When managing a fleet of vehicles for business purposes, it is crucial to keep track of the mileage driven in each vehicle. A meticulous record of the mileage can help businesses ensure that their vehicles are being used for legitimate business purposes and can also serve as a valuable tool for tax deductions.

This article will explore the importance of keeping a vehicle mileage log and how it can benefit both employers and employees.

What is a Vehicle Mileage Log?

A vehicle mileage log is a detailed record of the distance traveled by a vehicle over a specific period. It includes information such as the starting and ending odometer readings, the date and time of each trip, the purpose of the trip, and the total number of miles driven. This log is typically maintained by employees who use their vehicles for business purposes or by businesses that own and operate a fleet of vehicles.

By keeping a vehicle mileage log, businesses can keep track of how their vehicles are being used and ensure that they are being utilized for legitimate business purposes. It also provides a clear and accurate record of mileage, which can be invaluable for tax purposes and reimbursements.

Why Keep an Employee Car Mileage Log?

Even with the advent of technology and GPS tracking systems, maintaining an employee car mileage log is still necessary to prove that the vehicle is being used for business purposes.

Here are a few reasons why businesses should encourage their employees to keep a mileage log:

- Accurate recordkeeping: A mileage log provides an accurate record of the distance traveled for business purposes, which can be used for tax deductions and reimbursements.

- Proof of business use: In the event of an audit by the IRS or other regulatory authorities, a mileage log serves as proof that the vehicle is being used for legitimate business purposes.

- Employee accountability: By requiring employees to maintain a mileage log, businesses can ensure that employees are using company vehicles responsibly and not for personal use.

- Cost control: Keeping track of mileage can help businesses identify any excessive or unnecessary vehicle usage, allowing them to implement cost-saving measures.

How to Keep a Mileage Log

Keeping a mileage log doesn’t have to be a daunting task. Here are some tips to help you maintain an accurate and organized mileage log:

- Choose a format: Decide whether you want to maintain a physical logbook or use a digital app or spreadsheet to record your mileage.

- Record all necessary information: Make sure to include the date, starting and ending odometer readings, the purpose of the trip, and the total number of miles driven for each entry.

- Be consistent: Make it a habit to record your mileage immediately after each trip to ensure accuracy.

- Keep supporting documentation: Save receipts, invoices, or any other relevant documents that support the purpose of your business trips.

- Review and update regularly: Set aside time each month to review your mileage log, make any necessary corrections or additions, and ensure that it aligns with your other financial records.

What Happens if You Don’t Keep a Mileage Log?

Not keeping a mileage log can have several potential consequences, both for employees and employers:

- Lack of evidence: Without a mileage log, employees may not be able to prove that their vehicle was used for business purposes, potentially leading to the denial of tax deductions or reimbursement claims.

- Audit risk: Businesses that fail to maintain mileage logs may face increased scrutiny from tax authorities during audits, which can be time-consuming and costly.

- Inaccurate reimbursements: Without an accurate mileage log, businesses may struggle to calculate reimbursements for employees who use their vehicles for business purposes, leading to potential disputes and dissatisfaction.

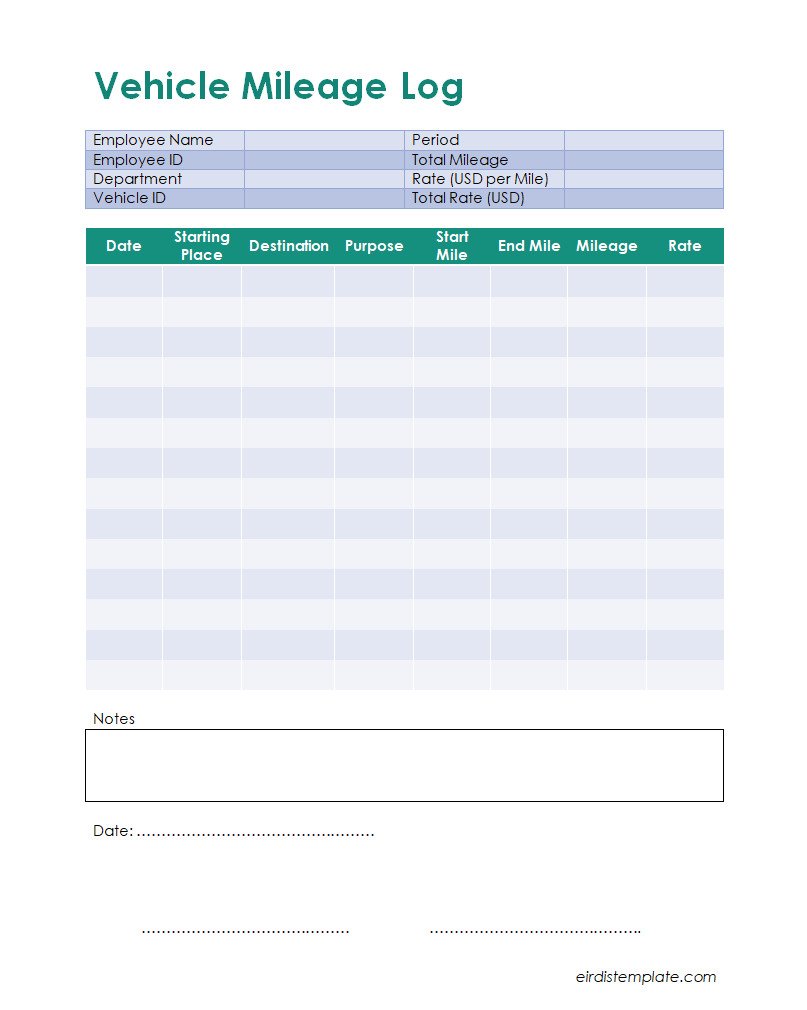

Free Vehicle Mileage Log Template!

Track your travel expenses with ease using our vehicle mileage log template in Word! This tool helps you record dates, destinations, and miles traveled, making it perfect for business reimbursements or tax deductions. Stay organized on every trip and simplify your mileage tracking.

Use now for accurate, hassle-free record-keeping!

Vehicle Mileage Log Template – Word

- Month-to-month Lease Agreement Template - March 4, 2026

- Monthly Profit And Loss Statement Template - March 2, 2026

- Free Nurse Resignation Letter Template (Word) - February 28, 2026