Planning an event is an exciting and rewarding experience, but it also comes with a multitude of financial responsibilities. From securing a venue to booking entertainment and catering services, every aspect of an event requires careful financial planning. One of the most critical elements of event planning is creating a comprehensive budget that serves as a financial roadmap.

An event budget not only controls spending and allocates resources effectively but also helps the event meet its financial goals, whether that is turning a profit, breaking even, or minimizing losses. By providing a structured framework for planning and detailing all potential expenses and revenue streams, an event budget ensures stakeholders have a clear financial overview of the event, aids in making informed decisions, and allows for post-event analysis of financial performance.

What is an Event Budget?

An event budget is a detailed financial plan that outlines all anticipated expenses and revenue sources associated with hosting an event. It serves as a roadmap for financial decision-making throughout the event planning process.

By creating an event budget, event organizers can proactively manage finances and ensure that the event stays within its financial constraints. An event budget typically includes a breakdown of all costs, such as venue rental fees, catering expenses, entertainment costs, marketing expenditures, staff wages, and any other relevant expenses. On the revenue side, the budget outlines various income sources, including ticket sales, sponsorships, merchandise sales, and other potential revenue streams.

Why is Event Budgeting Important?

Event budgeting plays a crucial role in the success of an event for several reasons.

Financial Control and Resource Allocation

An event budget provides event organizers with financial control by setting clear spending limits and ensuring that expenses do not surpass the allocated budget. By having a detailed breakdown of expenses and revenue sources, event organizers can allocate resources effectively to maximize the impact of their spending. This ensures that the event stays within its financial constraints and avoids unnecessary overspending on non-essential items.

Goal Alignment and Transparency

Creating an event budget helps align financial goals with the overall objectives of the event. Whether the goal is to generate a profit, break even, or simply cover costs, the budget serves as a financial roadmap to guide decision-making and resource allocation. By sharing the budget with stakeholders, sponsors, and partners, event organizers can demonstrate transparency and accountability in managing event finances, which can foster trust and confidence in the event’s financial management.

Performance Evaluation and Decision-Making

One of the key benefits of event budgeting is its role in performance evaluation and decision-making. By tracking expenses and revenue throughout the planning process, event organizers can assess the event’s financial performance in real-time and make data-driven decisions to optimize financial outcomes. Post-event analysis of the budget allows event organizers to identify areas of success, analyze cost-effectiveness, and learn from any financial challenges or setbacks for future events.

Key Elements of an Event Budget

When creating an event budget, it is essential to consider several key elements to ensure comprehensive financial planning and management. These key elements help event organizers develop a detailed and realistic budget that aligns with the event’s objectives and financial goals. Some of the key elements of an event budget include:

Income Sources

Identifying all potential sources of income for the event is a critical element of the budgeting process. This includes revenue streams such as ticket sales, sponsorships, donations, merchandise sales, VIP packages, and any other income-generating activities. By accurately projecting income sources, event organizers can estimate the event’s revenue potential and plan expenses accordingly to achieve financial goals.

Expenses

Detailing all anticipated expenses related to the event is another crucial element of an event budget. Expenses may include venue rental fees, catering costs, entertainment fees, marketing and promotional expenses, staffing wages, transportation costs, permits and licenses, insurance fees, technology and equipment rentals, decorations, and any other operational costs. By itemizing expenses, event organizers can create a comprehensive budget that covers all financial aspects of the event.

Contingency Fund

Allocating a contingency fund within the event budget is essential to prepare for unforeseen expenses or emergencies that may arise during the event planning process or the event itself. A contingency fund acts as a financial buffer to address unexpected challenges, such as last-minute changes, additional expenses, equipment failures, or other unforeseen circumstances. By setting aside a portion of the budget for contingencies, event organizers can mitigate financial risks and ensure that the event runs smoothly despite unexpected challenges.

ROI Analysis

Conducting a return on investment (ROI) analysis for each expense item in the event budget is an integral part of financial planning and decision-making. By evaluating the potential return on investment for each expense, event organizers can prioritize spending on items that offer the highest ROI and align with the event’s objectives. This analysis helps maximize the impact of spending, optimize resource allocation, and ensure that the event’s financial resources are used effectively to achieve desired outcomes.

Tracking and Reporting

Implementing a system for tracking expenses and revenue in real-time is essential for monitoring the event’s financial performance and making informed decisions throughout the planning process. By tracking expenses against the budget, event organizers can identify cost overruns, adjust spending as needed, and stay within budgetary limits. Reporting on financial performance to stakeholders, sponsors, and partners provides transparency and accountability in managing event finances and ensures that all parties are informed of the event’s financial status.

How to Create an Event Budget

Creating an event budget requires careful planning, attention to detail, and a strategic approach to financial management. By following a systematic process and incorporating best practices in budgeting, event organizers can develop a comprehensive financial roadmap for their event. The following steps outline how to create an effective event budget:

Set Financial Goals

Define the financial objectives for your event by establishing clear goals that guide your budgeting decisions. Whether the goal is to generate a profit, break even, or minimize losses, having defined financial goals helps align the budget with the event’s overall objectives and financial targets. Consider factors such as revenue targets, expense limits, cost-saving opportunities, and ROI expectations when setting financial goals for the event.

Research Costs

Researching the costs associated with hosting an event is essential for creating an accurate and realistic budget. Gather information on venue rental fees, catering costs, entertainment expenses, marketing and promotional expenditures, staffing wages, transportation fees, permits and licenses, insurance costs, technology and equipment rentals, decorations, and any other relevant expenses. Conducting thorough research allows you to estimate costs accurately and create a budget that reflects the financial requirements of the event.

Allocate Resources

Determine how resources will be allocated within your budget by prioritizing expenses that align with the event’s objectives and theme. Allocate funds to essential elements of the event, such as venue, catering, entertainment, and marketing, while considering cost-saving opportunities and revenue-generating activities. By strategically allocating resources, you can maximize the impact of your spending and ensure that the event meets its financial goals within budgetary constraints.

Monitor Expenses

Regularly monitor expenses and revenue throughout the event planning process to ensure that you are staying within budgetary limits. Implement a system for tracking expenses in real-time, such as using budgeting software or spreadsheets, to record and categorize expenses, compare actual spending to budgeted amounts, and identify any discrepancies or areas where costs can be reduced. By monitoring expenses proactively, you can address financial challenges promptly, make adjustments to the budget as needed, and maintain financial control throughout the event planning process.

Conduct Post-Event Analysis

After the event has taken place, conduct a thorough analysis of the event’s financial performance by comparing actual expenses and revenue to the budgeted amounts. Evaluate the success of the event in meeting its financial goals, assess the cost-effectiveness of expenses, and identify areas for improvement in future events. Analyze the ROI of each expense item, revenue source, and overall financial performance to glean insights that can inform future budgeting decisions and enhance the financial success of upcoming events.

Tips for Effective Event Budgeting

Effective event budgeting requires careful planning, attention to detail, and a strategic approach to financial management. By incorporating best practices and following these tips, event organizers can create a successful event budget that maximizes financial outcomes and ensures the event’s success:

Start Early

Begin budgeting for your event as early as possible to allow ample time for research, planning, and decision-making. Starting early allows you to gather accurate cost estimates, identify cost-saving opportunities, and create a realistic budget that aligns with the event’s objectives and financial goals. Early budgeting also allows for flexibility in making adjustments as needed throughout the planning process.

Communicate with Stakeholders

Keep stakeholders, sponsors, partners, and team members informed throughout the budgeting process to ensure transparency, alignment with financial goals, and collaboration in decision-making. Communicate regularly about budget updates, financial constraints, cost-saving initiatives, and any changes that may impact the budget. By engaging stakeholders in the budgeting process, you can foster a sense of ownership, trust, and accountability in managing event finances.

Use Budgeting Tools

Utilize budgeting software, templates, spreadsheets, or other tools to streamline the budgeting process, track expenses, and monitor financial performance in real-time. Budgeting tools help you organize expenses, categorize spending, compare actual costs to budgeted amounts, and generate reports for analysis and decision-making. Choose a budgeting tool that aligns with your needs, preferences, and level of complexity to enhance efficiency and accuracy in managing event finances.

Review and Revise

Regularly review and revise your event budget to account for any changes in expenses, revenue projections, or event dynamics. Conduct periodic budget reviews to assess financial performance, identify areas for cost reduction or revenue enhancement, and make adjustments as needed to stay within budgetary limits. By reviewing and revising the budget proactively, you can address financial challenges, optimize resource allocation, and maximize the financial success of your event.

Seek Professional Guidance

If you are unsure about certain aspects of event budgeting or financial management, consider seeking advice from financial experts, event planners, or experienced professionals in the industry. Consult with professionals who have expertise in budgeting, financial planning, and event management to gain valuable insights, best practices, and recommendations for creating a successful event budget. Professional guidance can help you navigate complex financial decisions, address challenges effectively, and optimize financial outcomes for your event.

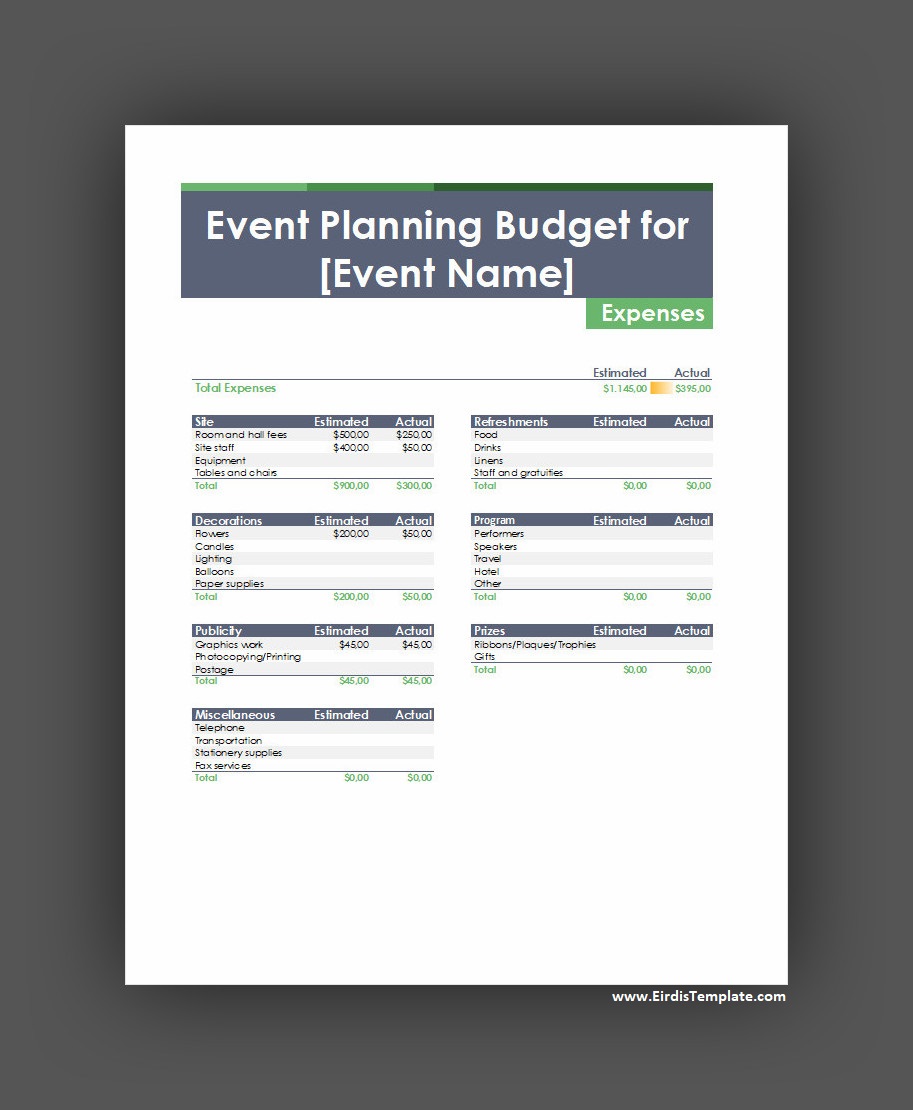

Event Budget Template

An event budget is an essential tool for organizing and tracking all financial aspects of your event. It helps you list expenses, allocate funds, and monitor actual spending to ensure you stay within budget. Whether you’re planning a wedding, corporate event, or fundraiser, this template provides a clear overview of your finances for better decision-making.

Download and use our event budget template today to plan smarter, control costs, and keep your event on track financially.

Event Budget Template – Excel

- NDA Disclosure Agreement Template (Word) - March 5, 2026

- Month-to-month Lease Agreement Template - March 4, 2026

- Monthly Profit And Loss Statement Template - March 2, 2026