Planning for the future is an essential aspect of financial management. One of the key tools for this purpose is a yearly budget.

By setting up an annual budget, individuals and businesses can gain a clear understanding of their expected income and expenses for the upcoming year.

In this comprehensive guide, we will explore the importance of creating a yearly budget and provide practical steps for setting one up.

What Is a Yearly Budget?

A yearly budget, also known as an annual budget, is a financial plan that outlines projected income and expenses for a specific period, typically one year. It serves as a roadmap for managing finances and helps in making informed decisions about spending and saving.

By creating a yearly budget, individuals and businesses can track their financial progress, identify areas for improvement, and work towards achieving their financial goals.

The Importance of Creating an Annual Financial Budget

Setting up a yearly budget offers several benefits, including:

Financial Planning

A budget provides a framework for planning future expenses and savings, allowing individuals and businesses to allocate resources efficiently. By anticipating income and expenses, individuals can make informed decisions about how to allocate their funds, ensuring that they can meet their financial obligations and work towards their long-term financial goals.

Control Spending

One of the key benefits of creating a yearly budget is that it helps in controlling spending. By setting limits on various expense categories, individuals can track their spending habits, identify areas of overspending, and make adjustments to stay within their financial means. This control over spending can lead to increased savings, reduced debt, and a more stable financial future.

Goal Setting

A budget serves as a tool for setting financial goals and tracking progress towards achieving them. Whether the goal is to save for a vacation, purchase a home, pay off debt, or build an emergency fund, a budget provides a roadmap for allocating resources towards these objectives. By breaking down larger goals into smaller, manageable steps, individuals can stay motivated and focused on achieving their financial aspirations.

Emergency Preparedness

Having a budget in place can help individuals prepare for unexpected expenses or financial emergencies. By setting aside funds for contingencies and establishing an emergency fund, individuals can weather unexpected financial shocks without derailing their long-term financial plans. This preparedness provides peace of mind and financial security in times of uncertainty.

Financial Awareness

Regularly reviewing and updating the budget increases financial awareness and promotes better money management habits. By understanding where their money is going, individuals can make more informed decisions about spending, saving, and investing. This awareness can lead to improved financial literacy, increased confidence in financial decision-making, and a greater sense of control over one’s financial future.

Decision Making

A budget serves as a tool for making informed financial decisions based on a clear understanding of income and expenses. By having a comprehensive view of their financial situation, individuals can prioritize their spending, identify areas for improvement, and make strategic choices about how to allocate their resources. This decision-making process is essential for achieving financial goals, building wealth, and securing a stable financial future.

10 Steps for Setting a Budget

Creating a yearly budget involves several steps to ensure its effectiveness. Here are ten steps to help you set up a comprehensive budget:

Determine Your Income

The first step in setting a budget is to calculate your total income, including salary, bonuses, rental income, investments, and any other sources of revenue. Having a clear picture of your income will help in planning for expenses. Consider both regular income streams and any irregular or one-time payments that may impact your financial picture.

List Your Expenses

Make a comprehensive list of all your anticipated expenses for the year, including fixed costs like rent, utilities, insurance, and variable expenses such as groceries, entertainment, travel, and healthcare. Be as detailed as possible to capture all possible expenditures and ensure that your budget reflects your true financial situation.

Differentiate Between Needs and Wants

Classify your expenses into needs (essential items like housing, food, healthcare, and transportation) and wants (non-essential items like dining out, shopping, vacations, and entertainment). This differentiation will help you prioritize your spending, identify areas where you may be able to cut back, and ensure that your budget aligns with your financial goals and values.

Set Financial Goals

Define your financial goals, whether they are short-term objectives like building an emergency fund or long-term aspirations like saving for retirement or buying a home. Allocate a portion of your income towards these goals to ensure that you are making progress and staying motivated. Your financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART) to guide your budgeting efforts effectively.

Create Categories for Expenses

Organize your expenses into categories like housing, transportation, food, entertainment, savings, debt repayment, healthcare, education, and miscellaneous. This categorization will provide a clear overview of where your money is going, help you identify areas for potential savings or reallocation, and enable you to track your spending patterns over time. Consider using budgeting software or apps to streamline this categorization process and make it easier to track your expenses.

Calculate Savings and Investments

Determine how much you want to save and invest each month to achieve your financial goals. Whether you are saving for a specific purpose like a vacation or a new car, or investing for long-term wealth accumulation, it is essential to prioritize saving and investing in your budget. Consider setting up automated transfers to your savings or investment accounts to ensure consistency and discipline in your savings habits.

Account for Irregular Expenses

Include irregular expenses like annual insurance premiums, property taxes, vehicle maintenance, home repairs, or holiday gifts in your budget. These expenses may not occur every month, but can have a significant impact on your financial stability. Set aside funds each month in a separate account or budget category to cover these irregular expenses when they arise, preventing financial strain or the need to dip into your emergency fund.

Review and Adjust Regularly

Regularly review your budget to track actual spending against projected amounts and adjust your budget as needed to accommodate any changes in income, expenses, or financial goals. Consider conducting monthly or quarterly budget reviews to assess your progress, identify areas for improvement or adjustment, and stay on track with your financial plan. Be flexible and willing to make changes to your budget as your financial situation evolves or unexpected circumstances arise.

Monitor Progress and Adjustments

Monitor your progress towards your financial goals and make adjustments to your budget as necessary. Celebrate milestones along the way, such as reaching a savings target or paying off a debt, and use these accomplishments as motivation to continue working towards your financial objectives. Be proactive in reassessing your priorities, making changes to your budget as needed, and staying committed to achieving financial success over the long term.

Seek Professional Guidance

If you are unsure about setting up a budget or need assistance with financial planning, consider seeking advice from a financial advisor, counselor, or coach. These professionals can provide personalized guidance, strategies, and recommendations tailored to your unique financial situation and goals. Working with a professional can help you gain clarity on your financial objectives, develop a realistic budget, and create a roadmap for achieving financial success.

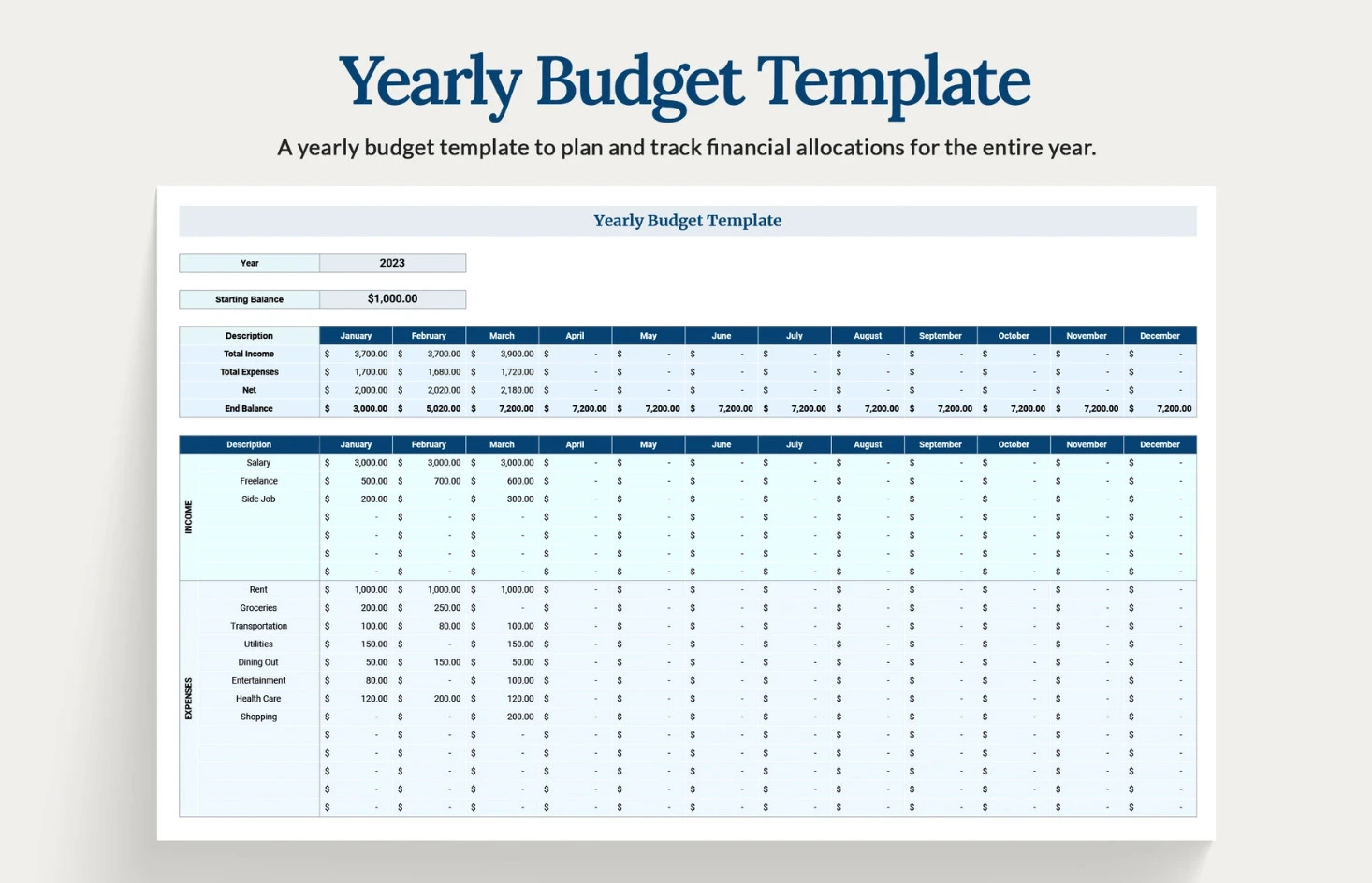

Free Yearly Budget Template

In conclusion, a Yearly Budget is a powerful tool for managing your finances, tracking expenses, and planning for long-term goals.

Stay financially organized and make smarter money decisions—download our Yearly Budget Template today to take control of your annual finances!

Yearly Budget Template – DOWNLOAD

- Printable Monthly Budget Planner Template - February 10, 2026

- Free Printable Money Receipt Template - February 7, 2026

- Money Management Worksheet Template - February 5, 2026