Using credit cards for purchases has become common in today’s digital age. Whether shopping online or making in-store transactions, credit cards offer convenience and security. However, keeping track of your expenses and protecting yourself from unauthorized charges is important. One effective way to do this is by keeping credit card receipts.

In this article, we will explore the benefits of credit card receipts and how they can help you with tracking expenses, reconciling statements, disputing unauthorized charges, and providing proof of purchase for warranty or tax purposes.

What Is a Credit Card Receipt?

A credit card receipt is a document that serves as proof of payment for a transaction made with a credit card. It contains important information such as the date of the transaction, the name of the merchant, the amount charged, and the last few digits of the credit card used.

These receipts can be obtained either electronically or in physical form, depending on the method of payment.

Why Are Credit Card Receipts Essential?

Credit card receipts are essential for several reasons. They serve as a record of your transactions, allowing you to track your expenses and manage your finances effectively. By keeping track of your purchases, you can easily identify any discrepancies or unauthorized charges on your credit card statement.

Additionally, credit card receipts can be used as proof of purchase for warranty or tax purposes. If you need to return an item or claim a warranty, having the receipt can make the process much smoother.

What Information Does a Credit Card Receipt Include?

A credit card receipt typically includes the following information:

- Date: The date of the transaction.

- Merchant Name: The name of the establishment or online retailer where the purchase was made.

- Transaction Amount: The total amount charged to your credit card.

- Last Few Digits of the Credit Card: For security purposes, the receipt may only display the last few digits of your credit card number.

- Authorization Code: A unique code that verifies the transaction.

Some credit card receipts may also include additional details such as the itemized list of purchases or the name of the salesperson.

Is Keeping Credit Card Receipts Mandatory?

While keeping credit card receipts is not mandatory by law, it is highly recommended for financial management and security purposes. By holding onto your receipts, you have a tangible record of your purchases and can easily compare them to your credit card statements.

This helps you identify any unauthorized charges or errors and take appropriate action. Additionally, having credit card receipts can provide peace of mind in case of warranty claims or tax audits.

Tracking Expenses and Reconciling Statements

One of the main benefits of keeping credit card receipts is the ability to track your expenses and reconcile your credit card statements. By comparing your receipts to your monthly statements, you can ensure that all charges are accurate and authorized.

This process is especially important if you notice any discrepancies or suspicious transactions. Keeping a record of your receipts allows you to promptly address any issues with your credit card provider and protect yourself from fraudulent activity.

Disputing Unauthorized Charges

If you come across unauthorized charges on your credit card statement, having credit card receipts can be crucial in disputing these charges. By providing evidence of your purchases, you can prove that you did not authorize the transactions in question.

Your credit card receipts serve as proof of payment and can support your case when communicating with your credit card company to resolve the issue. Without these receipts, it can be challenging to prove that the charges were unauthorized.

Providing Proof of Purchase for Warranty or Tax Purposes

Credit card receipts are also valuable when it comes to warranty claims or tax purposes. When making a significant purchase, such as electronics or appliances, it’s common for manufacturers to require proof of purchase for warranty coverage.

By keeping your credit card receipts, you have the necessary documentation to support any warranty claims that may arise. Additionally, credit card receipts can be used as proof of purchase for tax deductions or reimbursements, especially for business expenses.

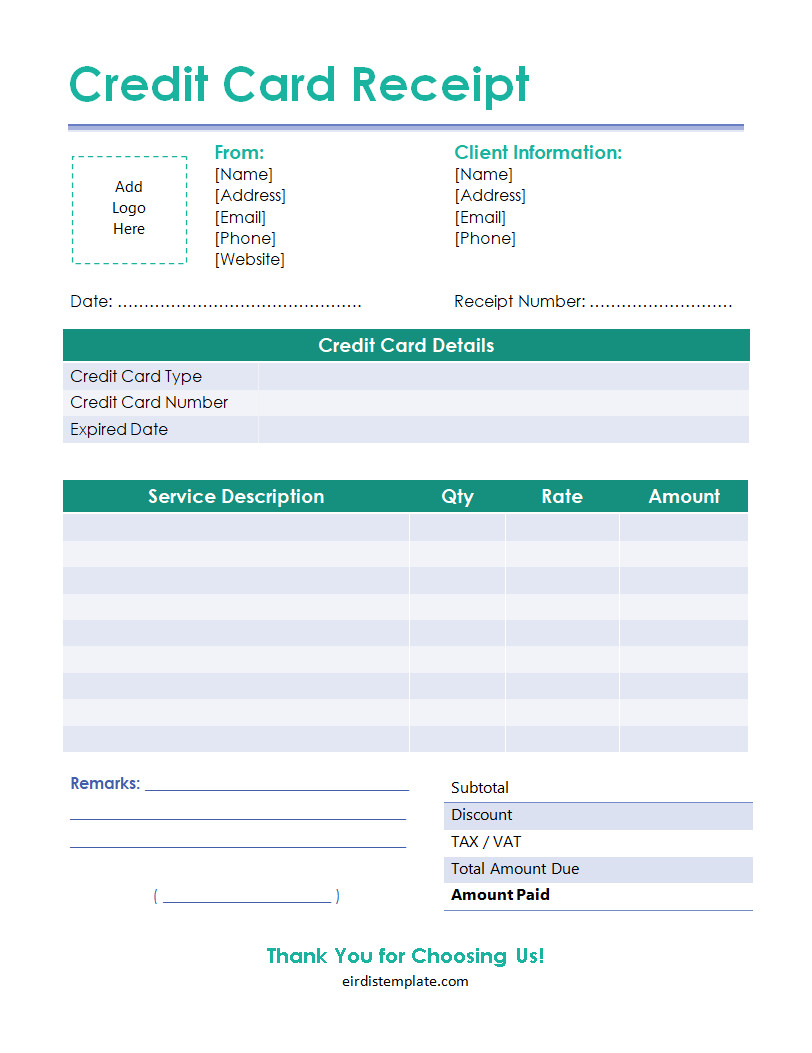

Free Credit Card Receipt Template!

Simplify your transaction process with our credit card receipt template. Perfect for businesses of any size, this customizable and professional template ensures accurate records while saving time. Ideal for maintaining customer trust and staying organized, it’s easy to use and designed for efficiency.

Enhance your operations with a reliable receipt solution that fits your business needs.

Credit Card Receipt Template – Word | PDF

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026