Managing finances is a crucial aspect of running a successful business. One key element of this is providing accurate and timely billing statements to your clients. It is a document that summarizes the financial transactions between a business and its clients.

It is a vital tool for keeping your clients informed about the minimum payment they need to make within a specified period to keep their accounts current and active. Additionally, it plays a crucial role in providing accurate tax reporting for your business.

What is a Billing Statement?

A billing statement is a document that provides a summary of the financial transactions between a business and its clients. It typically includes details such as the client’s name, contact information, account number, billing period, and a breakdown of charges, payments, and outstanding balances. The statement aims to keep clients informed about their financial obligations and provides them with a clear picture of their account status.

It is usually issued regularly, such as monthly or quarterly, depending on the billing cycle agreed upon with the client. It serves as a reminder for clients to make timely payments, helping them stay current and avoid any disruptions in the services or products provided by the business.

Is a Billing Statement an Invoice?

While a billing statement and an invoice share similarities, they serve different purposes. An invoice is a request for payment issued to a client for specific products or services rendered. It typically includes detailed information about the items or services provided, along with their respective costs, quantities, and any applicable taxes or discounts.

On the other hand, a billing statement is a comprehensive overview of all the financial transactions between a business and its client within a specific period. It includes not only the individual invoices but also any payments made, adjustments, and outstanding balances. The purpose of a billing statement is to provide a holistic view of the client’s account and inform them of the minimum payment required to keep their account current.

Benefits of Using a Billing Statement

Using a billing statement offers several benefits for both businesses and clients:

- Transparency: It provides transparency by clearly outlining all the financial transactions between a business and its clients. It allows clients to review and verify the accuracy of the charges, payments, and outstanding balances.

- Payment Reminders: It serves as payment reminders for clients. By clearly stating the minimum payment required within a specified period, they help clients stay on top of their financial obligations and avoid late payments.

- Account Status: Clients can easily assess their account status by referring to the billing statement. It provides them with a snapshot of their outstanding balances, payments made, and any adjustments or credits applied.

- Tax Reporting: It plays a crucial role in accurate tax reporting for businesses. They provide a comprehensive record of all financial transactions, making it easier to calculate taxable income and claim deductions or credits.

- Dispute Resolution: In case of any discrepancies or disputes, it serves as an essential reference point. Both businesses and clients can refer to it to resolve any issues and ensure that the financial records are accurate and up to date.

How Do I Create a Billing Statement?

Creating a billing statement involves several steps:

- Gather all relevant information: Collect all the necessary details, including the client’s name, contact information, account number, billing period, and a breakdown of charges, payments, and outstanding balances.

- Choose a format: Decide on a format for your statement. You can use pre-designed templates available in accounting software or create a custom format that aligns with your branding.

- Include all relevant details: Make sure to include all the required information, such as the client’s name, contact information, account number, billing period, and a breakdown of charges, payments, and outstanding balances.

- Calculate the minimum payment: Calculate the minimum payment required to keep the client’s account current. This can be a fixed amount or a percentage of the outstanding balance, depending on your business policies.

- Add payment instructions: Clearly state the payment methods accepted by your business and provide detailed instructions on how clients can make their payments.

- Review and proofread: Double-check all the information and calculations on the statement for accuracy. Proofread the document to ensure there are no typos or grammatical errors.

- Deliver the billing statement: Send the statement to your client through a preferred method, such as email or mail. Make sure to maintain a record of the statement for your reference.

- Follow up: Monitor the payment status and follow up with clients who have not made the minimum payment within the specified period. Maintain open lines of communication to address any questions or concerns.

Final Thoughts!

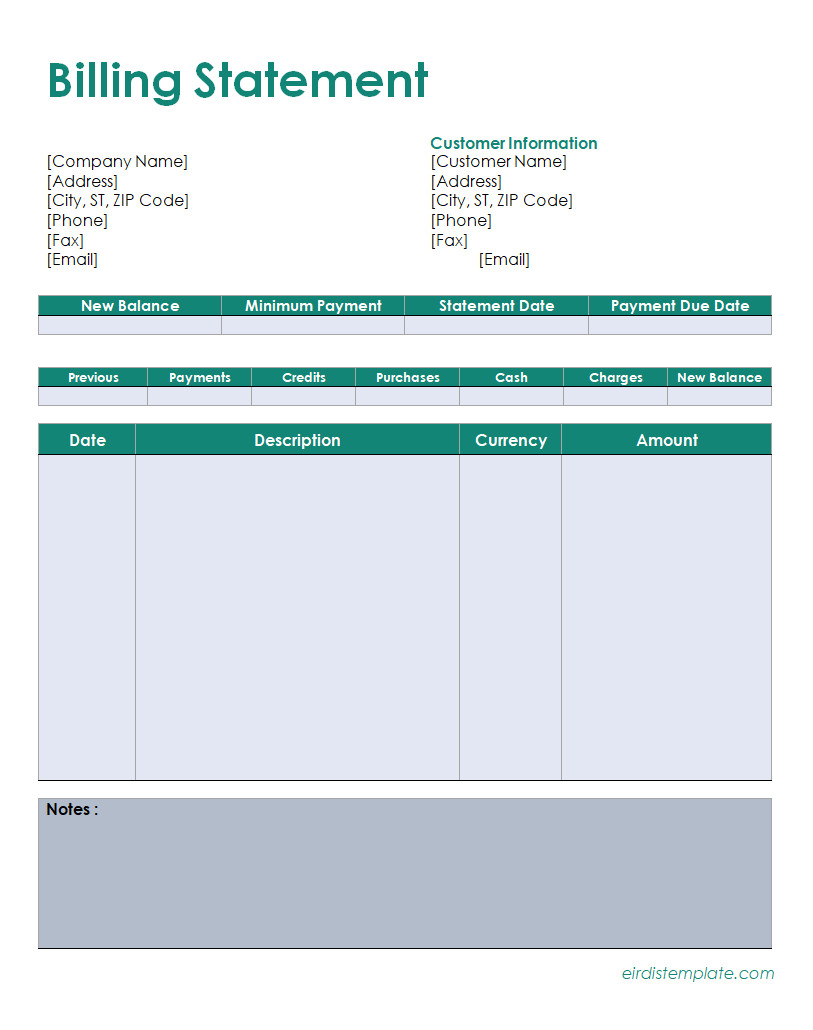

Streamline your billing process with our billing statement template in Word! This tool allows you to organize client charges, payment history, and outstanding balances in a clear, professional format. Perfect for small businesses and freelancers, it simplifies record-keeping and invoicing.

Use now to create organized, accurate billing statements and maintain strong client relationships effortlessly!

Billing Statement Template – Word

- Month-to-month Lease Agreement Template - March 4, 2026

- Monthly Profit And Loss Statement Template - March 2, 2026

- Free Nurse Resignation Letter Template (Word) - February 28, 2026