Managing your finances can often feel overwhelming, especially when you’re juggling various expenses, bills, and financial goals. This is where a monthly budget planner can be a game-changer. By tracking your income and expenses, a budget planner helps you gain control over your finances, understand where your money is going, adjust your spending habits, pay bills on time, save for the future, reduce debt, and prepare for emergencies.

Ultimately, using a monthly budget planner can lead to reduced financial stress and greater confidence in your financial decisions.

What is a Monthly Budget Planner?

A monthly budget planner is a tool that allows you to track your income and expenses for a specific period, typically monthly. It helps you allocate your money towards different categories such as housing, utilities, groceries, transportation, entertainment, savings, and debt repayment.

By using a budget planner, you can see a clear picture of your financial situation and make informed decisions about your spending and saving habits.

Why Use a Monthly Budget Planner?

There are several benefits to using a monthly budget planner:

- Financial Awareness: A budget planner helps you become more aware of where your money is going and how you can make improvements.

- Goal Setting: You can set financial goals such as saving for a vacation, paying off debt, or building an emergency fund, and track your progress towards these goals.

- Reduce Stress: Knowing exactly where your money is going can help reduce financial stress and anxiety.

- Improve Financial Decision-Making: With a budget planner, you can make more informed decisions about your spending and saving priorities.

Key Elements of a Monthly Budget Planner

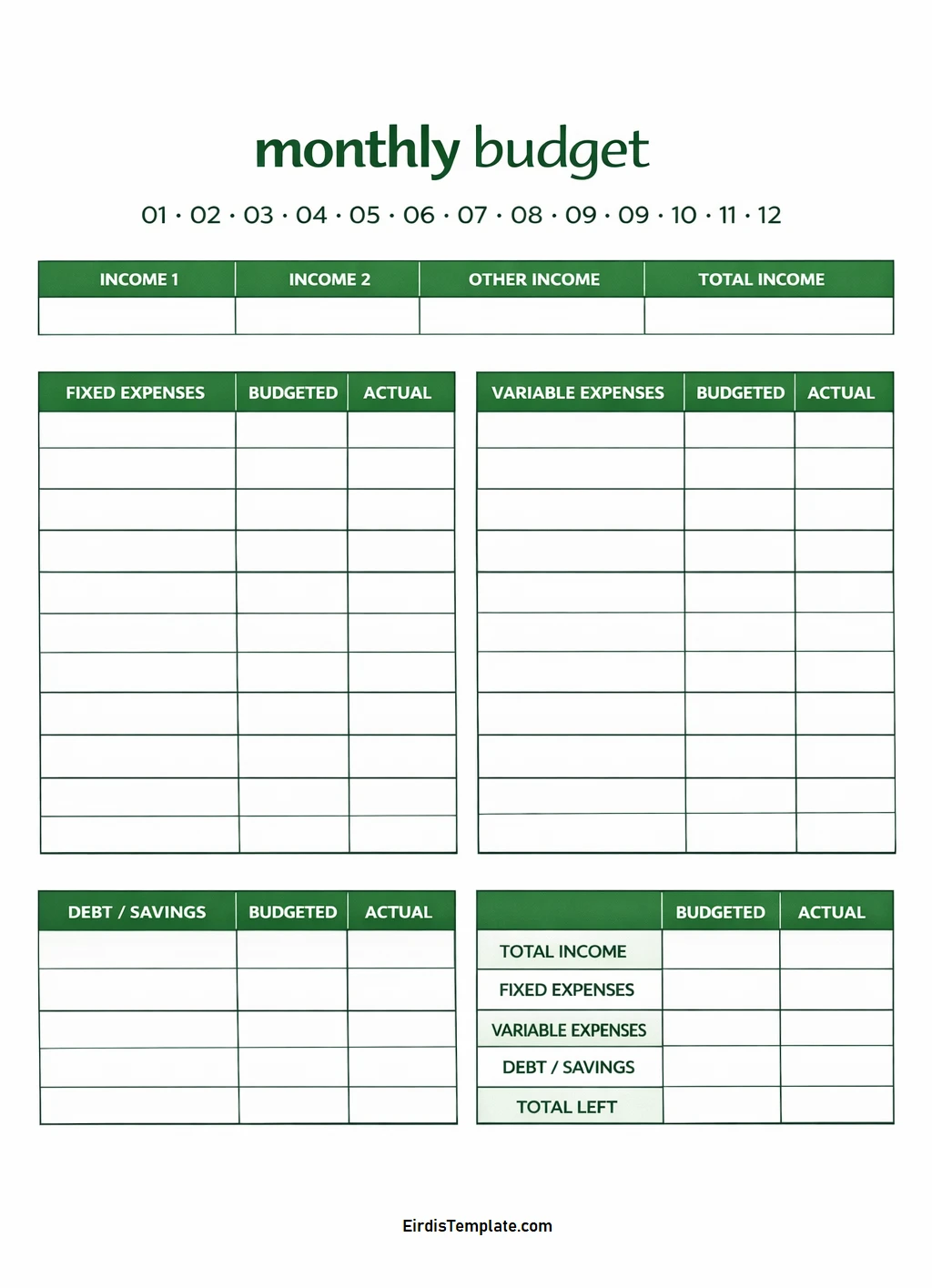

A monthly budget planner typically includes the following key elements:

- Income: List all sources of income for the month.

- Expenses: Categorize and list all expenses, including fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment).

- Savings: Allocate a portion of your income towards savings goals.

- Debt Repayment: Include any debt payments you need to make during the month.

- Emergency Fund: Set aside money for unexpected expenses or emergencies.

How to Create a Monthly Budget Planner

Creating a monthly budget planner is a straightforward process that involves the following steps:

1. Calculate Your Income

Start by calculating your total income for the month, including salaries, bonuses, freelance income, and any other sources of income.

2. List Your Expenses

Make a list of all your expenses, categorizing them into fixed expenses (e.g., rent, insurance) and variable expenses (e.g., groceries, entertainment).

3. Allocate Funds

Determine how much money you want to allocate to each expense category, savings goals, debt repayment, and emergency fund.

4. Track Your Spending

Keep track of your spending throughout the month to ensure you stay within your budget and make adjustments as needed.

5. Review and Adjust

At the end of the month, review your budget planner to see how well you stuck to your plan. Make adjustments for the following month based on your spending patterns.

6. Set Financial Goals

Use your budget planner to set specific financial goals and track your progress towards achieving them.

7. Stay Consistent

Consistency is key when it comes to budgeting. Make it a habit to update your budget planner regularly and stick to your financial plan.

Tips for Successful Budgeting

Here are some tips to help you succeed in budgeting with a monthly budget planner:

- Be Realistic: Set achievable financial goals and be realistic about your income and expenses.

- Track Your Spending: Keep a close eye on your spending habits and adjust as needed to stay within your budget.

- Prioritize Savings: Make saving a priority by allocating a portion of your income towards savings goals.

- Review Regularly: Take time to review your budget planner regularly and make necessary adjustments.

- Seek Professional Help: If you’re struggling with budgeting, consider seeking help from a financial advisor or counselor.

- Celebrate Milestones: Celebrate small wins along the way as you reach your financial goals.

- Stay Motivated: Stay motivated by reminding yourself of the financial freedom and security that come with effective budgeting.

By using a monthly budget planner to gain control over your finances, you can achieve your financial goals, reduce stress, and feel more confident in your financial future. Start budgeting today and take a step towards financial empowerment!

Monthly Budget Planner Template – DOWNLOAD

- Printable Monthly Budget Planner Template - February 10, 2026

- Free Printable Money Receipt Template - February 7, 2026

- Money Management Worksheet Template - February 5, 2026