A construction receipt is essential documents that serve as proof of payment for work done in the construction industry. Contractors use these receipts to keep track of their financial transactions and determine how much money they are owed.

This article will explore construction receipts, their main purpose, why they are important, what information should be included, and how to create a professional receipt.

What is a Construction Receipt?

A construction receipt is a document that records financial transactions in the construction industry. It serves as proof of payment for work completed and helps contractors keep track of their earnings. Construction receipts are typically issued by contractors to their clients or customers and outline the details of the payment made, including the amount, date, and description of the work done.

Construction receipts are important for both contractors and clients, as they provide transparency and accountability in financial transactions. They help ensure that contractors are paid for their services and provide clients with a record of their payments.

What is the Main Purpose of a Receipt?

The main purpose of a construction receipt is to document financial transactions in the construction industry. This includes recording payments made by clients to contractors for work completed.

Construction receipts serve as proof of payment and help contractors keep track of their earnings. They also provide a record of financial transactions for clients, ensuring transparency and accountability in the construction process.

Why Are Construction Receipts Important?

Construction receipts are important for several reasons:

- Proof of payment: Construction receipts serve as evidence that a payment has been made for work completed. They provide both contractors and clients with a record of financial transactions.

- Transparency and accountability: Construction receipts help ensure transparency and accountability in financial transactions within the construction industry. They provide clients with a clear record of their payments and help contractors keep track of their earnings.

- Legal protection: Construction receipts can serve as legal protection for contractors. In case of any disputes or issues regarding payments, having a well-documented receipt can help resolve the matter more easily.

- Tax purposes: Construction receipts are essential for tax purposes. Contractors need to keep track of their earnings and expenses accurately to report them correctly for tax purposes. Construction receipts provide the necessary documentation to support these financial records.

What Should Be Included In a Construction Receipt?

A construction receipt should include the following information:

- Contractor information: The receipt should include the name, address, and contact information of the contractor or company issuing the receipt.

- Client information: The receipt should include the name, address, and contact information of the client or customer who made the payment.

- Date: The receipt should include the date when the payment was made.

- Payment details: The receipt should include the amount paid, the method of payment (cash, check, credit card, etc.), and any additional details regarding the payment.

- Description of work: The receipt should include a brief description of the work completed or services provided.

- Contract or project number: If applicable, the receipt should include the contract or project number for easy reference.

- Signature: The receipt should be signed by the contractor or an authorized representative.

How to Create a Professional Receipt

To create a professional construction receipt, follow these steps:

1. Use a professional template:

Start with our professional receipt template that includes all the necessary fields, such as contractor and client information, payment details, and a description of the work. You can find it at the end of this page.

2. Include all required information:

Make sure to include all the required information in your receipt, such as the date, payment details, and description of work. This will ensure that your receipt is accurate and comprehensive.

3. Use clear and concise language:

Write your receipt using clear and concise language to ensure that all information is easily understood by both contractors and clients. Avoid using technical jargon or complex terminology.

4. Include a signature line:

Include a signature line at the bottom of the receipt for the contractor or an authorized representative to sign. This will provide an additional level of authenticity to the document.

5. Keep copies for your records:

Make sure to keep copies of all construction receipts for your records. This will help with accounting, tax purposes, and in case of any disputes or issues in the future.

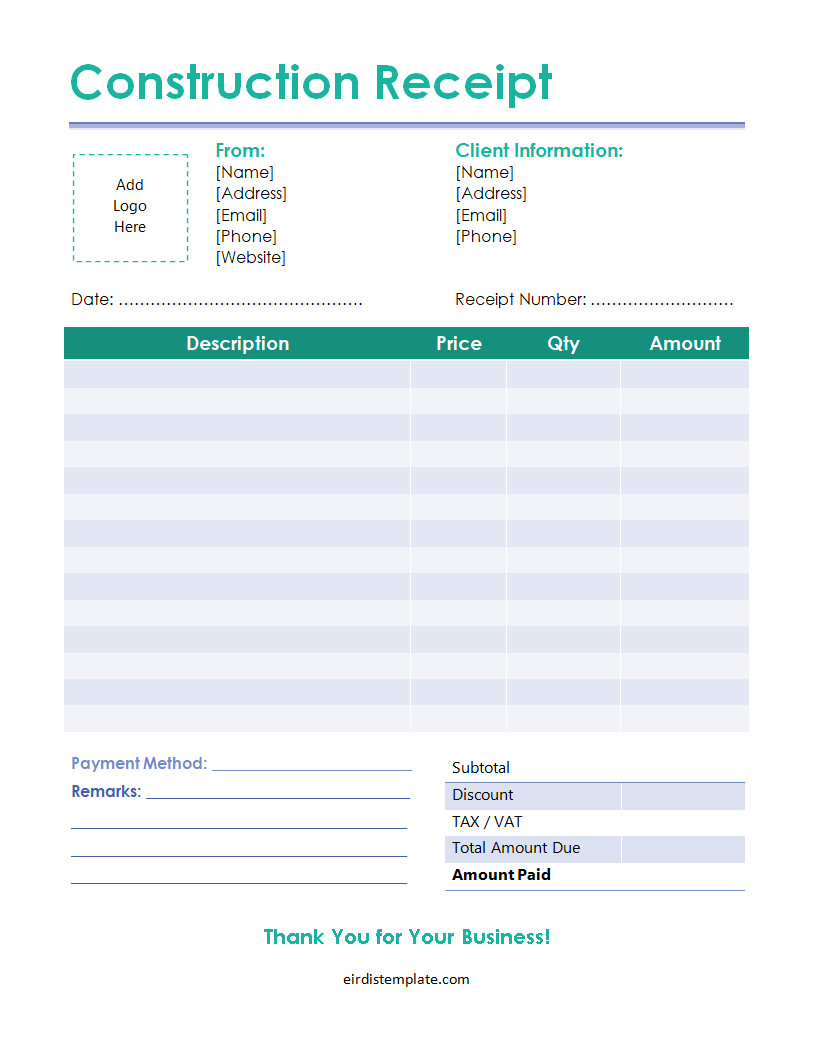

Free Construction Receipt Template!

Keep your construction transactions organized with our construction receipt template! Perfect for contractors and clients, this professional tool helps you document payments, services, and materials clearly and accurately. Enhance transparency, maintain detailed records, and simplify your billing process.

Use our template to ensure smooth, hassle-free construction project management every time!

Construction Receipt Template – Word | PDF

- Motor Vehicle Bill of Sale Template - February 20, 2026

- Mutual Confidentiality Agreement Template - February 19, 2026

- Free Nanny Agreement Template (Word) - February 19, 2026