Investment agreements are essential documents that serve as legally binding contracts between investors and companies. These agreements clearly define the terms of the investment, protecting the rights and responsibilities of both parties.

By formalizing the investment, ensuring mutual understanding, minimizing conflicts, and safeguarding against future disputes, investment agreements play a crucial role in the world of investments.

What is an Investment Agreement?

An investment agreement is a contract that outlines the terms of an investment between an investor and a company. It serves as a legal document that protects the interests of both parties by clearly defining their rights and responsibilities.

These agreements are vital in formalizing the investment process and setting the expectations for all parties involved.

Why Are Investment Agreements Important?

Investment agreements are crucial for several reasons.

Ensuring Legal Protection

One of the primary reasons why investment agreements are important is that they provide legal protection for both parties involved in the investment deal. By clearly defining the terms and conditions of the investment in a legally binding document, investment agreements help prevent disputes and protect the interests of both the investor and the company.

Establishing Trust and Credibility

Investment agreements also play a crucial role in establishing trust and credibility between the investor and the company. By formalizing the investment process and setting clear expectations, investment agreements demonstrate a commitment to transparency and professionalism. This, in turn, helps build a strong foundation for a successful partnership based on mutual trust and respect.

Minimizing Potential Conflicts

Another key benefit of investment agreements is that they help minimize potential conflicts that may arise during the investment process. By clearly outlining the rights, responsibilities, and expectations of both parties, investment agreements reduce the likelihood of misunderstandings and disagreements. This proactive approach to conflict resolution can help maintain a positive and productive relationship between the investor and the company.

What to Include in an Investment Agreement?

When drafting an investment agreement, there are several key components that should be included to ensure clarity and enforceability. Some essential elements to include in an investment agreement are:

Parties Involved

Identifying the parties involved in the investment agreement is essential to establishing who is entering into the contract. Clearly defining the investor and the company ensures that there is no confusion about the roles and responsibilities of each party throughout the investment process.

Investment Details

Specifying the details of the investment, including the amount, terms, and conditions, is critical to ensure that both parties are aware of the financial implications of the deal. By outlining the specifics of the investment, such as the funding amount and any milestones or conditions attached to the investment, the agreement sets clear expectations for all parties involved.

Rights and Responsibilities

Defining the rights and responsibilities of each party in the investment agreement is essential to establishing a clear framework for the partnership. This includes outlining decision-making authority, voting rights, and financial obligations to ensure that both parties understand their roles and obligations throughout the investment process.

Exit Strategy

Specifying the exit strategy in the investment agreement is crucial to ensure that all parties are aware of the conditions under which the investment can be terminated or transferred. By defining the exit strategy upfront, the agreement provides a roadmap for potential scenarios that may arise in the future, such as selling the investment or transferring ownership.

Confidentiality Clause

Including a confidentiality clause in the investment agreement is vital to protect sensitive information shared during the investment process. This clause ensures that any proprietary or confidential information disclosed during the partnership remains secure and cannot be shared with third parties without consent.

Dispute Resolution

Specifying the process for resolving disputes in the investment agreement is essential to provide a framework for addressing conflicts that may arise during the partnership. By outlining a clear dispute resolution mechanism, such as mediation or arbitration, the agreement helps prevent disagreements from escalating and provides a structured approach to resolving conflicts.

Term and Termination

Defining the duration of the agreement and the conditions under which it can be terminated is crucial to establishing the timeline and boundaries of the investment deal. By setting clear terms for the duration of the agreement and outlining conditions for termination, the agreement provides clarity on the expectations and obligations of both parties throughout the partnership.

Governing Law

Determining the jurisdiction and laws that will govern the investment agreement is essential to establishing the legal framework for the partnership. By specifying the governing law in the agreement, both parties are aware of the legal standards and regulations that apply to the investment deal, ensuring compliance and providing a basis for resolving any legal disputes that may arise.

How to Draft an Investment Agreement

Drafting an investment agreement requires careful consideration and attention to detail to ensure that all parties are protected and that the terms of the investment are clear and enforceable. Here are some steps to follow when drafting an investment agreement:

Consult with Legal Experts

Seeking advice from legal experts or professionals with experience in drafting investment agreements is crucial to ensure that the document is legally sound. Legal experts can provide valuable insights and guidance on structuring the agreement to protect the interests of both parties and comply with legal requirements.

Research and Preparation

Before drafting an investment agreement, it is essential to conduct thorough research and preparation to understand the terms, conditions, and legal implications of the investment deal. Researching industry standards, legal requirements, and best practices can help ensure that the agreement is comprehensive and aligns with the goals of both parties.

Define Terms Clearly

Using clear and concise language to define the terms of the investment is essential to avoid misunderstandings and ambiguity. Clearly defining key terms, such as the amount of the investment, the rights and responsibilities of each party, and the conditions of the agreement, helps ensure that all parties have a mutual understanding of the deal.

Include Necessary Clauses

It is important to include all necessary clauses in the investment agreement to protect the interests of both parties and address potential scenarios that may arise during the partnership. Clauses such as confidentiality, dispute resolution, governing law, and termination provide a comprehensive framework for the agreement and help minimize risks and uncertainties.

Review and Revise

Reviewing the investment agreement carefully and revising as needed is essential to ensure that all details are accurate and reflective of the agreement between the investor and the company. Conducting a thorough review of the agreement with legal experts and stakeholders can help identify any discrepancies or omissions that need to be addressed before finalizing the document.

Tips for Negotiating an Investment Agreement

Be Prepared

Before entering into negotiations for an investment agreement, it is crucial to be prepared and have a clear understanding of your goals, expectations, and bottom line. Conducting thorough research on the company, the industry, and market trends can help you make informed decisions and negotiate from a position of strength.

Communicate Effectively

Effective communication is key to successful negotiations for an investment agreement. Clearly articulating your expectations, concerns, and requirements to the other party helps ensure that both sides have a mutual understanding of the terms and conditions of the deal. Open and transparent communication can help build trust and facilitate a productive negotiation process.

Seek Compromise

Negotiating an investment agreement often requires compromise from both parties to reach a mutually beneficial agreement. Being willing to make concessions on certain terms or conditions can help bridge the gap between differing perspectives and lead to a successful outcome. Finding common ground and seeking compromises can help move the negotiation process forward and build a positive relationship with the other party.

Get Legal Advice

Consulting with legal experts or advisors experienced in investment agreements is essential to ensure that the terms of the agreement are fair, legally sound, and in compliance with regulations. Legal advisors can provide valuable insights, review the agreement for any potential legal issues, and offer guidance on how to protect your interests and rights throughout the negotiation process.

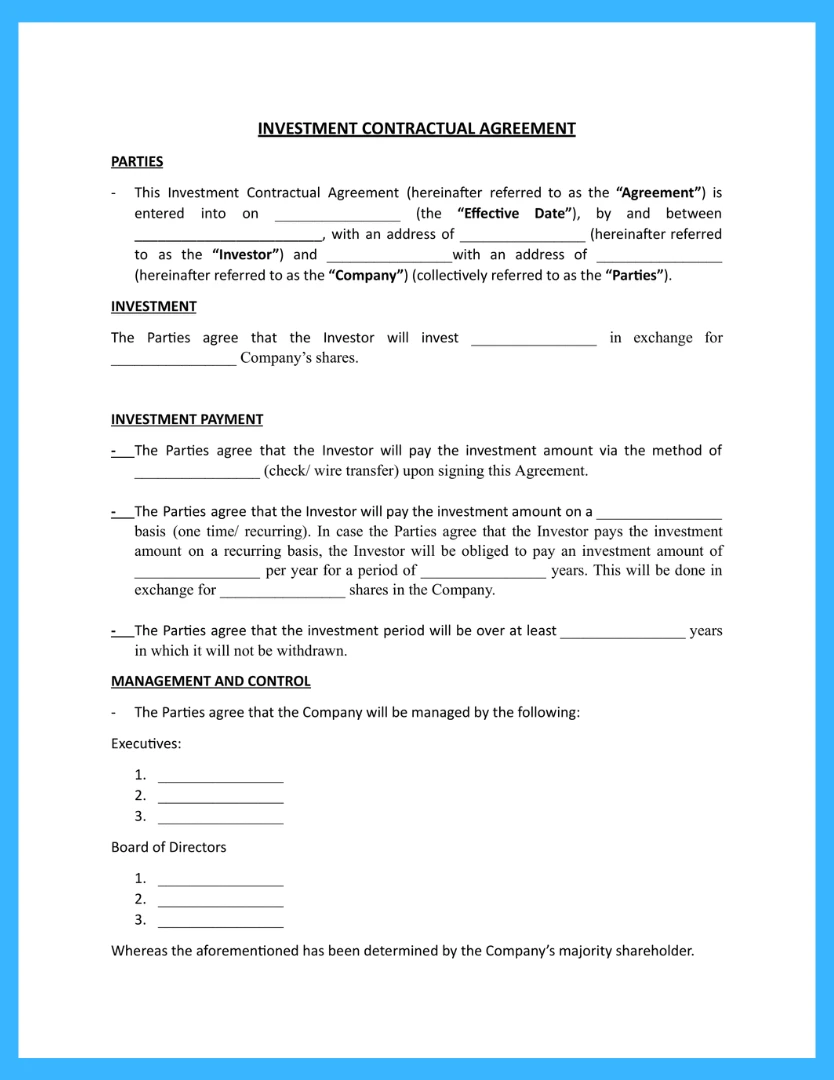

Investment Agreement Template

In conclusion, an Investment Agreement helps clearly define the terms, responsibilities, and expectations between investors and businesses, ensuring transparency and legal protection for all parties.

Secure your investment deals with confidence—download our Investment Agreement Template today to create a professional and legally sound agreement!

Investment Agreement Template – DOWNLOAD

- Printable Monthly Budget Planner Template - February 10, 2026

- Free Printable Money Receipt Template - February 7, 2026

- Money Management Worksheet Template - February 5, 2026