Money management is a critical skill that everyone should master in order to achieve financial stability and security. One way to clarify your financial picture and take control of your money is by using a money management worksheet.

This tool helps you track your income and expenses, create a budget, identify your spending habits, and set financial goals. By making informed, purposeful decisions about your money, you can control your spending, save more effectively, pay down debt, and build wealth.

What is a Money Management Worksheet?

A money management worksheet is a tool that helps you organize your finances by tracking your income and expenses. It provides a clear snapshot of where your money is coming from and where it is going. By creating a budget, identifying your spending habits, and setting financial goals, you can use the worksheet as a roadmap for your finances.

This will help you move from simply earning money to strategically using it to achieve your life goals, such as saving for emergencies, retirement, or major purchases.

Why Use a Money Management Worksheet?

There are several benefits to using a money management worksheet to improve your financial situation:

- Clarity: By tracking your income and expenses, you have a clear understanding of your financial situation.

- Budgeting: Creating a budget allows you to allocate your money wisely and avoid overspending.

- Identifying Habits: You can pinpoint areas where you may be overspending and make adjustments accordingly.

- Setting Goals: By setting financial goals, you have a clear target to work towards and stay motivated.

- Control Spending: With a clear financial plan in place, you can control your spending and avoid unnecessary purchases.

- Saving Effectively: The worksheet helps you save more effectively by allocating funds towards savings goals.

- Paying Down Debt: By identifying areas where you can cut back, you can allocate more money towards paying off debt.

- Building Wealth: Ultimately, the worksheet helps you build wealth by making purposeful decisions about your money.

What to Include in a Money Management Worksheet

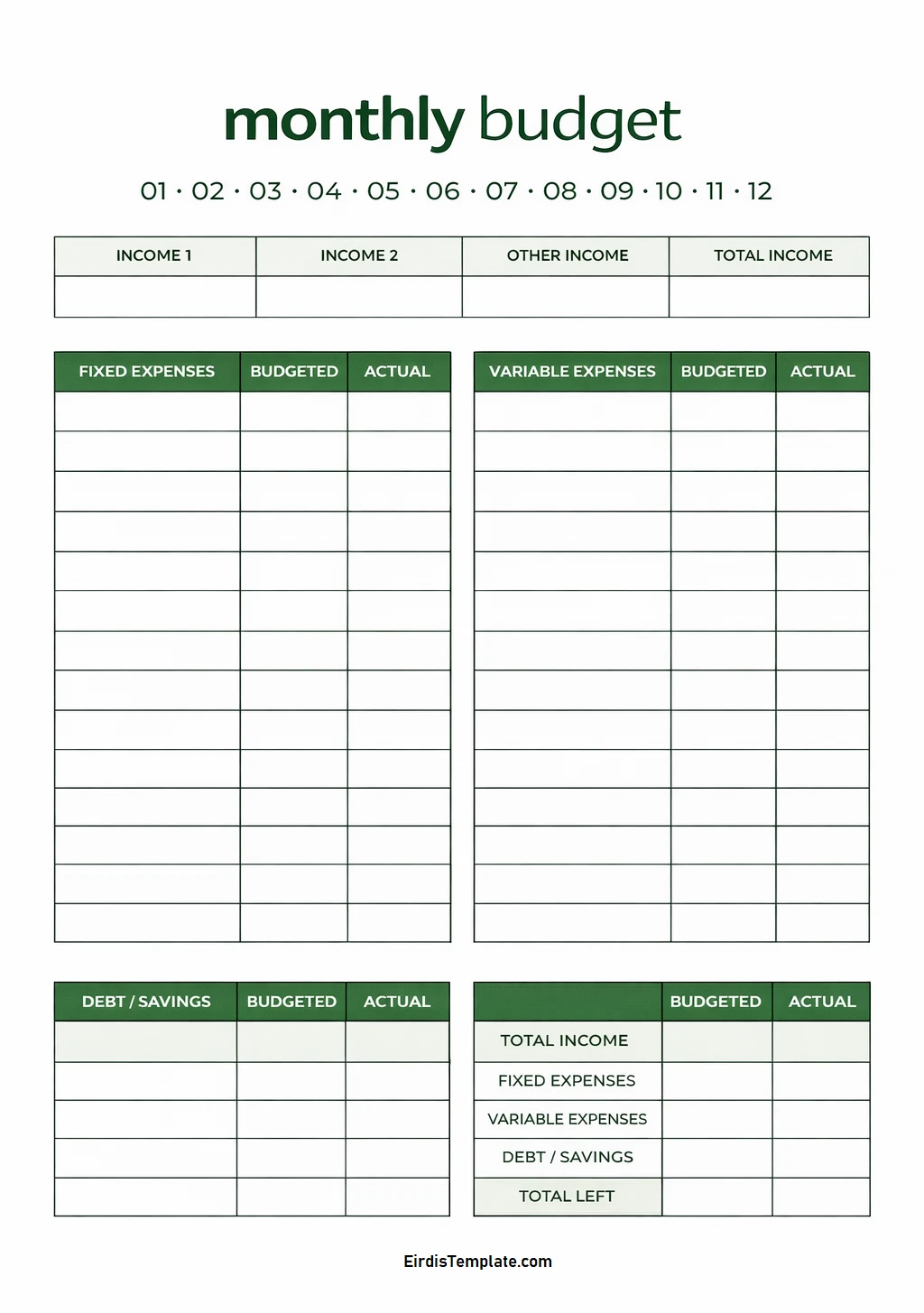

When creating a money management worksheet, there are several key elements to include:

- Income: List all sources of income, including wages, bonuses, investments, etc.

- Expenses: Track all expenses, such as rent, utilities, groceries, entertainment, etc.

- Budget: Create a budget that allocates your income towards various expenses and savings goals.

- Spending Habits: Identify areas where you tend to overspend or could cut back.

- Financial Goals: Set short-term and long-term financial goals, such as saving for a vacation or retirement.

How to Use a Money Management Worksheet

Using a money management worksheet is a straightforward process that can have a significant impact on your financial well-being. Follow these steps to effectively utilize the worksheet:

- Gather Your Financial Information: Collect all your financial documents, including pay stubs, bills, and bank statements.

- List Your Income: Record all sources of income, including regular paychecks, side hustles, and investment returns.

- Track Your Expenses: Record all expenses, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out).

- Create a Budget: Allocate your income towards expenses, savings, and debt repayment to create a balanced budget.

- Identify Spending Habits: Analyze your spending patterns to identify areas where you can cut back or reallocate funds.

- Set Financial Goals: Establish short-term and long-term financial goals to work towards and keep you motivated.

Tips for Effective Money Management

Here are some additional tips to help you effectively manage your money using a money management worksheet:

- Review Regularly: Update your worksheet regularly to ensure you are staying on track with your budget and goals.

- Be Realistic: Set achievable financial goals and adjust your budget as needed to accommodate unexpected expenses.

- Seek Professional Help: If you are struggling with debt or financial planning, consider consulting a financial advisor for guidance.

- Automate Savings: Set up automatic transfers to your savings account to ensure you are consistently saving towards your goals.

- Celebrate Progress: Celebrate small victories along the way to keep yourself motivated and engaged with your financial journey.

- Stay Committed: It’s essential to stay committed to your financial plan and make adjustments as needed to reach your goals.

Conclusion

A money management worksheet is a powerful tool that can help you take control of your finances, clarify your financial picture, and achieve your financial goals. By tracking your income and expenses, creating a budget, identifying your spending habits, and setting financial goals, you can make informed decisions about your money and build wealth over time. Use the tips and strategies outlined in this guide to effectively manage your money and create a secure financial future for yourself and your family.

Money Management Worksheet Template – DOWNLOAD

- Money Management Worksheet Template - February 5, 2026

- Free Customizable Modern Resume Template - February 3, 2026

- Free Missing Person Poster Template - February 2, 2026