necessary for payment processing. Including this information helps establish a clear connection between the payer and recipient and facilitates the electronic transfer of funds.

Sign and Date the Form

Authorize the direct deposit by signing and dating the form as required. Your signature confirms your consent for electronic payments to be deposited into your bank account, and dating the form ensures that the authorization is current and valid. Make sure to follow any additional instructions provided on the form for signature requirements.

Tips for Successful Direct Deposit Enrollment

To ensure a smooth and successful direct deposit enrollment process, follow these tips to avoid common mistakes and issues:

Double-Check Information

Before submitting your direct deposit enrollment form, review all the information you have provided to ensure that it is accurate and up to date. Check your bank account details, personal information, and any additional details required on the form for accuracy and completeness.

Keep a Copy

Make a copy of the completed direct deposit enrollment form for your records before submitting it to the payer. Keeping a copy of the form allows you to reference the information provided and verify that it matches the details on file with your bank and the payer.

Update Information Promptly

If there are any changes to your bank account information or personal details after enrolling in direct deposit, notify the payer immediately. Keeping your information up to date ensures that payments are processed correctly and prevents any delays or issues with future direct deposits.

Verify Deposit

After enrolling in direct deposit, verify with your bank that the direct deposit has been successfully set up. Confirm that the funds are being deposited into your account as expected on the designated payment dates. If there are any discrepancies or issues with the direct deposit, address them promptly with the payer to ensure that payments are processed accurately.

Monitor Account Activity

Regularly monitor your bank account activity to ensure that direct deposits are being processed correctly and that no unauthorized transactions occur. Review your bank statements each month to verify that the expected payments have been deposited into your account and that there are no discrepancies in the transaction details.

Communicate with the Payer

If you encounter any issues with your direct deposit, such as missing payments or incorrect amounts, communicate with the payer immediately. Contact the payer’s payroll department or customer service team to address any concerns or discrepancies and request a resolution to ensure that payments are processed accurately and on time.

Stay Informed

Stay informed about the direct deposit process and any updates or changes that may affect your payments. Be aware of the timing of direct deposits, payment schedules, and any relevant policies or procedures related to electronic payments. Keeping yourself informed will help you stay on top of your finances and ensure that your payments are received as expected.

Seek Assistance if Needed

If you encounter challenges or have questions about the direct deposit enrollment process, don’t hesitate to seek assistance. Reach out to the payer’s support team, your bank, or a financial advisor for guidance on setting up or troubleshooting direct deposit. Seeking assistance can help resolve any issues promptly and ensure that your direct deposit payments are processed smoothly.

Conclusion

Direct deposit enrollment forms play a crucial role in facilitating electronic payments securely, conveniently, and efficiently. By understanding the purpose of these forms, what information to include, how to fill them out correctly, and tips for successful enrollment, individuals can ensure that their payments are delivered on time and without any hassle.

Whether you are an employer setting up payroll or an individual receiving payments, utilizing direct deposit offers numerous benefits that enhance the overall payment experience. Take advantage of the convenience and security of direct deposit by completing your enrollment form accurately and staying informed throughout the process.

Direct Deposit Enrollment Form – Download

- Free Editable Nursing Resume Template (Word) - February 23, 2026

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026