Creating a personal monthly budget is a crucial step in gaining control over your finances. By tracking your income and expenses, you can ensure that bills are paid on time, prevent debt from accumulating, build savings for the future, and work towards achieving your financial goals.

A monthly budget provides insight into where your money is going, helps reduce wasteful spending, and ensures that you have enough money each month to cover your needs and prepare for unexpected emergencies.

What Is A Personal Budget?

A personal budget is a financial plan that outlines your income and expenses for a specific period, typically a month. It helps you allocate your money towards essential expenses, such as rent, utilities, groceries, and transportation, while also setting aside funds for savings and discretionary spending.

By creating a budget, you can track your financial progress, identify areas where you may be overspending, and make adjustments to ensure that you are living within your means.

Why You Need a Personal Budget?

A personal budget is essential for managing your finances effectively and achieving your financial goals. Without a budget, it can be challenging to track your spending, save money, and avoid debt. By creating a budget, you give yourself a roadmap for your financial future and ensure that you are making informed decisions about your money.

There are numerous benefits to having a personal budget, including:

- Financial Awareness. A budget helps you become more aware of your financial situation and where your money is going each month.

- Goal Setting. By creating a budget, you can set specific financial goals and track your progress towards achieving them.

- Debt Prevention. A budget can help you avoid accumulating debt by ensuring that you are living within your means.

- Savings Growth. Setting aside money for savings in your budget allows you to build an emergency fund and save for future expenses.

- Financial Security. With a budget in place, you can feel more secure about your financial future and be prepared for unexpected expenses.

The Components of A Personal Monthly Budget

A personal budget consists of several components, including:

- Income. Your total monthly income from wages, bonuses, investments, and other sources.

- Expenses. Your monthly expenses, including fixed expenses like rent and utilities, variable expenses like groceries and entertainment, and savings contributions.

- Financial Goals. Your short-term and long-term financial goals, such as saving for a vacation, paying off debt, or buying a home.

- Emergency Fund. A buffer for unexpected expenses to ensure that you are prepared for emergencies that may arise.

How To Create A Monthly Budget

Creating a monthly budget involves several steps to ensure that you accurately track your income and expenses and allocate your money effectively.

Calculate Your Income

Start by determining your total monthly income, including wages, bonuses, and any other sources of income. This will give you a clear picture of the money you have coming in each month to work with.

List Your Expenses

Make a list of all your monthly expenses, including fixed expenses like rent and utilities, as well as variable expenses like groceries, dining out, entertainment, and transportation. Be sure to include all your expenses to get an accurate picture of your spending habits.

Set Financial Goals

Identify your short-term and long-term financial goals, such as saving for a vacation, paying off debt, building an emergency fund, or investing for retirement. Setting clear goals will help you prioritize your spending and stay motivated to stick to your budget.

Allocate Your Income

Divide your income into different categories, such as necessities (rent, utilities, groceries), savings (emergency fund, retirement savings), and discretionary spending (entertainment, dining out). Allocate a specific amount of money to each category to ensure that you meet your financial obligations and work towards your goals.

Track Your Spending

Keep track of your expenses throughout the month to see how well you are sticking to your budget. Use a budgeting app, spreadsheet, or notebook to record your expenses and compare them to your budgeted amounts. This will help you identify areas where you may be overspending and make adjustments as needed.

Review and Adjust

At the end of the month, review your budget to see how well you stuck to it. Compare your actual expenses to your budgeted amounts and identify any areas where you may have overspent. Make adjustments for the following month to stay on track with your financial goals.

How To Manage Any Overspending

If you find yourself overspending in certain categories, there are several strategies you can use to get back on track with your budget.

Identify Problem Areas

Take a close look at your expenses to determine where you are overspending. This could be in categories like dining out, shopping, entertainment, or transportation. By identifying problem areas, you can make targeted adjustments to your spending habits.

Cut Back on Discretionary Spending

If you are overspending on non-essential items, consider cutting back on discretionary spending to free up more money for essential expenses and savings. This could include reducing the frequency of dining out, shopping for clothes less often, or finding free or low-cost alternatives for entertainment.

Find Ways to Save

Look for ways to save money on everyday expenses to reduce your overall spending. This could include using coupons, shopping sales, buying generic brands, or taking advantage of discounts and promotions. Small changes in your spending habits can add up to significant savings over time.

Set Realistic Goals

If you consistently find yourself overspending, it may be time to adjust your budget and set more realistic goals for your spending habits. Take a closer look at your income and expenses to ensure that you are budgeting accurately and living within your means.

Seek Additional Income

If you are struggling to stay within your budget due to overspending, consider finding ways to increase your income. This could involve taking on a part-time job, freelancing, selling items you no longer need, or finding other ways to earn extra money. Increasing your income can help you cover expenses and reach your financial goals more easily.

Stay Committed

Creating and sticking to a budget requires discipline and commitment. Stay focused on your financial goals and make adjustments as needed to achieve them. Remember that a budget is a tool to help you manage your finances effectively and work towards a more secure financial future.

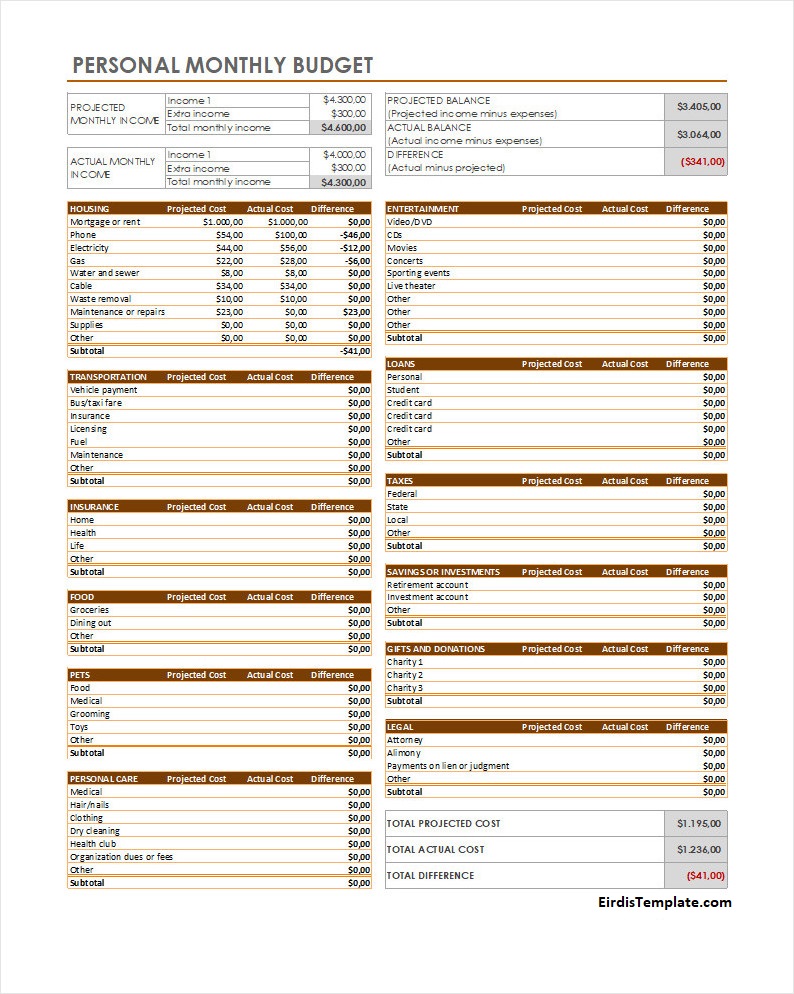

Personal Monthly Budget Template

A personal monthly budget is a helpful tool for managing income, expenses, and savings in an organized way. It allows you to track spending habits, set financial goals, and stay in control of your money.

To make budgeting simple and effective, use our free personal monthly budget template and organize your finances with confidence!

Personal Monthly Budget Template – Excel

- Free Printable Monthly Expenses Template - February 12, 2026

- Printable Monthly Employee Schedule Template - February 11, 2026

- Printable Monthly Budget Planner Template - February 10, 2026